Why Sydney and Melbourne Prices WON’T Boom Now (Even After Rate Drops)

By: Niro Thambipillay

July 25, 2019

3 Reasons Why the Sydney and Melbourne Markets Are NOT About To Boom Again

The Sydney and Melbourne property markets have had their heaviest losses in recorded history – and all that in just the last 2 years. Now with the 2 recent rate drops, people are starting to wonder if these two markets are about to start their next big boom.

Let me give you 3 reasons why the answer is no!

And I’ve got some notes to ensure I give the facts behind my research so you don’t think I’m just making this up.

Now, don’t get me wrong. The rate drops are good news in that it will slow the bleeding. I do not expect property prices over the next 2 years to drop as fast as they have dropped over the previous 2 years – and some areas will see some modest growth

However, I don’t think you’ll start to see a boom in our 2 biggest markets for the following reasons.

- The current bias against overseas investors:

Current policies penalise overseas investors who buy in Australia by having to pay more in Stamp duty, there are tougher lending restrictions to off shore investors and restrictions on the percentage of units in new apartment buildings that can be sold to off shore investorsAccording to the Australian Bureau of Statistics, lending to overseas investors has dropped 45.4% since April 2015 and according to the Chief Economist at RealEstate.com.au, buyers from China have dropped 60% in just the last 12 months to the lowest levels ever recorded!Now here’s the thing.What was the primary cause of the property boom of 2012 to 2017? Did all of a sudden people living in Sydney and Melbourne decide that it was time to buy property and rush in? Or was it an increase in overseas buyers wanting our property, primarily from China?

It was overseas buyers.

For example, did you ever go to an auction during the boom periods and find yourself competing with an “agent” who was simply on the phone to a buyer from overseas, and was often buying the property without even seeing it?

If you have, you know what I’m talking about.

Now, as per the statistics I mentioned earlier, we know that demand from overseas buyers has been artificially dampened. I say, artificially because I’m fairly certain overseas buyers would still love to buy our property but the government policies and lending restrictions have put a halt to that, at least for now!

So that lack of overseas buyers will certainly kill any excess demand, which will keep price growth negligible at best in Sydney and Melbourne.

And why, Sydney and Melbourne? Because, that’s where the majority of the overseas investment was coming into. Our other cities were not nearly as affected directly.

But this leads us to the second growth constraint.

- There is still a huge oversupply in the unit marketThey are still building lots of apartments and there are still cranes in the air. Yet, with the demand from overseas drying up, plus banks still being very hesitant to lend on apartments there is a lot of supply coming onto the market and yet nowhere near enough demand.This is reflected in the vacancy rate of certain areas.

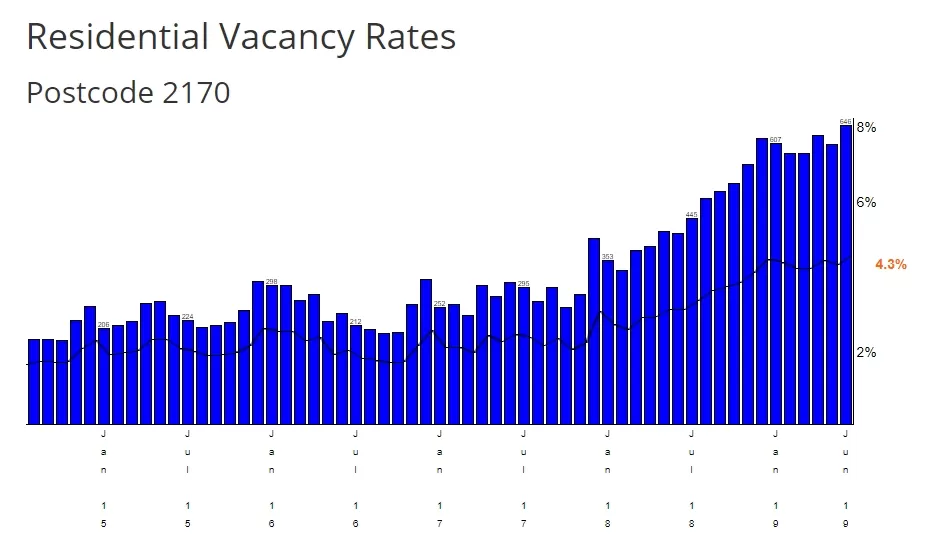

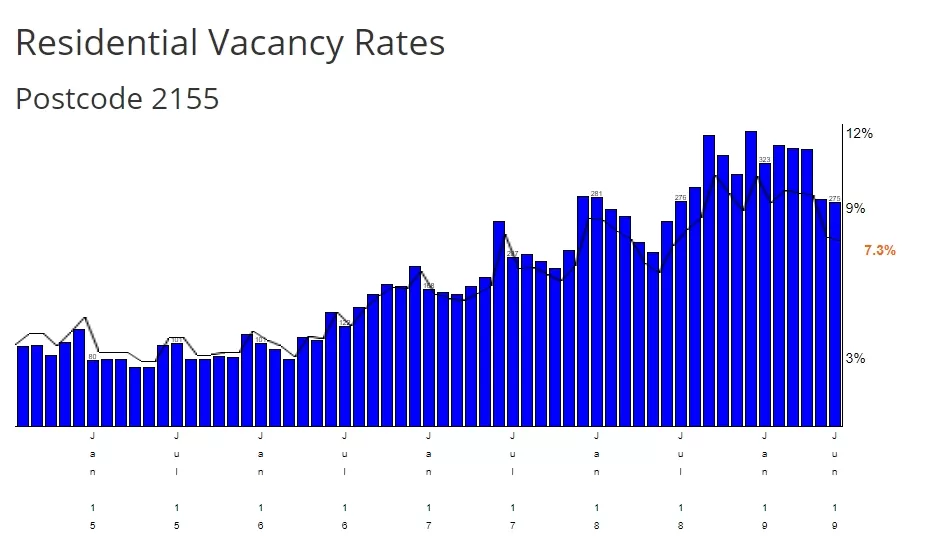

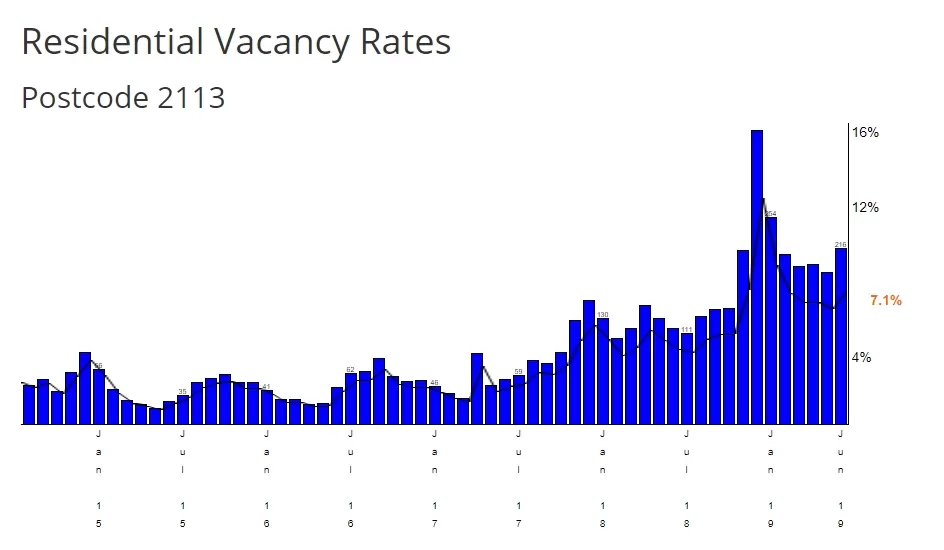

You see, a vacancy rate higher than 3% means that there is excess supply over demand. In other words, too many properties for people wanting to live in the area – and if you’re investing in those kinds of suburbs, that’s bad news because you will struggle to get your property rented and you will struggle to see price growth.

For example, look at the vacancy rate of:

Liverpool

Rouse Hill

Macquarie Park

The fundamental reason for prices to rise is demand greater than supply, and until this oversupply is mopped up, price growth is going to be negligible.

And then, the biggest reason of all…

- Low affordability

Although the price drops in our two biggest cities have made headlines for the last couple of years as almost every headline seeking man and their dog has been talking about a price crash, the fact is, there has been no price crash in our two biggest markets.For those of you, who have been following my work, you know I’ve been saying this for a while.And now with the rate of price drops slowing, it means that we still have to face the biggest issue of all and that is the average price of property in Sydney and to a lesser extent in Melbourne, is still a stretch for the average person.In fact, the Australian Bureau of Statistics show that the percentage of people who own their home outright in our two biggest markets has dropped from around 45% in the mid 1990s to now only about 30%. This has resulted in an increase in the proportion of people who have a mortgage on their home, with many now nearing retirement and being in the unenviable position of still having a debt on their home.

And with wage growth being almost negligible, which has been a major contributing factor towards our recent rate drops, it’s going to be a while before people are in a position where they can afford higher prices.

And until the average buyer in an area can afford higher prices, price growth will always be muted.

So then what do you do if you’re looking to invest in property?

You need to find a market that does these 3 things

#1 – A market where affordability is really good, where people who live in the area can easily afford prices today

#2 – A market where demand is greater than supply, due primarily to people moving into an area.#3 – A market which has job creating infrastructure to support that price growth.

There are no guarantees but if you find a market that can meet the 3 criteria just mentioned, you stack the odds in your favour of investing in an area with great potential for capital growth, while being easy to rent out.

If you’d like my team and I to help you such a property so that you don’t have to spend your time and energy doing so, then click the link below where you’ll see a case study of how we helped two time poor IT professionals create a portfolio of 5 investment properties in 6 years… and then if you’d like to find out more, you can also book in for a free strategy session to speak to me personally.

—

[Free Case Study] – How I helped a couple go from 0 to 5 investment properties in 6 years -> http://nirocall.com