The federal budget just changed the property market forever

By: Niro Thambipillay

March 26, 2025

The federal government has just handed out its latest budget, and there were three key initiatives that we need to look at. As a result of those three initiatives, there was a key takeaway message. And in fact, that message is probably the answer to the biggest question most people ask me when it comes to investing in property.

But before we get to that, let’s look at each of the three initiatives. Beginning with migration in October of 2022, the federal government said that they would allow 235,000 migrants in each year for the next two years leading to a total of 470,000 people coming into this country. But what was the actual truth?

They allowed more than double this number. In fact, over a million people moved into Australia over that two-year period. Why is that important? Because the federal government has said that they’re going to slash migration numbers down to 260,000, which would be about half of what they’re allowing into the country right now.

Yet if we look at their track record, it’s very clear that whatever numbers, the federal government. Estimates, they almost always go well above that, so I expect the same thing to happen again. But even if they stick to that number of 260,000 people coming into Australia, that’s still well above our long-term average, which is sitting at around about 80 or 90,000 people per year.

So, we are looking at still three times the average in terms of number of people coming into Australia. And as I said, I expect the numbers will end up being much higher than the 260,000 limit that the federal government has announced. So, what does that mean for the property market?

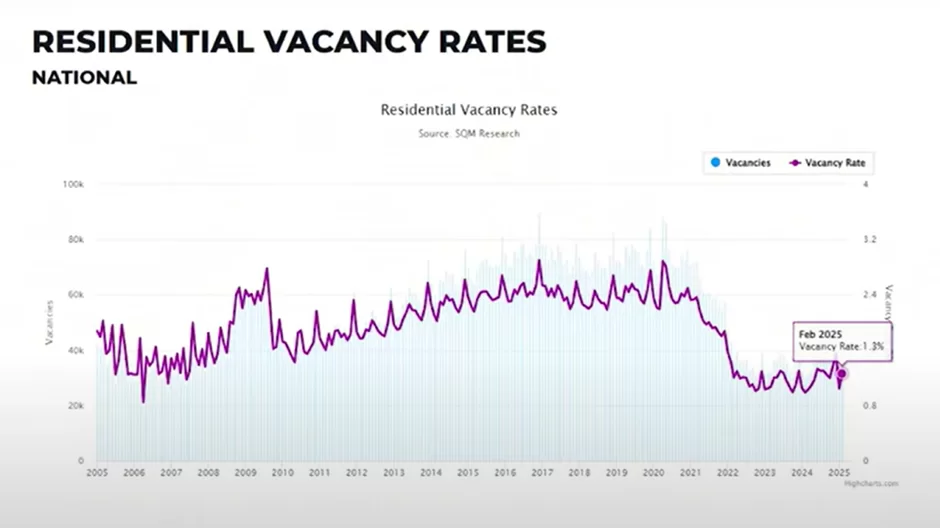

Well, first of all, it’s going to keep vacancy rates really low because there’s going to be massive rental demand. In fact, as you can see here,

the vacancy rate right now in Australia as a whole is 1.3%, which is among the lowest it’s been in the last 20 years.

But that’s average it’s even lower in places like Brisbane, Adelaide, Perth, and multiple regional markets. Anywhere where they’re unable to build enough properties for the number of people who want to live there, the vacancy rate is extremely low, and that will continue to place upwards pressure on rents.

So, in the short term, you’re going to see rents continue to rise and over the medium to long term as many of these people who come into Australia then want to stop renting and buy their own home, that will place upwards pressure on property prices.

Then we move on to the second initiative that’s relevant from the budget. The budget announced new price caps for Labor’s help to buy a scheme where the government takes an equity stake in home purchases, Sydney will have a $1.3 million limit, which is well below the city’s median house price of $1.5 million.

Melbourne’s limit would be $950,000 compared with $1m for Brisbane. With both levels near the midpoint of house prices in those cities, Adelaide’s cap is at $900,000 compared with $850,000 for Perth, $700,000 for Hobart, $1m for Canberra, and $600,000 for the Northern Territory. Now, what do you think that’s going to mean for property prices in each of those markets.

Well, when we look at this next chart from domain, using data from Core Logic and seeing what’s happened to property prices since essentially the start of this year, what we can see is that in Sydney and Melbourne, it’s been the most expensive quarter, the most expensive 25% of properties that have started to rise the most. The cheaper end and the mid-range of properties haven’t done as well.

However, with the updated caps to the help to buy scheme from the Labor government, it’s going to make it easier for people to be able to buy properties in these markets that are at the lower end. That’s going to create more demand for property prices in that lower end. I expect you’re going to see the lower and mid-range segments of these property market start to rise as well.

Driven by the fact that the government is now offering more incentives. While if we look at, say, Brisbane, where the lower quarter, the lowest 25% of properties has been the best performing segment of pretty much all of our capital cities. And now with the extra incentives coming from the federal government, that will again, make it easier for people to buy in that segment. And I expect in Brisbane, you are going to see property prices being led by the lower end and mid-range segments of that market.

So, as you can see, these two initiatives are likely to keep fuelling demand, having more and more people who are able to and willing to buy property in Australia. But then what about supply? Because the federal government keeps talking about its goal of building 1.2 million homes by 2029. Well, I spoke about in my last episode how they’re essentially well and truly behind to the tune of 393,000 homes.

That’s a gap that they’re not going to make up. So even if a target of 1.2 million homes was sufficient for the Australian population and the data shows that it isn’t, they’re still not going to reach that target, which means that they’re not going to be able to build enough properties.

Even though the Federal housing minister announced the government is throwing $33 billion at this target, they are still not going to reach that target because it’s taking longer in terms of planning approvals, construction times are longer. Construction costs are are higher. It’s just not a practical reality. So unfortunately, this shortfall in terms of number of properties we need versus the number of properties we can provide, there is always going to be a gap, at least for the next several years.

So, what does this all mean? Well, the key takeaway message, the final conclusion from the budget is that the federal government is putting in place measures to increase demand and stimulate demand. But not addressing the supply issue, at least not sufficiently. That means that demand is going to remain higher than supply for many, many years.

So, if you are someone who’s wondering, should you buy an investment property now or should you wait to see if property prices, correct? Well, what we’ve learned from the budget is that property prices are not going to correct. They’re not going to fall on average across the country. Even though affordability is so low, because the demand is there, the demand is being stimulated by the government and we don’t have enough supply, and therefore, just based on basic economics, when demand is higher than supply.

Property prices will continue to rise on a nationwide level on average. Now that does not mean they’re going to rise everywhere though. You cannot just go and buy blindly. You cannot just go and buy an off the plan apartment thinking, oh, that’s a great tax write off and I’m going to make money off that. No.

Every area around Australia is going to perform differently. Due diligence is going to be even more critical now than before because many people will jump into the property market blindly seeing that property prices are rising, and they don’t want to miss out. But at the same time, you need to know which areas are better for you, and if you want help with that. Check out the link in the description to get total for free the audio version and digital version of my book. Otherwise, I’ll see you next time.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.