Why More Aussies are Using Their Super to Invest in Property

By: Niro Thambipillay

February 7, 2025

There has been a significant increase in the number of Australians who are investing in property using a self-managed super fund. The question is, why? What’s the benefit and what could that mean for you? Well, that’s exactly what I’m going to go through in this episode, but here’s the short answer. Many Australians have worked out that investing in property with their super is a way to allow them to make more money with far less stress.

Let me explain. Hello, it’s Niro here and if you’re new to my channel, hit that subscribe button because I talk about all things related to the Australian property market and the economy. The latest SMSF quarterly data from the Australian taxation office showed that SMSF asset allocation for residential property grew 26.4% to 55.2 billion dollars between the June 2021 and the June 2024 quarters. That is a huge increase in just three years.

But to work out why more Australians are using their super to invest in property, we need to look at some numbers. And look, everything I’m about to tell you, none of it is financial advice. I’m just painting a scenario here for why other people are looking to invest in property using their super. And this might be helpful for you.

So, when you have your money invested in say a managed fund, well, then it’s essentially invested mainly in the share market. To compare whether keeping your money in a managed fund or putting it into property via an SMSF is a better option for you. We need to look at first of all, well, how much has the share market grown on average over the last 30 years?

Well, the last 30 years, from July 1994 to June 2024, has seen an annual return for the Australian share market of 9.1%. Every $10,000 invested in the market on July 1, 1994, would be worth $137,626 by 2024. Now that is a very good result, certainly better than keeping your money in the bank. So, let’s look at the share market growing at 9% per annum.

Okay, then what about the property market? Now again, property market, like the share market, it can be quite varied, different areas grow at different amounts, but let’s just say that the property market on average grows by 7%. Yes, I’m going to use a figure here. That’s less than what the share market seems to have grown.

So immediately people will say, well, if the share market grows at 9%, but the property marketing grows at 7% over the long term on average, why would you bother investing in property? Well, that’s when we need to look at the numbers. So, let’s say you have $200,000 in your super. That’s roughly the minimum that most people need to set up a self-managed super fund.

I know some people can do it with $150,000, but let’s say $200,000 is your starting point. And if you invest that $200,000, you keep it in a managed fund in investing in the share market. It continues to grow at 9.1% per annum on average over the next 10 years. Well, your $200,000 in 10 years’ time will be worth $477,834.50 not a bad result at all.

Now, let’s say you take that same $200,000 and you look to buy a property. First of all, you need to look at the borrowing capacity of that super fund that you’re setting up, and that’s really determined by two factures. Number one, your employer’s contributions, how much they’re putting into your super, which is obviously a function of your salary. And secondly, the rental income that your potential property could get.

But let’s say that with the $200,000 funds that you have in the super fund, you can afford a $700,000 property. Now, let’s assume that $700,000 properties only grows by the average of 7% per annum over 10 years. Look, many of our clients are getting much better rates than that in terms of capital growth. But 7% percent per annum, your $700,000 property after 10 years will be worth $1.377 million plus.

Now that’s just over 10 years. Let’s predict that to 15 years. And I’ll tell you why I’m doing that in just a moment. Again, $200,000 in the share market, growing on average at 9.1% over 15 years. You end up with $738,586.31 as your super balance. Not a bad result.

If you had taken that $200,000, bought a $700,000 property, it only grew at 7%, so a lower capital growth rate on average over 15 years. At the end of that 15-year period, your $700,000 properties would be worth $1.931 million plus. Now of course though, what about the debt on the property?

Remember you bought a property for $700,000 but you only had $200, 000 in cash. So, let’s say that you borrowed 80% of the value of that property when you started. So, you borrowed $560,000. So that means you put in $140,000, which is your 20% deposit plus your stamp duty and maybe other buying costs.

You might’ve been left with a little bit extra, which you put into an offset account. All right. Now, the thing is over the 15-year time period, the odds are that you would have paid off that investment property. Why? Because remember your borrowing capacity when you started was determined by your regular contributions plus the rental income. Equalling the outgoings on that property. So, you weren’t needing to put anything extra from your normal pay packet into this particular property.

But what happens over time? Well, rents increase, yes. Secondly, hopefully you’re getting some increases in your salary, which means that as a result of the increase in your salary, the amount put into super increases.

And with the super contribution percentage continuing to increase, there’s again more money going into your super.

So, when you do all the numbers, there’s a very strong chance that you would have in 15 years a fully paid off property. So that means that you have a property now worth $1.93 million dollars, fully paid off.

rather than just having $738,000 if you kept your money in a managed fund. Now, that’s a difference of $1.2 million. Now, of course, many people say, yeah, but you know, you’ve got to sell the property and then you’ve got to pay some capital gains tax. Okay, but if you sell the shares, you’ve also got to pay some capital gains tax, right?

The taxation rules across the two, whether it’s shares, managed funds versus property in your self-managed super, the taxation rules when it comes to capital gains tax are the same. So, we don’t have to worry about that because the impact on both will be the same. But there is one slight drawback with buying a property in your self-managed super.

You can’t use the equity as a property rises in value. You see, if you buy a property in your personal name and it rises in value, you can then go and use the equity that you’ve gained because of the rise in value. Again, assuming your borrowing capacity can handle that, you can use the equity to then go and buy another property.

You can’t do that with your Superannuation. However, if you bought this property and you’ve done nothing for 15 years and you sell this property, you have $1.9 odd million dollars, less whatever the tax rules might be at that time, depending on what stage of your life you’re selling this property at, but then you can go and buy maybe another two properties at $700,000 and keep some change.

Right? Or you might have extra cash because you’ve been making more contributions. So, you might now go and buy maybe three properties. And what happens if they rise in value over the next 10 years or so? You see, this is why so many people are looking to now buy property in their super, especially if they’ve got 10 years, 15 years, 20 years to go into a retirement because over that time period they end up with significantly more wealth than if they just relied on managed funds.

Now there’s another benefit though as well. You see we’re right now we’re seeing a lot of volatility in the share market with property. You don’t have that level of volatility. So, if you’re someone who gets concerned when there’s a change in the share market or a government somewhere does something silly or company do something silly and the share market tanks, well, you don’t have that concern.

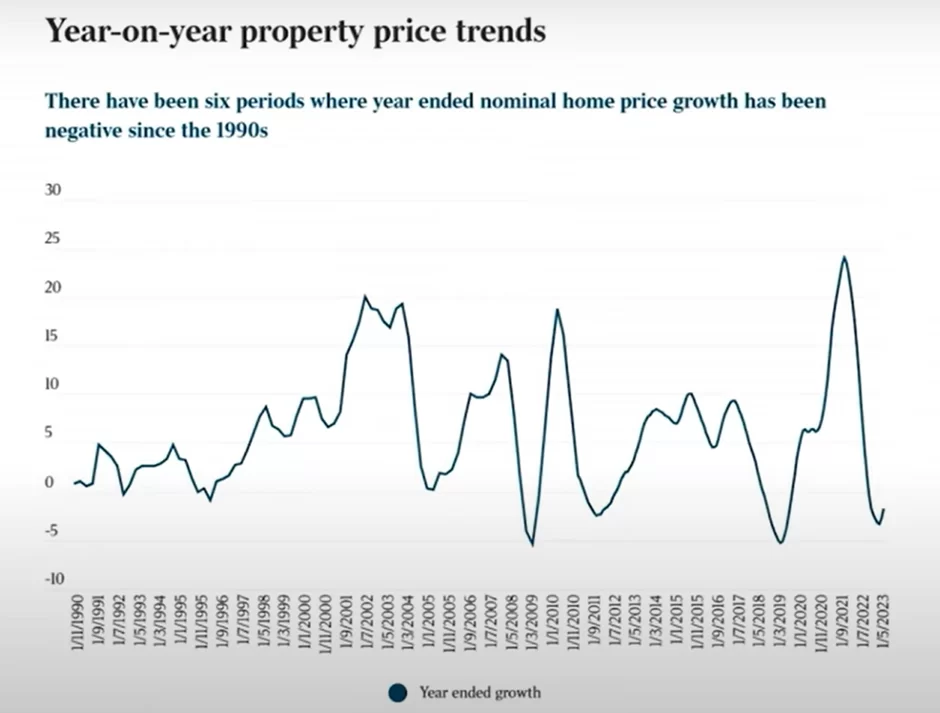

You don’t have that stress with the property market, right? It doesn’t almost matter what happens out there on a day-to-day basis. Nothing much really changes with property. And even over the long term. Property prices rarely fall a great deal. Have a look at this. Here we have a chart looking at property prices all the way back to 1991 –

And what we can see is there have been six periods in total where nominal house price growth was negative. What that means is there have been six periods where house prices have fallen. However, look at how much they actually fell. You can see that the biggest price fall was in 2009, just after the global financial crisis we had, where property prices on average fell 5.4%.

Then, we saw another price fall back in 2011 prices fell 2.34%. Then we saw property prices falling in 2018, 2019. The price fall was less than 5%. Now that of course then means that you’re not looking for a short-term gain by going down this path. This is a long-term investing plan. Again, you need to make sure you’re getting the right financial advice here, but hopefully you can clearly see that when you invest in property because of the concept of leverage.

You’re buying a property for $700,000. In this example, you’re only putting in say $200,000 or a bit less after you consider all your costs like stamp duty, ECT.

Because you’re using leverage and borrowing the gains are so much higher because they’re based off $700,000, not just $200,000.

But again, you don’t want to go and do this blindly. You want to maximize the capital gain you can make on this property that you’re looking to buy or properties while minimizing the risk. So doing your due diligence is very, very important. And if you want help with that, check out the link in the description to get total for free the audio version and digital version of my book here, because I really believe that this is an investment vehicle. That so many people are still not aware of yet, but it could really transform your financial future.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.