The Australian Property Market Will Never Be the Same

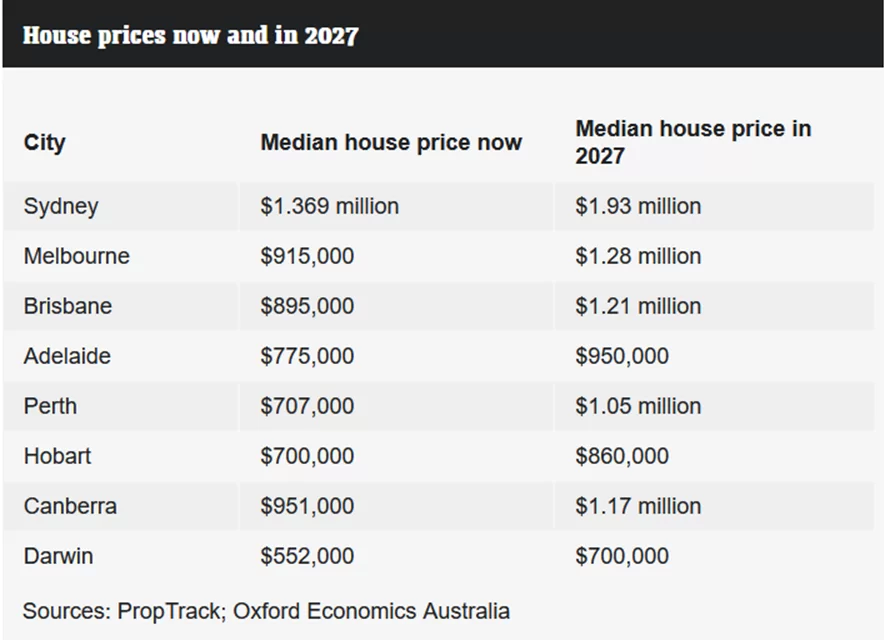

If you think property prices in Australia are expensive right now, a major economics firm has made a shocking prediction about what will happen to property prices in our capital cities in just the next three years.

What’s even more interesting is that these predictions are backed up by some of the major lenders.

In this post, I’m going to share with you exactly what these predictions are for our various capital cities. And as an investor or someone looking to buy property, how you can take maximum advantage for them.

Let’s get into it

Oxford Economics Australia, a large research house has made some shocking predictions about how much property prices will rise in our capital cities over the net 3 years

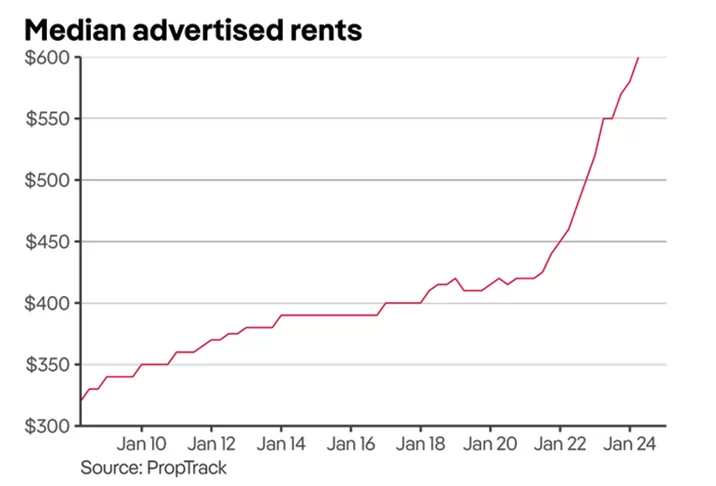

Now, you might be wondering, how is this possible when property prices are already so expensive and housing affordability is at record lows? Well, it all comes down to just one thing, not enough properties.

Marie Kilroy, Oxford Economics Senior Economist, said “you have a fundamentally undersupplied market and with net overseas migration running at half a million people, a growing participation by foreign buyers, downsizes, and cash buyers. Demand has outweighed the drag that interest rates would typically have.

Expectations of rate cuts later this year have also propped up buyer confidence in early 2024.”

Now, let’s have a look at this undersupply issue and see if we can work out how to take advantage of this if you’re looking to buy an investment property.

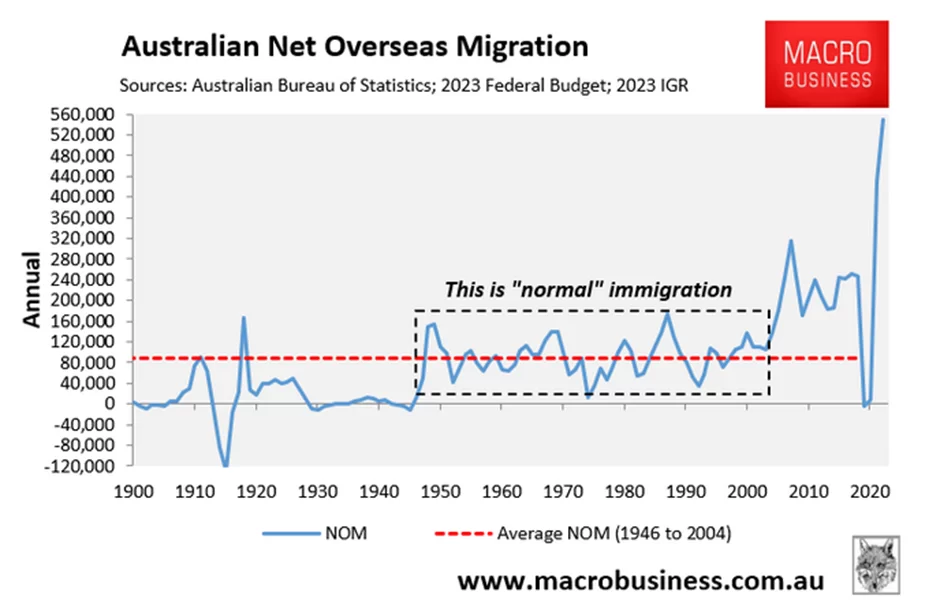

First of all, we know where most of the demand is coming from. It’s immigration.

As you can see from the chart above, migration has been operating at above average levels since really the year 2000. We dropped off during the pandemic, but now we’re at massive record highs.

Just last year, we brought in more people nationally than who live in Canberra right now.

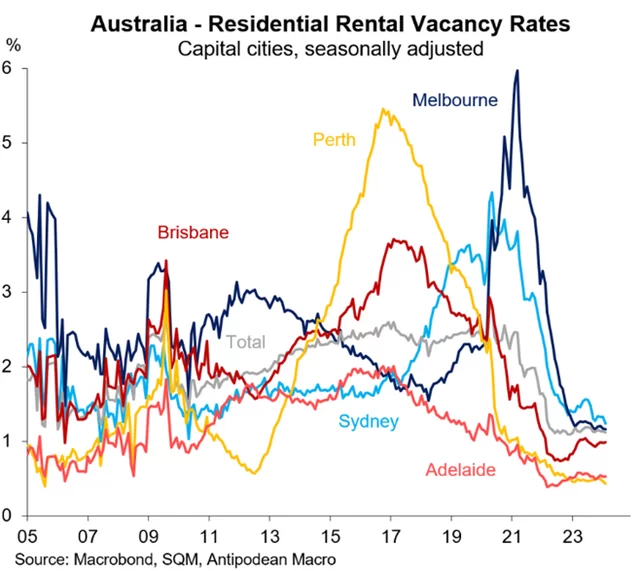

With all that demand on property, that’s why the vacancy rates nationwide are dropping through the floor, as you can see on this chart.

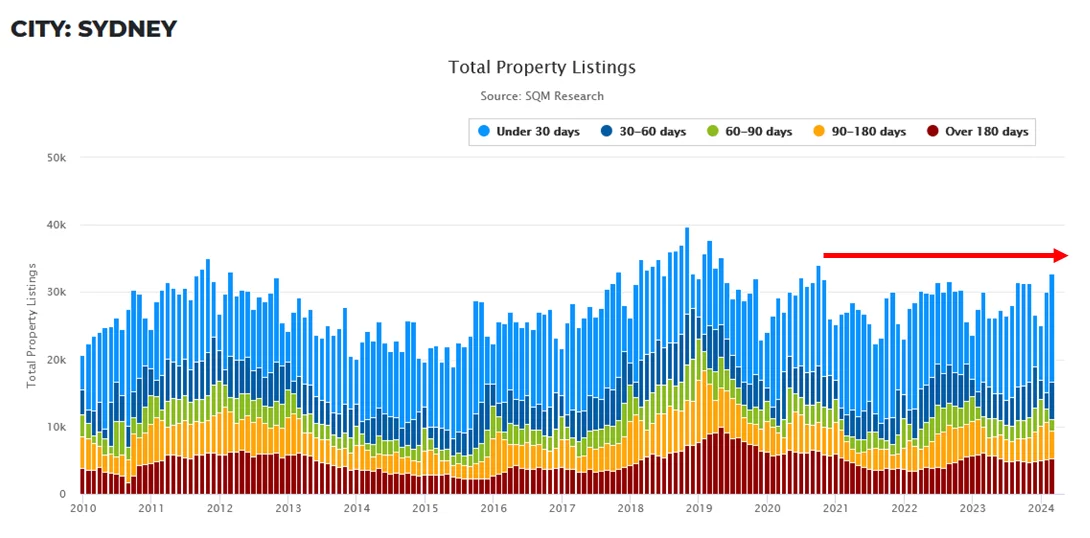

Sydney listings have stayed roughly flat since 2021. There have been a few seasonal falls and rises, but the overall trend has stayed the same.

This means that the number of properties for sale has been approximately the same, yet Sydney’s population has increased significantly over that time.

So, we know then that we have massive demand, but what about supply?

Well, supply comes down to two factors. Number one, the number of properties available for sale, or the number of listings, and then number two, the number of properties being built.

Let’s first look at the number of listings or properties for sale across our different capital cities – and see if they are falling, rising or staying flat.

Sydney listings have stayed roughly flat since 2021. There have been a few seasonal falls and rises, but the overall trend has stayed the same.

This means that the number of properties for sale has been approximately the same, yet Sydney’s population has increased significantly over that time.

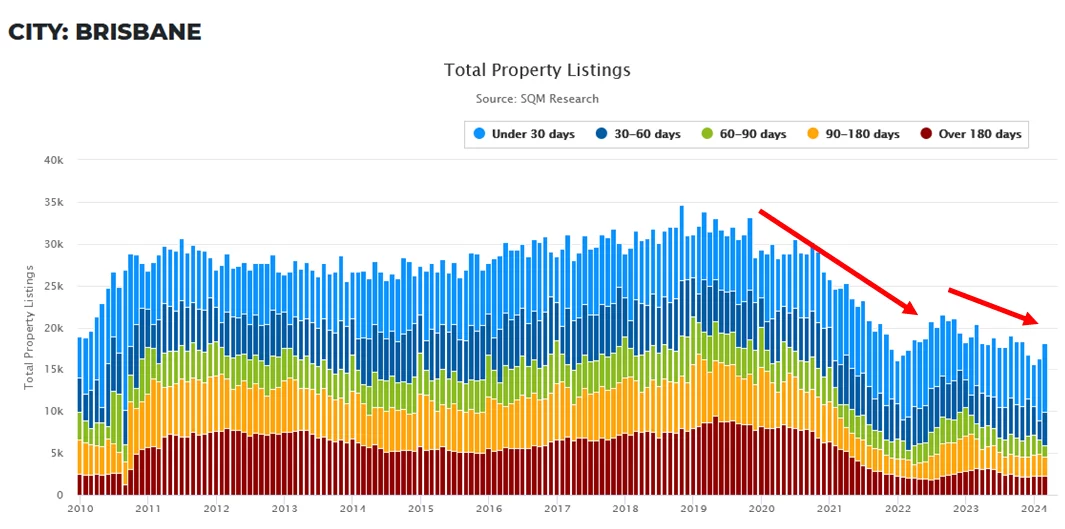

In Brisbane, the number of properties available for sale dropped from 2020, meanwhile property prices increased significantly from 2020.

Then, there was slight increase in listings in 2022, and prices dropped slightly.

Then from 2023, the number of listings has started to fall again, and Brisbane property prices have started to increase quite significantly once again.

In Darwin, listings have followed a similar pattern to Sydney. Long term, the number of listings has stayed flat, with a few seasonal fluctuations.

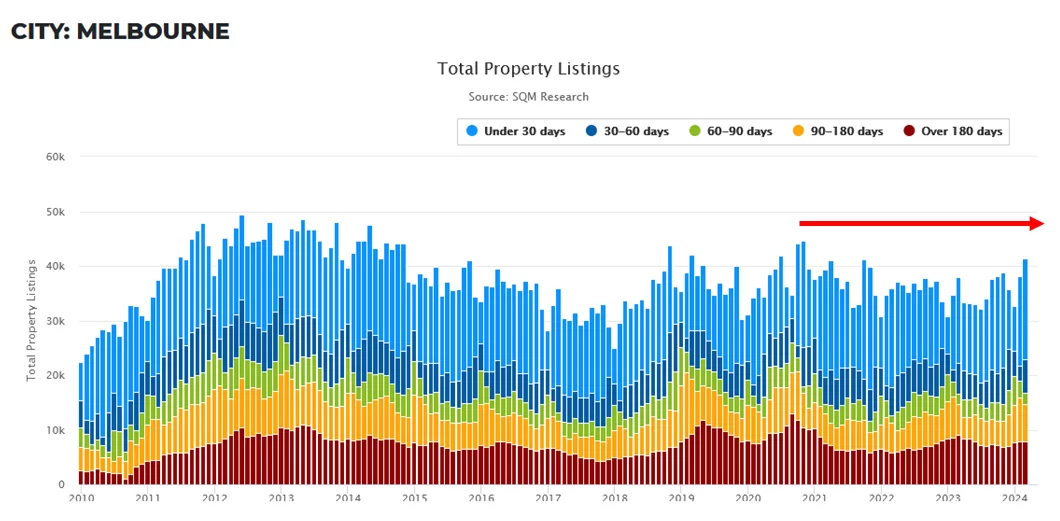

Melbourne has been one of our weakest markets in terms of capital growth. Part of the reason is that the number of listings has stayed fairly flat, and in fact we’re starting to see a slight increase right now. It will be interesting to see if this continues, because if it does, I suspect Melbourne property prices will continue to struggle.

Then from 2023, the number of listings has started to fall again, and Brisbane property prices have started to increase quite significantly once again.

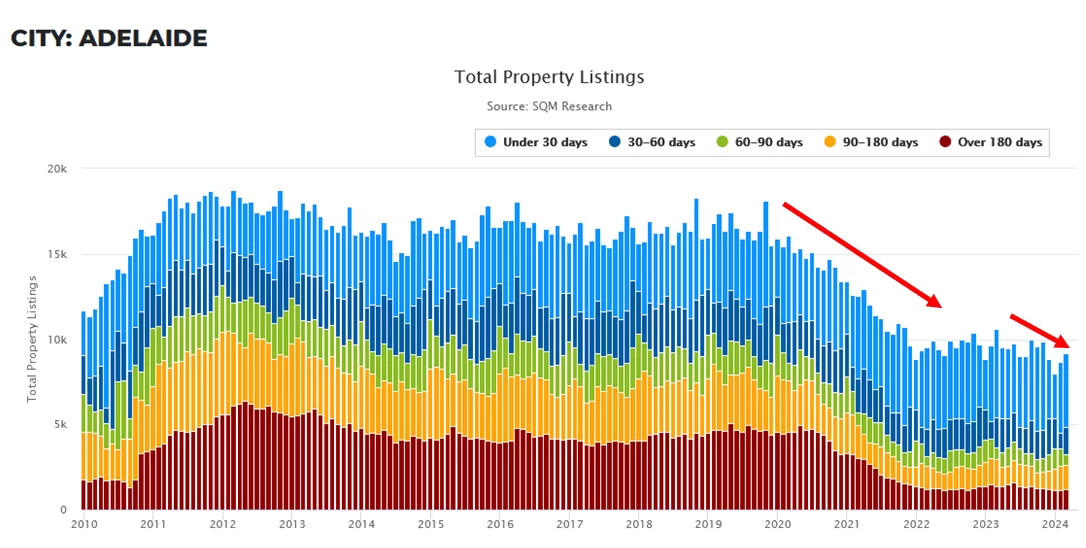

Adelaide has followed a similar pattern to Brisbane. Listings started to fall from 2020 and property prices started to rise significantly. Then listings went flat and since 2023, listings have started to fall again – and Adelaide property prices have started to increase again quite dramatically.

Melbourne has been one of our weakest markets in terms of capital growth. Part of the reason is that the number of listings has stayed fairly flat, and in fact we’re starting to see a slight increase right now. It will be interesting to see if this continues, because if it does, I suspect Melbourne property prices will continue to struggle.

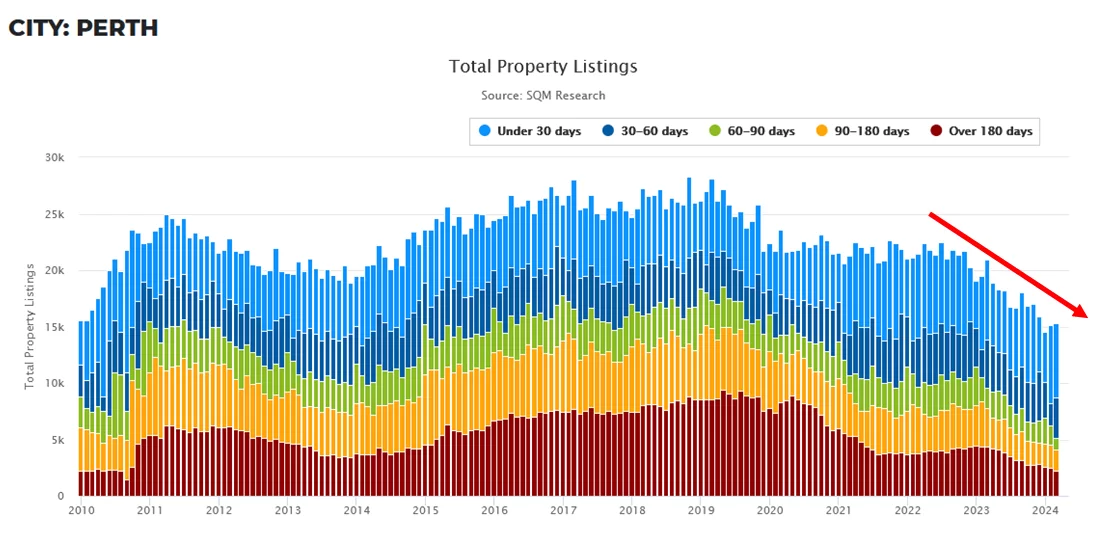

Perth had a drop in listings around 2020, but then from 2022 the number of properties available for sale have been falling away quite quickly. When you then add the number of people moving to Perth to live, it starts to paint a picture as to why the Perth market has increased so dramatically.

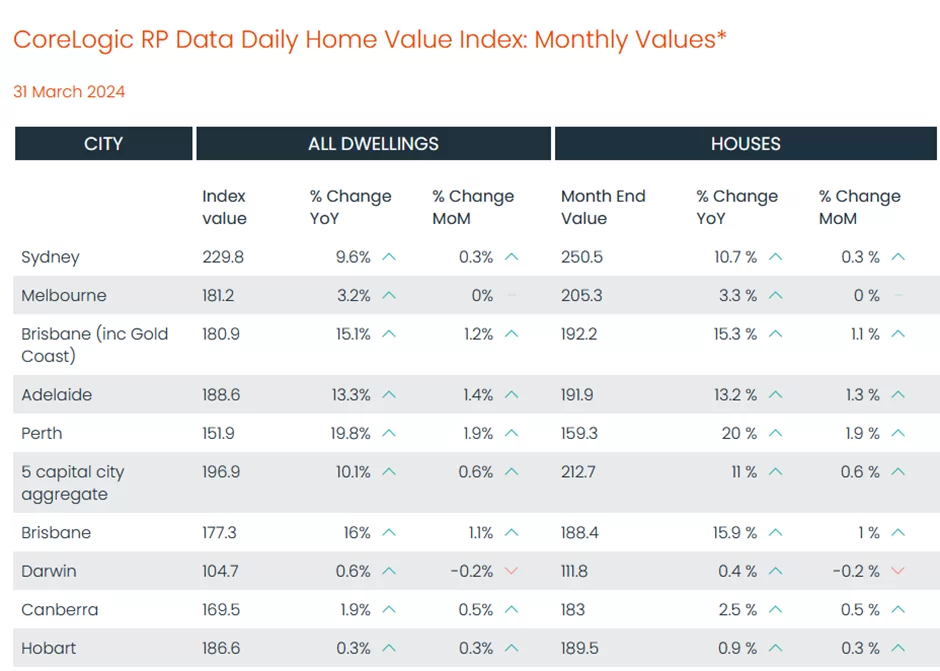

Now if you look at each of the above charts again and compare them with the property price growth from Core Logic below, you’ll quickly see that property prices in the areas where listings are falling, combined with population growth from overseas migration and / or domestic migration, seem to be rising the most.

This makes sense from a fundamental economics perspective. You have the number of properties available for sales decreasing, at a time when more people are moving into these areas. So, from an economic perspective, this means you have a decrease in supply at the very same time you have an increase in demand, which will almost always force prices higher.

But remember, there are two parts to supply. The first is listings, which we just went through.

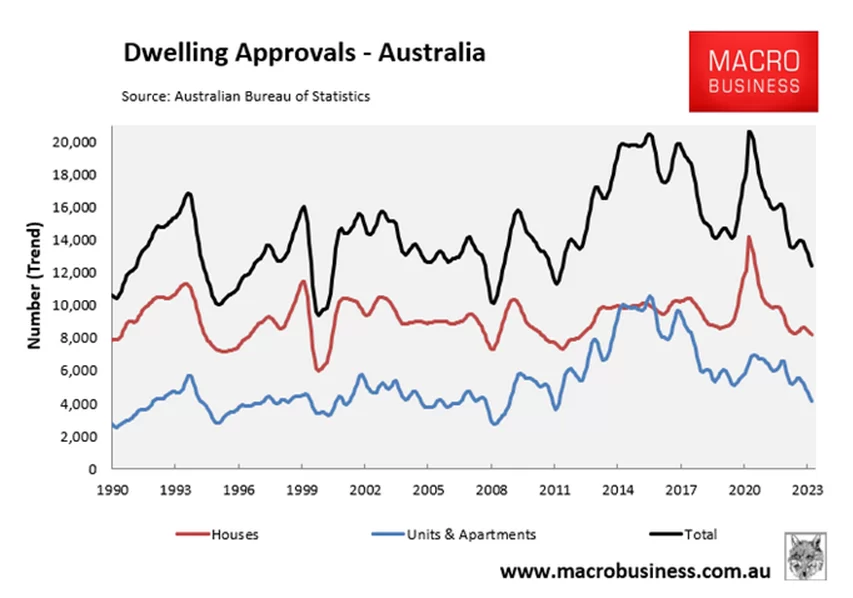

But what about new supply, new builds?

Unfortunately, there’s no good news there either. The Australian Bureau of Statistics, ABS, recently released data showing that only 12, 400 homes were approved for construction in trend terms in February 2024, the lowest monthly reading since April 2012. That’s 12 years ago and as you can see that from the chart above, the number of properties approved has been decreasing since 2020. This is at a time, when migration is increasing and therefore, we actually need approvals to be increasing as well.

If you break this down city by city, then you can really find out where the undersupply is the biggest. For example, in Brisbane right now, they’re only building roughly one home for every four and a half people who need one.

In Perth, it’s worse. There’s only one home for roughly every six and a half people that need them.

So when you see major research houses coming out and telling you about how much they think property prices will rise in value or major banks saying how much property prices will rise, you don’t then just go and buy property anywhere thinking that these research houses are totally correct.

What they’re talking about is the trend and the trend shows that property prices are likely to rise in multiple markets around Australia. However, as an investor what you want to do is you want to find the best places to buy property And that’s why you want to look at where demand over supply is the highest and attack those areas.

If you want help to know more about how to do that, click the orange button below to get, totally for free, the audio and digital version of my book. It’s a full property investing blueprint based on my now 22 years of property investing experience.

Free E-Book (Plus audio) For Aussie Property Investors Reveals…

“How to Build A Property Portpolio That Pays You An Income Every Month…

Even If You’ve Never invested Before!”

This FREE step by step guide gives you the skills and knowledge to invest with confidence every single time

I really hope you’ll take advantage of this information and if you can afford to, you do your due diligence and you get into the property market before almost everyone else who makes their decisions based on what they see in the mainstream media, decide that now is a great time to buy.

When they jump in the floodgates will open, increasing property prices even more, and increasing the rate at which property prices are rising. So, if you can take advantage of this information and jump into the market before the masses do, you can get a head start on everyone else.

Good luck

Want Help Finding Investment Property?

It all begins with a 15 minute call with a member of our team