The impact of the interest rate cut has already begun…

By: Niro Thambipillay

March 5, 2025

I’ve been totally stunned, I did not expect the property market to shift so quickly. So today I’m going to outline what’s actually happening to our various property markets. What’s caused this really abrupt shift. And then number three, the three factors you need to look out for that will have the biggest impact on property prices.

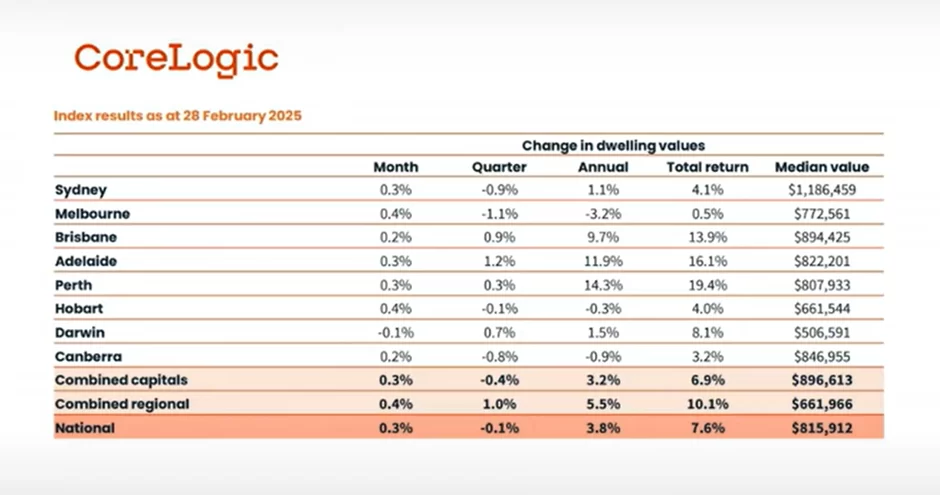

Hello, it’s Niro here. If you’re new to my channel, hit that subscribe button because I talk about all things related to the Australian property market and the economy. Housing downturn reverses in February, with Melbourne and Hobart leading the way. CoreLogic’s National Home Value Index posted a 0.3% rise in February, breaking the short and shallow downturn that lasted just 3 months and dragging the national measure of home values negative 0.4% lower.

So, what that means is that the short downturn we had, which lasted only three months, brought the national median house price down by 0.4%. And yet, in just the month of February, prices rose 0.3%, almost erasing everything that happened in those three months. Now, if we look at the data on a city by city basis, we can see that pretty much every single market, with the exception of poor Darwin, rose in February.

Melbourne and Hobart led monthly gains. The largest month on month change across the capitals was recorded in Melbourne and Hobart, both up 0.4%, where home values have previously been among the weakest. For Melbourne, the lift breaks a streak of 10 consecutive months of falling home values. Conversely, The mid sized capitals of Brisbane, Perth and Adelaide have lost their mantle as the strongest growth markets.

With a monthly change of 0.2 to 0.3%, the mid-sized capitals were outpaced by Melbourne and Hobart. Now, does that mean then that you should now completely ignore Adelaide, Brisbane, Perth? No, we need to look a bit deeper. When we look at this next chart, again from CoreLogic, we see a slightly different picture.

Yes, we can see the change in dwelling values. Last month was positive for all cities except Darwin. But if we look at the last quarter of growth for the last three months, what we can see is that Sydney and Melbourne are still negative. Brisbane and Adelaide are actually the strongest performers. Perth is positive.

However, if you look at the growth, you can see that for the quarter, it was 0.3%, but for last month it was also 0.3%. So, what that means is that in December and January combined, growth was essentially zero in Perth according to this data. So yes, February was a really good month for Sydney and Melbourne.

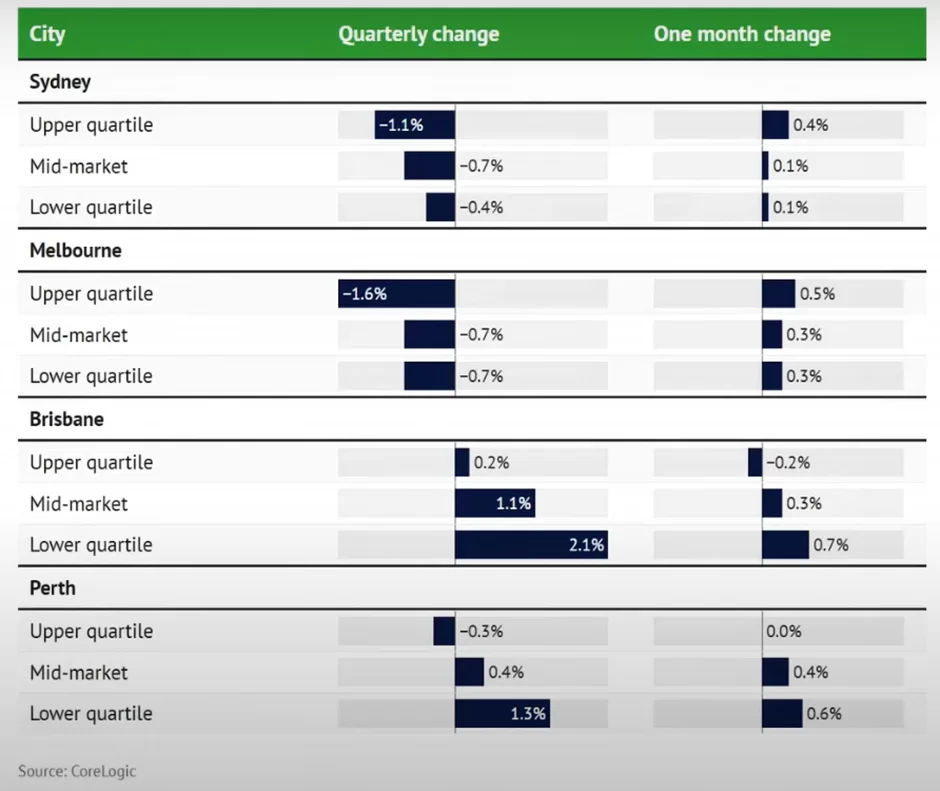

But that doesn’t mean that all pockets of our two biggest cities are rising the most. And we can see that quite clearly in this next chart, the source of the data is again, CoreLogic.

We can see that when we look at the one month change column on the right hand side, Sydney, the upper quartile, which is the most expensive, 25% of properties, Rose 0.4%, but the mid-range market and the lower quartile only rose 0.1%.

Melbourne again, the upper quartile was the best performer up 0.5% last month, but the mid-range market and lower quartile up 0.3%. But then look at what happened to Brisbane, the upper quartile dropped 0.2%, but the mid range market rose 0.3% and the lower quartile, which is again, the cheapest 25% of properties rose 0.7%.

It was actually the best performing segment of properties of all these four cities that we’re looking at. Perth upper quartile last month was essentially flat. Mid-market rose 0.4%. The lower quartile rose 0.6%. So, what this shows you is that even though all of our capital cities, again with the exception of Darwin, are starting to rise, and regional markets on average are starting to rise in value, you can’t just buy blindly.

You do need to drill down further to look at exactly what’s happening in the individual pockets that you might be targeting. But the question though is, what has sparked this shift? Obviously, it’s interest rates being cut. It might not be what you think. You see, interest rates were cut in the middle of February.

So, essentially we had two weeks of February when people were hoping interest rates were going to be cut, and then two weeks afterwards when interest were cut. During the two weeks since interest rates have been cut by the RBA, many lenders have still not yet passed on the rate cuts to their borrowers.

Many of the borrowing capacity calculators have not yet been updated. So essentially, since the rate cut, virtually no one’s borrowing capacity has changed. Virtually no one’s mortgage payments have changed. There’s been an uptick in the property market. Why? It all comes down to sentiment. The latest rate cut has infused a much higher level of confidence in the market, both from sellers who are now expecting to get a better price in the market, and buyers who feel that now is a great time to buy.

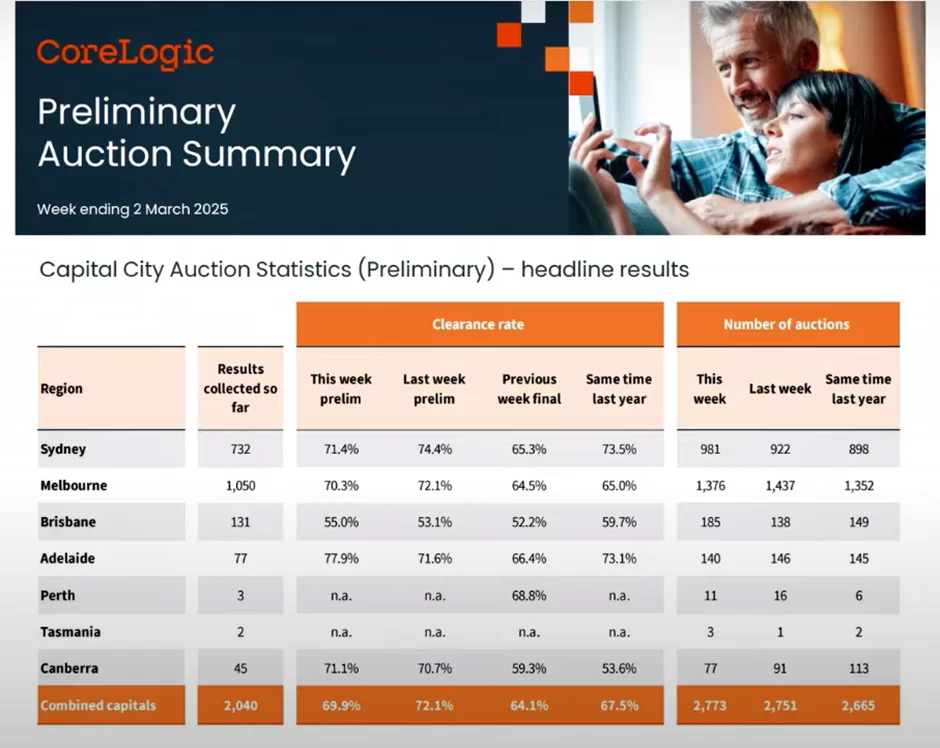

And this sentiment is being reflected in prices rising, which I just showed you, and also auction clearance rates in our two bigger cities. As you can see in this next table,

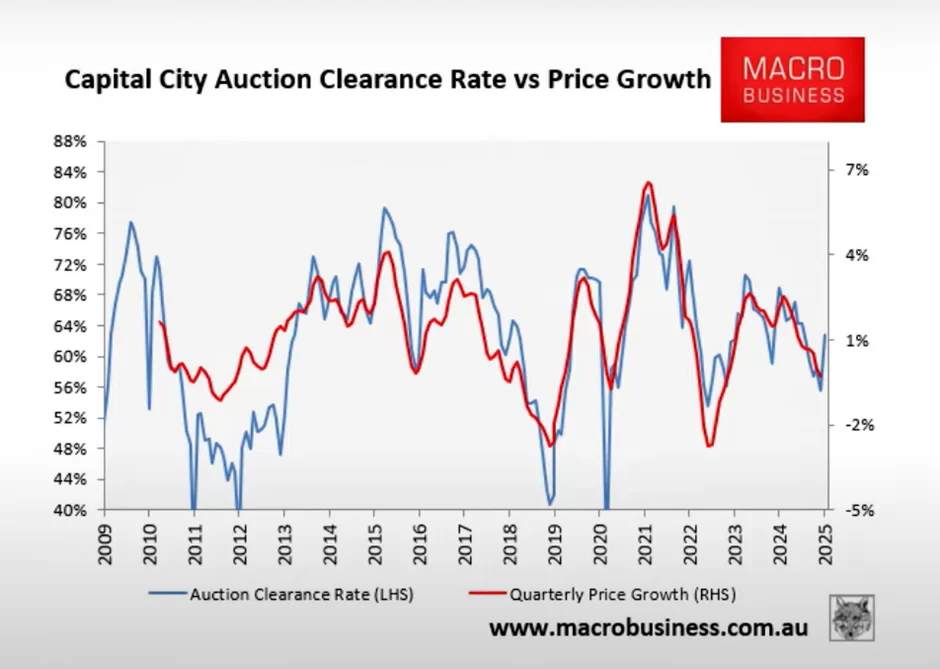

As I’m recording this, the preliminary auction clearance rates in Sydney and Melbourne for the last two weekends has been over 70%. From experience, when I see auction clearance rates consistently staying at 70% or above, that indicates a market where there’s strong demand, stronger demand than supply.

Plus, when we look throughout history and we track auction clearance rates versus movement in property prices, what we’ve seen is that as auction clearance rates start to rise, property prices start to rise as well.

So there is no doubt that the latest rate cut has improved sentiment, has improved confidence, and so we’re seeing property prices start to rise.

Even before the actual impact of rate cuts in terms of people’s improved borrowing capacities, people’s mortgage payments being reduced, that hasn’t yet filtered through and yet prices are starting to rise. But then, going forwards, the question you have to ask yourself is Well, is this sentiment likely to continue?

Is it just a short term blip upwards in property prices? Well, to answer that question, there are three factors you need to consider. Number one, yes, it is still going to be interest rates and interest rates inflation. Is the RBA going to deliver more rate cuts? They have so far indicated that they don’t believe there are going to be further rate cuts coming.

I think that’s just them sort of painting a negative picture because if the RBA said that there are more rate cuts coming, people will start spending as if those rate cuts had already happened, which would worsen our inflation problem. So, I still expect there are further rate cuts to come later on this year.

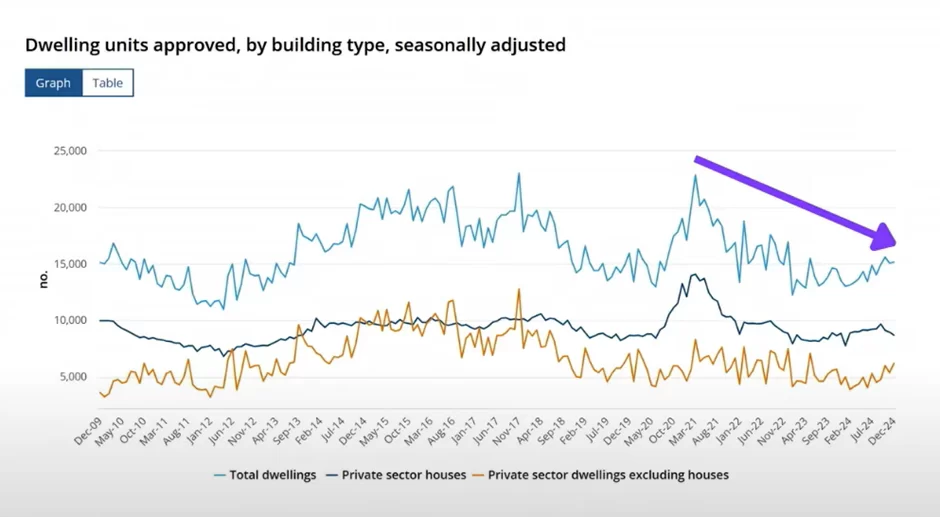

However, that’s one thing to watch. Secondly, we want to be looking at our population growth. Yes, our rate of population growth has fallen from, say, 12 months ago or 18 months ago, but it’s still well above the long-term average. And as long as population growth continues to remain at elevated levels while we are not building enough properties, and as you can see from our latest data here –

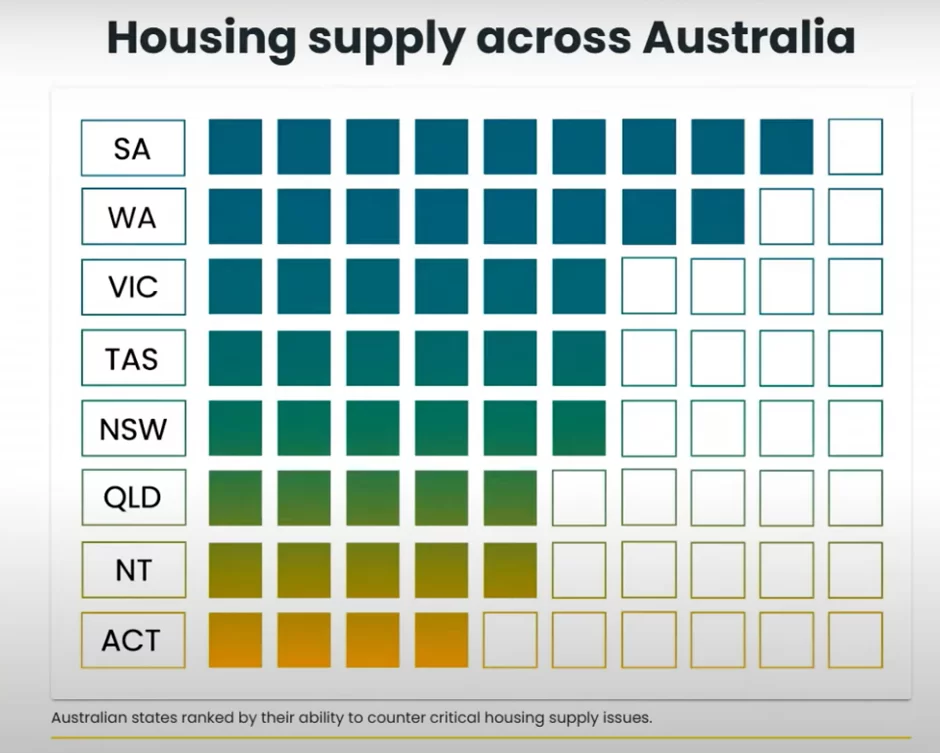

The number of building approvals that we have in Australia is lower than it was a few years ago when our population was even less. So, we still have more people coming into the country, more people needing somewhere to live, not enough properties available. And when we look at this next chart from HIA or the Housing Industry Association of Australia, it’s tracking how well supply is increasing across our different states.

Initially, it looks like, oh look, South Australia and Western Australia are doing well, the other states are doing badly. That’s actually not the case. Yes, South Australia and Western Australia are doing the best, but the way to look at this is that South Australia and Western Australia are doing badly in terms of addressing their housing supply, the other states are just doing worse.

Because none of these states are looking to meet their target for the number of properties needed based on their population. So, the under supply of housing, the housing crisis we have in Australia is nationwide. And as long as we don’t have enough properties available for the number of people who want them, you’re going to see property prices rise. That’s just fundamental economics.

But then the third factor you need to look at when looking at what’s likely to happen to property prices going forwards is jobs growth or unemployment, with wage growth slowing and unemployment creeping up. This is what the RBA is expecting and as long as that continues, we can then expect further rate cuts, which will continue to stimulate the property market and see prices finish this year higher than they started.

But as I indicated earlier, different markets are going to perform differently. So, if you want help to work out, well, where’s the best place for you to buy an investment property based on your budget, then check out the link in the description below to get total for free the audio version and digital version of my book. Otherwise, I’ll see you next time.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.