The Truth About Apartment Prices Rising

This is like deja vu for me. House prices are becoming more and more expensive. And so people are being advised to invest into apartments. This was the same advice I was given 22 years ago when I started my property investing journey. And a big part of the reason why I have the life and the business that I have now is because I did not follow that advice.

So today I’m going to share with you a number of charts and data that show you what’s likely to happen to apartment prices in the future. Some of the major risks associated with buying apartments that almost nobody else will tell you, but they will bleed your cashflow dry. And finally, Why so many people regret buying an apartment in a capital city as an investment.

Let’s dive in. Hello, it’s Niro here, founder of the Investment Rise Buyers Agency. And if you’re new to my channel, hit that subscribe button because I talk about all things related to the economy and the property market. Now let’s begin by looking at what has grown the most over the last several years.

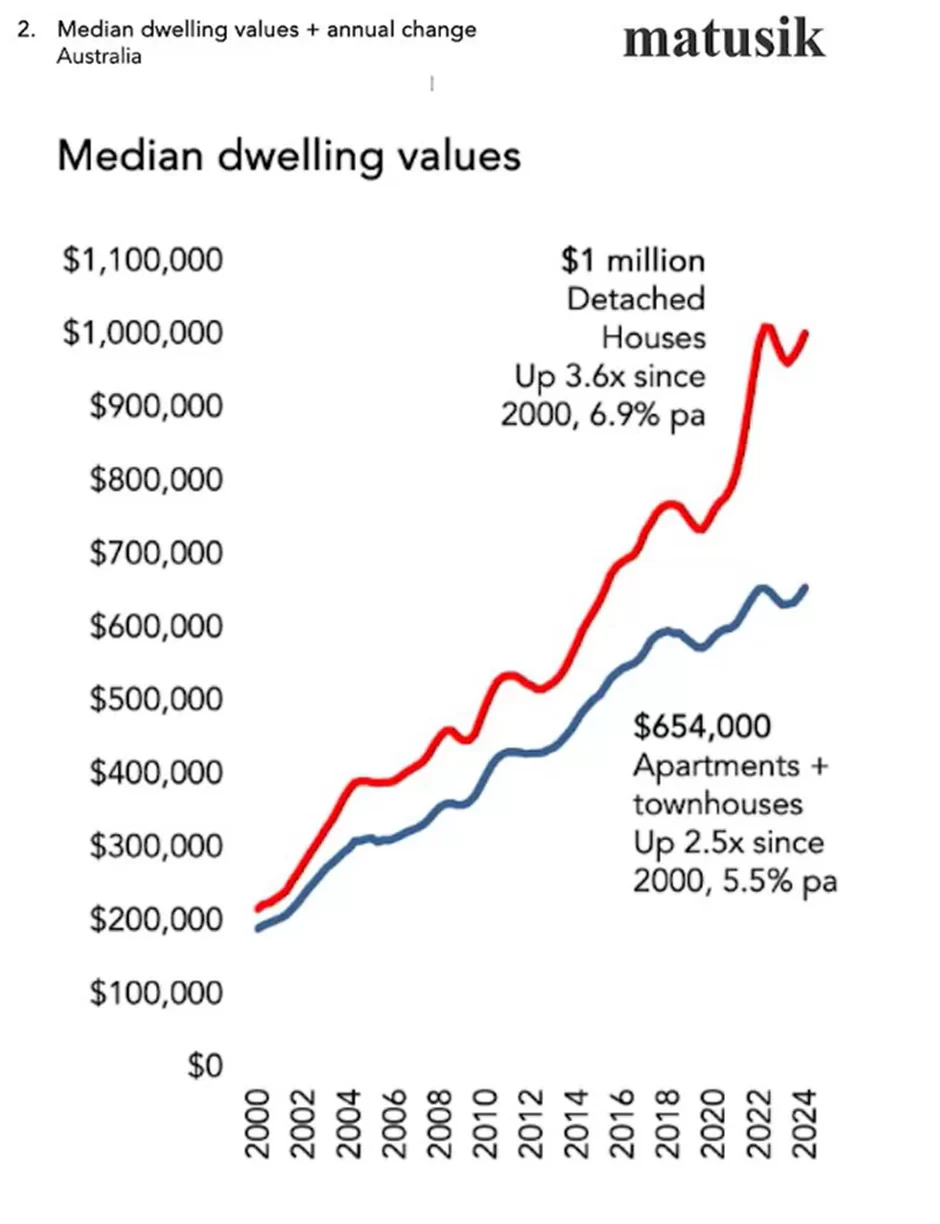

Houses or apartments. What we have here is data from Matusik looking at the annual change in median values of detached houses versus apartments from the year 2000, all the way to 2024.

And what you can see is the red line houses have clearly outperformed apartments. Houses have risen. 3.6 times since the year 2000, whereas apartments have only risen two and a half times since the year 2000.

Now, before I talk about what I expect to happen going forwards, you might be thinking, Well, look Niro, if I can’t afford a house in a particular area, well then surely I’d just buy an apartment there, because apartments have still risen quite considerably based on the data that you just shared. And sure, that’s fair enough.

Yes, if you’re thinking about just buying anything as an investment, you don’t really care about getting the best returns, then yeah, maybe an apartment might be better than doing nothing. Or, if you’re looking to buy an apartment because that’s what you want to live in, then ignore all this data. Just buy what you want to live in that you can afford.

Afford. Okay. It’s just that simple. However, if you’re looking to build an investment portfolio, you want to be making sure that every investment choice you make is the right step. It’s a stepping stone to future investments. And you don’t want to buy the wrong type of investment because if you buy an investment property, then he goes up this much, but then you could have for the same amount of money, potentially bought a property that really grows this much.

Okay. In a different area, maybe it’s a house, you’ve actually missed out on the gap. And as you saw in that previous data, the gap, the difference between buying, say, an average apartment that rose at the average amount versus an average house that rose at the average amount was several hundred thousand dollars.

So, if you’re serious about investing in property to supplement your retirement and secure your financial future, or help your kids, The data shows that houses have outperformed apartments, and that’s going to be likely to continue going forwards. Here’s why.

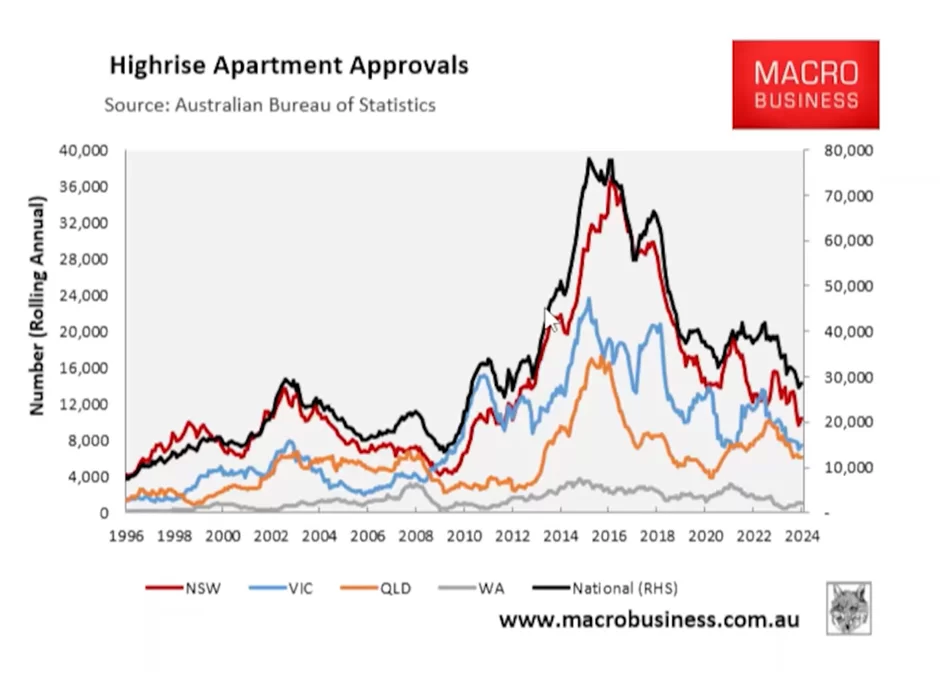

Here we have data from the Australian Bureau of Statistics put together by macro business tracking apartment approvals.

What you can see is this black line here is tracking approvals on a national basis, so you can see that if we go through history from about 2002 approvals that dropped, there was a bit of a blip up in 2008, then it dropped again. Up, down, and then from 2012, there was a huge boom in terms of apartment approvals, massive amount of supply coming on board.

Now, the thing with these approvals is that doesn’t mean then that the apartment is built tomorrow, right? It can take years for many of these high-rise towers to be built. So, when we see this massive upturn In approvals, that means that there’s a significant amount of supply coming on to the market, and that will definitely compromise on capital growth.

So, in Sydney and Melbourne, for example, we saw that apartment prices rose quite significantly from 2012 to 2017. But from 2017, price growth was essentially zero. And in many areas, apartment prices dropped. Why? A big part of the reason is all of this supply that we can see here came online. So the apartment approvals changed to being apartment completions.

What I mean by that is all of these approvals here, those projects got approved, the buildings got constructed and all of a sudden there was this massive increase in supply. So many apartments being built, not enough demand and hence price growth essentially went flat. Many people who bought in 2017 saw virtually zero price growth until 2023 and even 2024.

I know many people who bought apartments in places like the Docklands in Melbourne or Parramatta in Western Sydney sold their apartments at a loss. Some people just broke even. Now of course you might be thinking, yes, but Niro, there was a massive boom between 2012 and 2017. You’re not talking about that.

No, absolutely there was some significant price growth in the apartment market, but you needed to know when the end was coming. And if you are someone who believes that you can totally predict the market, you can predict when apartment price are going to rise and then when they will go down.

Either go flat or fall because apartment price growth is far more volatile than house price growth because of the ease in which you can increase supply. So if you can predict that, you clearly have a better functioning crystal ball than I do. Ultimately though, buying apartments for capital growth is a quite a high-risk venture because there’s so many other things happening that are outside of your control.

Here’s why I expect that the recent upturn in apartment price growth is going to be quite short lived. Home building is heading for an apartment led recovery in 2026, so less than two years away, as starts on higher density homes pick up on the back of lower borrowing costs, higher rents, Policies encouraging social housing development and planning changes, Oxford Economics Australia says attached home starts, so that’s apartments, townhouses and semi detached homes will surge 80% from their annual rate of 60,728 in the March quarter to 109,573 by June 2029, the consultancy says in its latest forecasts.

And 80% plus Increase in the number of apartments is nearly double and the thing is that they’re not going to be uniformly spread, right? They’ll be concentrated in certain pockets. We know this already when we look at what the state government planning maps are doing So therefore when you’re buying an apartment in a high rise tower somewhere you’re buying in a micro area where they’re rapidly Increasing supply and that’s why I expect that price growth there will be very minimal going forwards, although there might be a short term window where you could see some capital uplift.

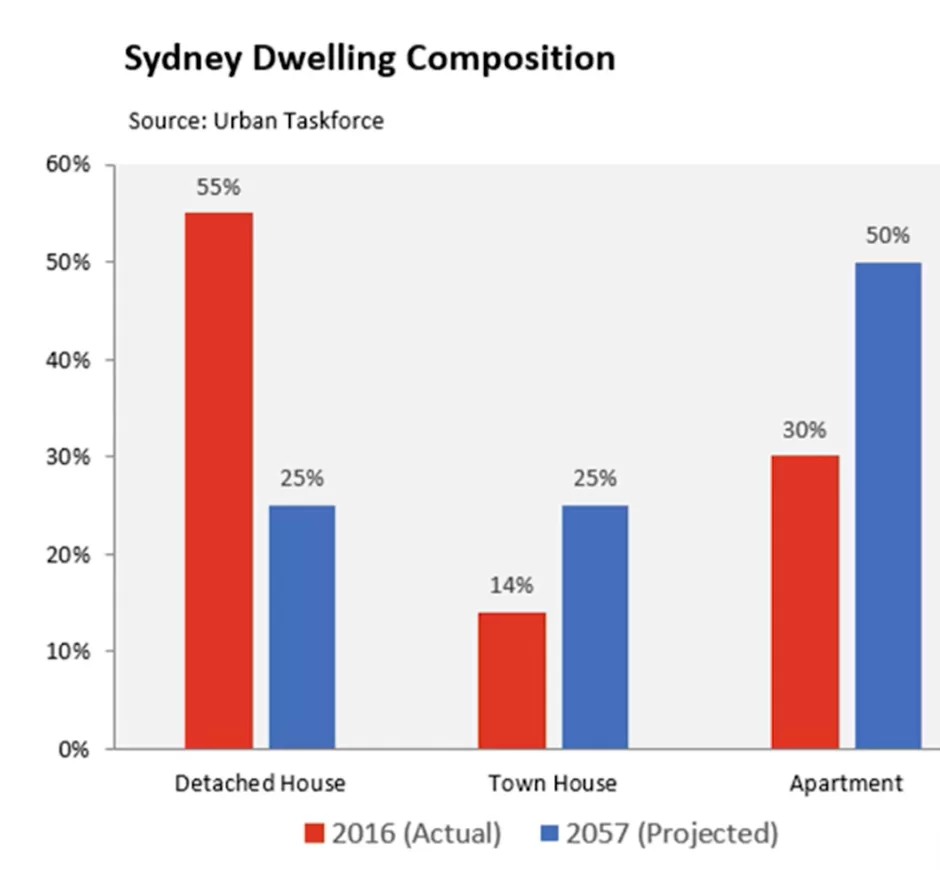

Here we have data from the Urban Task Force,

again put together by Macro Business, and what it looks at is a Sydney dwelling composition. We can see that in 2016, 55 percent of properties in Sydney were detached houses, 14 percent were townhouses and 30% were apartments. But look how that’s expected to change by 2057 from 55% detached houses.

We’ll only have 25% detached houses. Townhouses will increase from 14% to 25%, but apartments will increase from 30% of all properties in Sydney to 50% of will become very much a high rise kind of city, just like New York and other places around the world are. So what that shows you is that the government is planning on increasing the supply of apartments to handle the fact that our population is growing so quickly.

Yet the average Australian, would much rather live in a house. So therefore, houses will become more desirable, yet they’re not going to be in as much supply, which means that houses are more than likely going to outperform apartments because demand for houses is greater and not enough supply. But here’s the other problem with buying a unit as an investment property.

We know that in the last decade, so from 2010 to 2020, there was a massive increase in the number of apartments built, especially in Sydney and Melbourne, but a Four Corners investigation showed there was a litany of Issues associated with these apartments. We’ve got a real problem here. It’s systemic and it’s infecting lots of buildings across the landscape in all parts of the country.

It’s very clear. One building analyst told Four Corners in 2019, I have never seen a building that isn’t defective in some way. I know it’s my job, but even just walking around in public, I noticed these things. A forensic engineer added. Bronwyn Weir, Managing Director of Weir Legal and Consulting and co-author of the Australia’s Building Confidence Report, previously warned that thousands and thousands of apartments have serious defects in their buildings, labelling the problem enormous.

We have what is now a systemic failure that is quite difficult to unravel. Some of these buildings could potentially be a write off. Bronwyn Weir was interviewed this week by ABC Drive. Where she warned that hundreds of Australian apartment complexes remained wrapped in flammable cladding while countless others are suffering from major defects.

One of our clients is someone who tried to go down the path of investing in property by themselves. They chose to buy an, an apartment. They didn’t see any growth in that apartment, at least not as much as they wanted to. So then they enlisted our services. We bought them two properties. They’ve risen significantly and doing very, very well.

However, uh, This client now wants to sell that apartment that they bought by themselves. And because it is suffering from cladding issues, they can’t sell it. It’s in a lovely location, overlooking water. And yet, because of the cladding issues, they keep dropping the price. Dropping the price, dropping the price, and still can’t find a buyer.

You don’t want to be in that situation. And finally, if you still think you should be buying an apartment as an investment property, many people who do, or who might be advising you to do so, will tell you that it comes with better value. They look at the high-level yields and say that an apartment rental return is better than a house rental return.

Now generally then what they’re doing in those situations is that they’re taking the one suburb and they’re saying in that suburb, the cash flow return on an apartment is better than the cash flow return on a house. Now that may or may not be true. However, first thing to consider is that Is that there will be houses in other parts of the country that can give you equal if not better cash flow returns than say the apartment that you’re looking at in a high rise tower.

But secondly, and this is the thing most people forget, that the strata costs, the body corporate costs that come along with all of this. Owning an investment property rise much, much more quickly than the rental income does, which therefore means that although the high level yield might look better on paper and help somebody sell you that apartment for you from a cashflow perspective, the money in the bank, you actually end up bleeding cashflow because of the body corporate fees that are associated with these high rise apartments, often because they’re trying to fix.

Issues like cladding or anything else that comes with these high-rise towers. So essentially if you’re looking to buy an apartment, you are compromising on capital growth You are taking a risk from a construction perspective and you’re compromising on cash flow Why would you do it when there are better safer investment choices out there perhaps in other parts of the country.

But of course, though, that’s when due diligence has to be front and centre. You can’t just buy blindly. But that’s why people then go and buy an apartment because they think, oh, at least I know the area. But the data shows that you might know an area, but that doesn’t mean that the apartment price will give you the maximum capital growth.

That doesn’t mean that you’re going to avoid any construction issues. That’s why, in my opinion, focusing on houses with good growth potential will always be the safer and more profitable investment choice. But you need to know where to buy and look, if you want help with that, you’ve got a couple of options.

You can either, first of all, book an appointment with our buyer’s agency service using this link https://www.investmentrise.com.au/property-buyers-agent-service/ and we can take care of everything for you. Or if you want to learn more about. How we do what we do or how to find the right areas to invest in property. There’s a second link in the description that takes you to a free copy of, the audio version and digital version of my book here. It’s a full property investing blueprint based on my now 22 years of property investing experience.

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.

Want Help Finding Investment Property?

It all begins with a 15 minute call with a member of our team