This will reset the Australian Property Landscape

By: Niro Thambipillay

September 27, 2024

Once again, the Labor Federal Government has opened the doors to scrapping negative gearing. Some people think that’s a good thing. Some people think that’s a bad thing. Today, based on my 22 years of experience, I’m going to share my opinion on what happens to property prices, what happens to rental prices, if they scrap negative gearing.

and how as an investor you could protect yourself and potentially even benefit if the government scraps negative gearing. Let’s dive in. Hello, it’s Niro here. After pledging not to touch negative gearing and capital gains discounts for investors. The federal labor government is once again looking at whether those initiatives should be removed.

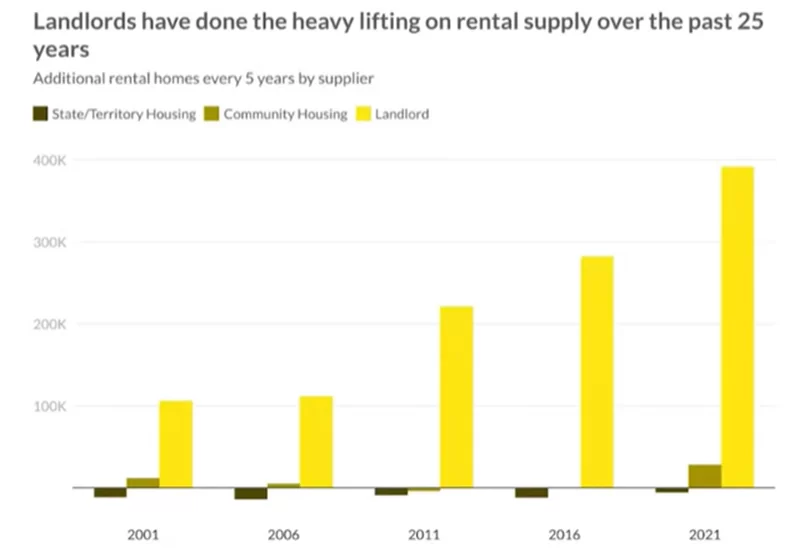

Many proponents of this are saying that would be a great thing because it’s greedy investors who have caused the property crisis and why people can’t get a property to rent and why there aren’t enough properties to buy. Really? If we look at this data from the ABS Census of Population and Housing from 1996 to 2021, so 25 years of data, what we can see is that between 1996 and 2021,

there were an additional 1.1 million rental properties provided Investors.

Now compare this to just an increase of 41,000 properties provided by community groups and a loss of 53,000 rental properties provided by the government. That means that over 96% of all rental accommodation right now is provided by mom and dad investors.

And instead of incentivizing people to invest in property, the government wants to wind back its tax breaks. And some people are celebrating this. Let me share with you what I think is going to happen to rents and property prices, if the government was to wind back its negative gearing benefits. And let’s begin by looking at rents.

Now, it’s more than likely that we’ve all seen videos like this online, looking at the length of the queues of people looking to rent properties. We just don’t have enough rental accommodation in Australia. And that crisis is only going to get worse because immigration continues to Increase. Yes, it might be slower than it was maybe a year ago, but it’s still well above long term averages.

So we have more and more people coming into this country looking for somewhere to rent. The demand from rentals is currently higher than supply. Now, what happens if you remove the negative gearing benefits from investors? Sure. Some investors will struggle like this particular person they may need to sell.

If they sell, there’s only two possibilities. Either that property is bought by another investor, which means these rental queues continue, but at least there’s still another place available for rent. Or the property is bought by an owner occupier, which means then tenants have one less property available to potentially rent.

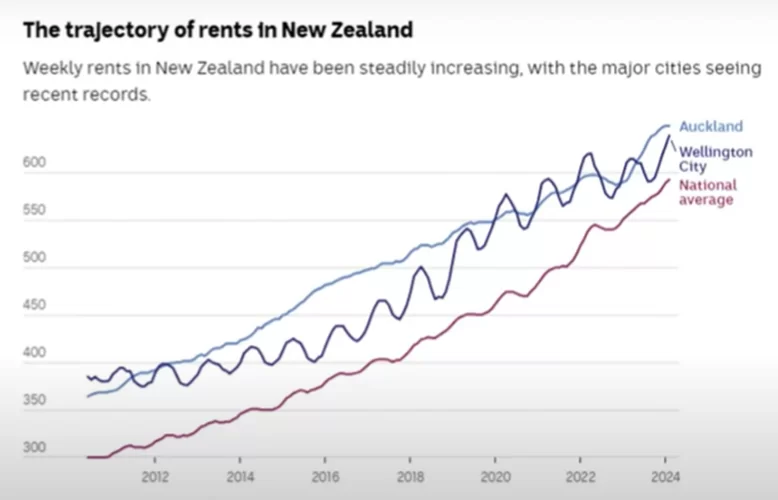

Now what happens if tenants have fewer properties available to rent and they all need to compete for those fewer properties? Rents will rise. Removing negative gearing won’t reduce rents. It’s actually going to increase them. And we’ve seen that because of what happened in New Zealand. They removed negative gearing there.

And what happened to rents? Well, as you can see from this chart,

the long term trend continued. Rents just kept rising and it became such an issue that the government is now reinstating negative gearing. So rents will actually increase If negative gearing is removed, because you will have fewer investors looking to buy these properties.

Why? Because so many investors look to invest just for tax benefits, or at least that’s their major driving force. They’re often advised by an accountant to buy. Buy property because they’re paying too much in tax. Now, if you’ve been following me for any length of time, you know that I never, ever, ever advise buying for tax benefits.

We always look at your cash flow on the property from a pre tax perspective, and then any tax benefits you get are cream on top. I don’t trust the government with tax benefits. Why? Because, as you’ve just seen, they may change their mind at any point in time. So we never make investment decisions because Based on tax benefits, we invest for wealth creation.

So while removing negative gearing may have a negative effect on some investors, it will actually have a bigger impact on tenants. Our rental crisis will actually get worse. But then what’s likely to happen to property prices? After all, if some investors sell, won’t that then crash the market? I’ll go out on a limb and say, Hey, Definitely not on a national level.

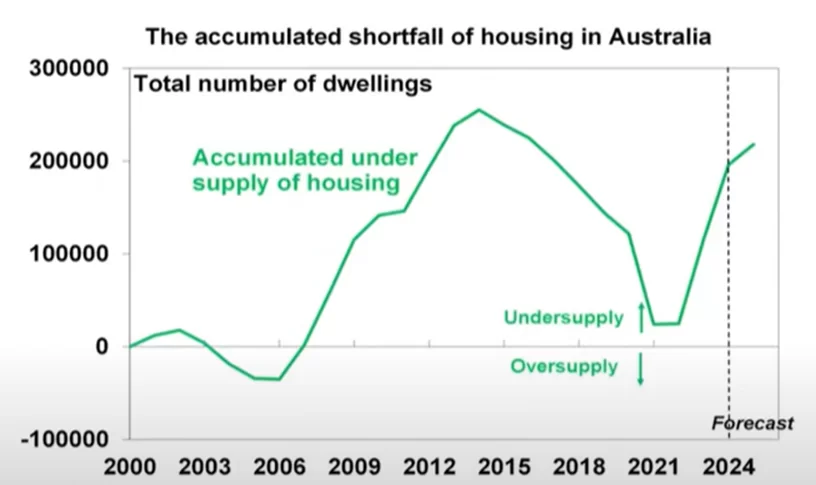

I’ll come back to what might happen in certain micro markets, but on a national level, removing negative gearing will have virtually zero impact on property prices. How can I say that? Simple supply and demand. As you can see from this chart,

which I’ve showed before, We have a massive shortage of properties in Australia.

It’s approaching 300,000. Now we’re also not building enough properties. In fact, the number of properties being built right now is fewer than it was 12 years ago. So demand is far exceeding supply on a nationwide level. And therefore based on simple economics, property prices will continue to rise. In certain markets though, Property prices will struggle.

What sort of markets are those? Markets where the majority of people who have bought are investors. So for example, certain higher density markets where there’s lots of apartment towers, and many people have bought there because of the tax benefits. They may struggle, but this is one of the reasons why for our clients, we always say you want to buy in markets where there is a significant number of owner occupiers, because from an owner occupier perspective, a change of negative gearing has zero impact to them.

They don’t get any benefits from negative gearing, so they won’t miss out on anything. If negative gearing benefits are taken away. So those markets, which is where we’re helping clients buy, where there is a majority of owner occupiers, we’ll see next to no impact from any changes to negative gearing.

Finally, though, what about the argument that investors take properties away from owner occupiers. Well, as I said before, if an investor sells, it’s either going to be bought by another investor who isn’t worried about the cashflow implications with negative gearing being taken away, or it’s going to be an owner occupier.

But right now, if you’re looking to buy a property to live in, especially in say some of our smaller capital cities or our larger regional areas, you may be able to afford property. But your biggest challenge isn’t the price. It’s finding a property to buy. We know in multiple locations around the country, sometimes a property goes on the market and a sales agent will get up to 30 offers.

Now if that means 30 different sets of people are trying to buy that one property, property. There can only be one buyer. So that means there are 29 other potential buyers who now need to go and look at other properties. So again, the demand from owner occupiers is so strong right now in multiple areas around the country, that even if an investor, Sells, it’s not going to tank the market because demand is so much higher than supply.

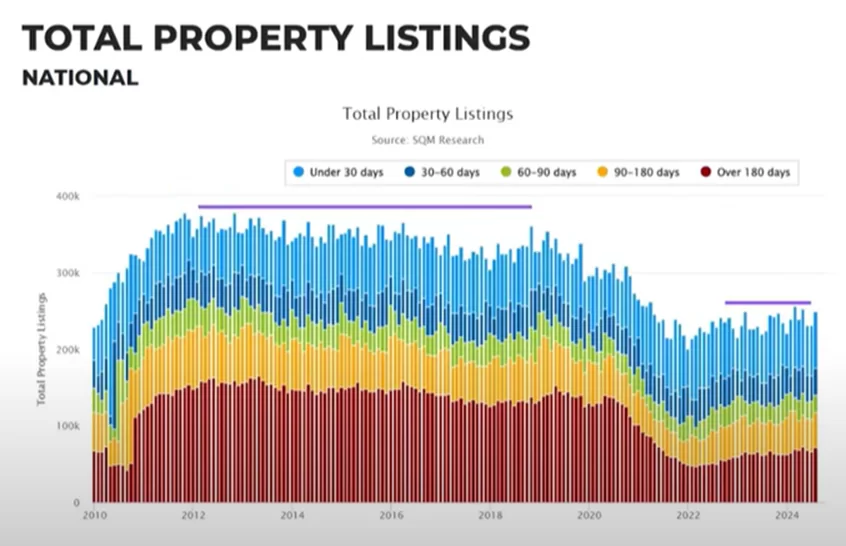

You can see that here in this chart,

which looks at stock on a national level, we have fewer properties for sale in 2024 than we had on average between 2012 to 2019. And yet our population is much higher now than it was during that time frame. So removing negative gearing. Won’t have a massive impact on property prices on nationwide level.

And even for most investors, they are not going to be massively impacted. Why? Because most investors follow this sort of cashflow pattern. They incur an average loss on a property every month for 12 months. Then at the end of the year, they go and file their tax returns and get a lump sum of money back.

But what this means is that they are able to handle the cash flow shortage on a month-to-month basis. And with where we are with interest rates and inflation, the latest data shows that inflation now is back within the Reserve Bank of Australia’s target band and falling, which indicates now that interest rates falling is no longer a matter of interest.

So if, but when will they fall? Everyone is making a different prediction. The fact is that interest rates are more than likely going to fall, which will only help improve most property investors cash flow. So as an existing investor myself, with a relatively large property portfolio, am I someone who’s worried about the government taking away negative gearing?

No, not at all. And as an investor, you shouldn’t be either. However, you still need to take a few things into consideration. Number one, when buying properties, make sure you’re buying in areas that are largely owner occupied. Secondly, make sure you’re buying in areas where demand from owner occupiers is higher than supply, which will then force property prices higher.

Third, Do your cash flow analysis pre-tax, ignore any tax benefits, let that be cream on top. So, if, for example, you can handle a cash flow shortage of 1,000 or 2,000 per month, and that’s okay for you, then find areas and find properties that match that cash flow shortage. And then if the government decides to keep negative gearing, you get that back as cream on top.

But if they don’t Watch how quickly your rents will rise, which will then improve your cash flow going forwards. And so for me, taking negative gearing away is no cause for concern. I still believe property prices in multiple areas around the country are likely to keep rising because negative gearing did not cause our property crisis that we have in Australia.

So taking it away won’t fix it. Property price rises are here to stay for some time yet.

If you want to know how to find these areas with strongest capital growth potential, get the audio version and digital version of my book here. It’s a full property investing blueprint based on my now 22 years of property investing experience.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.