Yes, the RBA cut interest rates but…

By: Niro Thambipillay

February 28, 2025

Yes, the RBA cut interest rates but

Okay, so the RBA has finally cut interest rates for the first time in 4 years. You will probably already know that by now, but today I’m going to go through what the RBA had to say when they announced the rate cut. And why I don’t believe you can take them at face value. Number two, the surprisingly fast impact this rate cut has already had on the property market. Then number three, ultimately what this all means for property prices.

Hello, it’s Niro here. If you’re new to my channel, hit that subscribe button because I talk about all things related to the Australian property market and the economy. When the RBA governor announced that interest rates were being cut, she made a few statements that had a lot of people concerned. For example, although she admitted that underlying inflation is moderating, she then went on to say that Upside risks remain.

Some recent labour market data had been unexpectedly strong, suggesting that the labour market might be somewhat tighter than previously thought. The central forecast for underlying inflation, which is based on the cash rate path implied by financial markets, has been revised up a little over 2026, so while today’s policy decision recognizes the welcome progress on inflation.

The board remains cautious on prospects for further policy easing. So, this seems to indicate that perhaps we’re done with rate cuts. There are no more coming, she then went on to elaborate a bit more about this at her press conference. Michelle Bullock said. I understand you are hurting, and I understand mortgage rates have increased a lot, but we need to get inflation down, because that is the other thing that is really hurting you, she said.

If we don’t get inflation down, interest rates won’t come down, and you’ll be stuck with inflation and high interest rates. So, we have to be patient. I understand it hurts, but it’s really important that we get inflation down. This certainly doesn’t sound very promising for further rate cuts.

But have a think about it for a moment. If the RBA governor came out and said, yep, this is the first rate cut we’re giving you, but we’re going to give you a whole lot more. What would that do? That would immediately inject an extra level of optimism into the market. People would potentially start spending and the inflation problem that we still have, although we’re starting to overcome it, could potentially rear its ugly head once again.

That’s why she’s come out with this very, very negative perspective on future interest rate cuts. Personally, though, although I can see why she’s making this statement, I don’t agree and neither do the bond markets. The bond market is at odds with the RBA and by midweek was factoring in another two rate cuts by year end with a small probability of another rate cut in early 2026, bringing the current easing cycle to 100 basis points.

So that means that the bond market is expecting a full percentage cut in interest rates from before the first rate cut. However, the RBA governor keeps talking about how strong our employment market is. But is it really? Wednesday’s wages data marked the weakest growth since 2022.

On an annualized basis wages are rising at just 2.6%, well below the RBA’s forecast of 3.4%. So, we have employment market data, specifically in relation to wages growth, coupled with the bond market, all saying that inflation is actually falling faster than what the RBA has predicted. That, to me, indicates that there are actually more rate cuts to come in 2025, and then even potentially in 2026.

So, while that’s really good news for mortgage holders, what does that mean for property prices moving forwards? Well, we’ve already seen the impact of just the first rate cut. And as I’m recording this, we’ve only had one weekend since the RBA cut rates and we’re seeing an immediate impact.

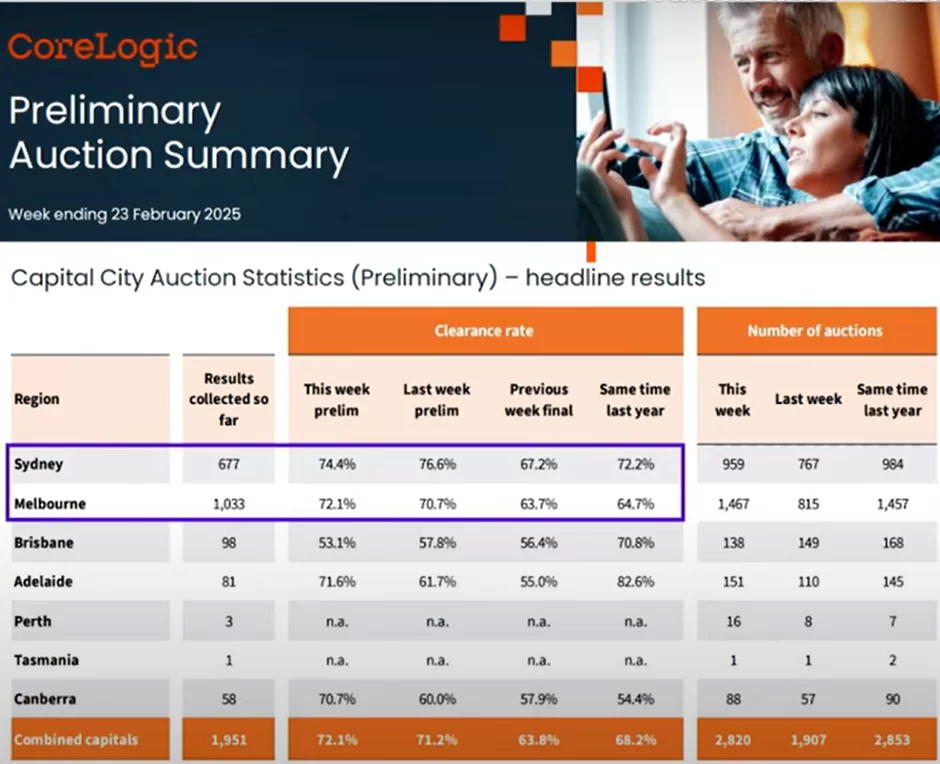

Tim Lawless, head of CoreLogic Research said, Auction markets have responded positively to the rate cut with 72.1% of homes selling under the hammer based on results collected so far by CoreLogic Australia.

Now this is the highest preliminary clearance rate since the last week of July 2024. And when there’s an increase in auction clearance rates, what does that mean for property prices? Well, I’ve spoken about it in the past, but auction clearance rates are essentially one of the most accurate indicators for what’s likely to happen to property prices in the future, especially in Sydney and Melbourne.

When auction clearance rates start to increase, which means more properties that come to auction end up selling, that normally means that property prices rise. However, when auction clearance starts to fall, which means less properties that come to auction actually sell, that normally means that prices then go backwards.

Right now, we’re seeing an increase in auction clearance rates. To me, that is going to replicate history. We will see property prices rise in multiple markets around the country. And as you can see in the chart,

Sydney and Melbourne, they are the markets that have the most number of auctions. And so that’s what this is primarily referring to. By what it shows is that, just one rate cut has already stimulated so much positive sentiment in the market. Even last week when I was looking at different properties and my team were out there attending open homes, the number of people who were there was a lot higher than just a couple of weeks earlier.

The queues were out the door. So, we’re seeing more and more people now wanting to jump in, wanting to buy, we personally have been flooded with so many requests for calls for people who want our help to find the ideal investment property. And look, we still have capacity for more. So, if you want help to find the right areas to invest in property so that you can get ahead of this next curve or at least take maximum advantage of the property uplift that’s coming, certainly check out the link below to book a complimentary consult with a member of our team.

However, What this all means is that as rate cuts continue to happen, and as I said, I expect there’s more than what the RBA governor has indicated. It will give more confidence to the market. People will then have more money to put into the property market.

So, it’s got more buyers that will drive up prices. People’s borrowing capacities will improve. That will have people who perhaps couldn’t afford either. their own home or an investment property, previously, they’ll now be able to jump into the market. What the data is showing is that with this increased demand in the marketplace, coupled with the fact that construction numbers are still falling away and lower than they were just a few years ago, we’re going to have a big gap between demand and supply, which will put significant upwards pressure on property prices in multiple locations around the country.

So, if you’re someone who’s thinking about buying, the odds are that those people who choose to wait and see, they will look back with regret, wishing that they had bought earlier. So don’t let that be you. But at the same time, that does not mean that you can just buy blindly. different areas will perform differently. And look, if you want help with that, check out the link in the description below to get total for free the audio version and digital version of my book. It’s a full property investing blueprint based on my now 23 years of investing experience. Otherwise, I’ll see you next time.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.