The Australian Property Market is about to get a whole lot harder says Major Research firm

By: Niro Thambipillay

March 20, 2025

If you think it’s hard for the average Aussie to afford a property right now, a major research company has come out with a horrific prediction for how much harder it’s going to get in the property market. Today, I’m going to share with you what that horrific prediction is, the data that backs that up and finally, the key question you need to answer if you’re trying to work out whether you should buy a property or not.

New homes to fall 400,000 short of national target. The supply of housing could substantially miss the national target of 1.2 million new homes over 5 years by one third or even more as builders and developers grapple with high construction costs and a sluggish planning system according to industry analyses.

Based on forecasts by industry lobby group, the Urban Development Institute of Australia. In a new report, the delivery of new homes will fall 393,000 dwellings short of the target for the combined capital cities alone by 2029. So that’s not even looking at what’s likely to happen in regional markets.

Two years ago, the federal and state governments agreed a target of 1.2 million new homes to be delivered over the five years from mid-2024, known as the National Housing Accord. But the UDIA analysis shows the production rate of both Greenfield homes and apartments has slowed dramatically below average.

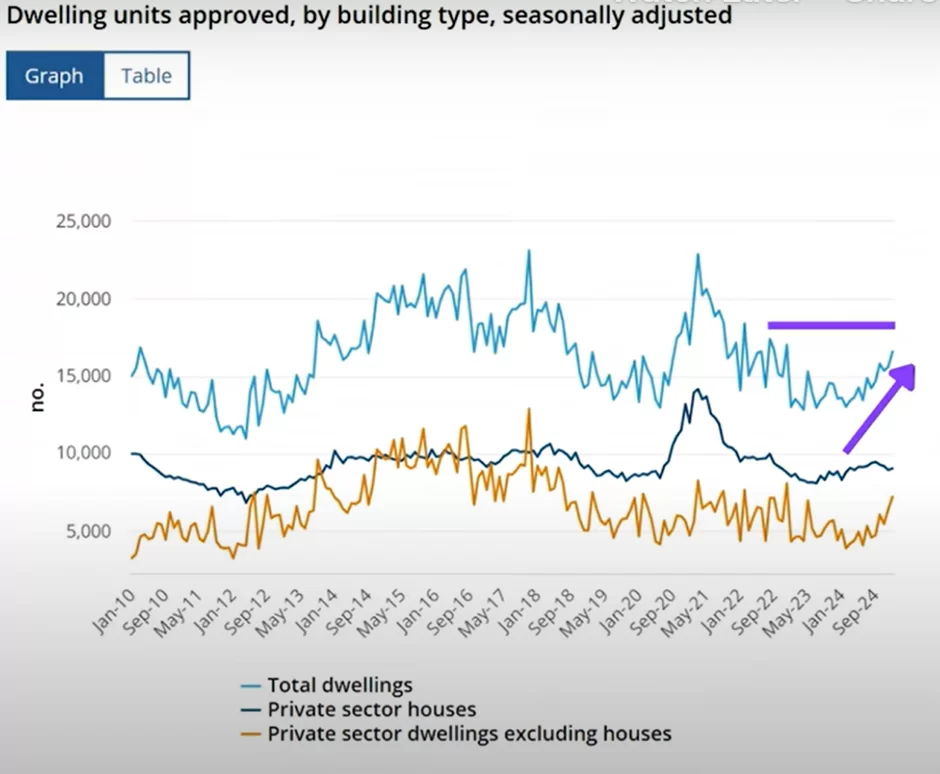

It forecasts an 11% decline in new dwelling production in 2025, a slowdown that will ultimately put upward pressure on prices for all kinds of housing. But hold on for a second. When we look at the latest data from the Australian Bureau of Statistics, looking at dwelling approvals, what we can see is there has been an increase.

In fact, dwelling approvals right now are at the highest they’ve been at since 2022. So, isn’t that a positive? Well, it is, but unfortunately, it’s not enough. Here’s what Cameron Cusher Director of Economic Research at PropTrack had to say. Each quarter, the Australian Bureau of Statistics, ABS, publishes data on the total value of dwellings, which also includes estimates of the number of dwellings nationally.

And he’s made his own version of the chart I just showed you from the Australian Bureau of Statistics. But Kusher goes on to say that the latest data found there was an estimated 11 million 294,300 dwellings across the country, with an increase of 0.5% over the quarter and 1.5% over the year.

So yes, there has been an increase in the number of dwellings, but as the chart highlights, this translates into an estimated 168,000 additional dwellings over the year, of an additional 94,200 over the past 6 months, the first 6 months of the Federal Government’s Housing Accord target. Now this is where it gets really scary.

Given that the Housing Accord target is 1.2 million new homes over a 5-year period, this translates to 240,000 a year or 120,000 new dwellings each six months. The increase in estimated dwellings is well below that figure. So, we need 120,000 dwellings every six months and the last six months we only built 94,200.

We’re well below target and it’s unlikely we’re ever going to reach there, especially with you DIAs predictions that construction volumes are actually going to reduce going forwards. Now before I share with you what this is all going to mean for people’s affordability. Let me share with you one more data source.

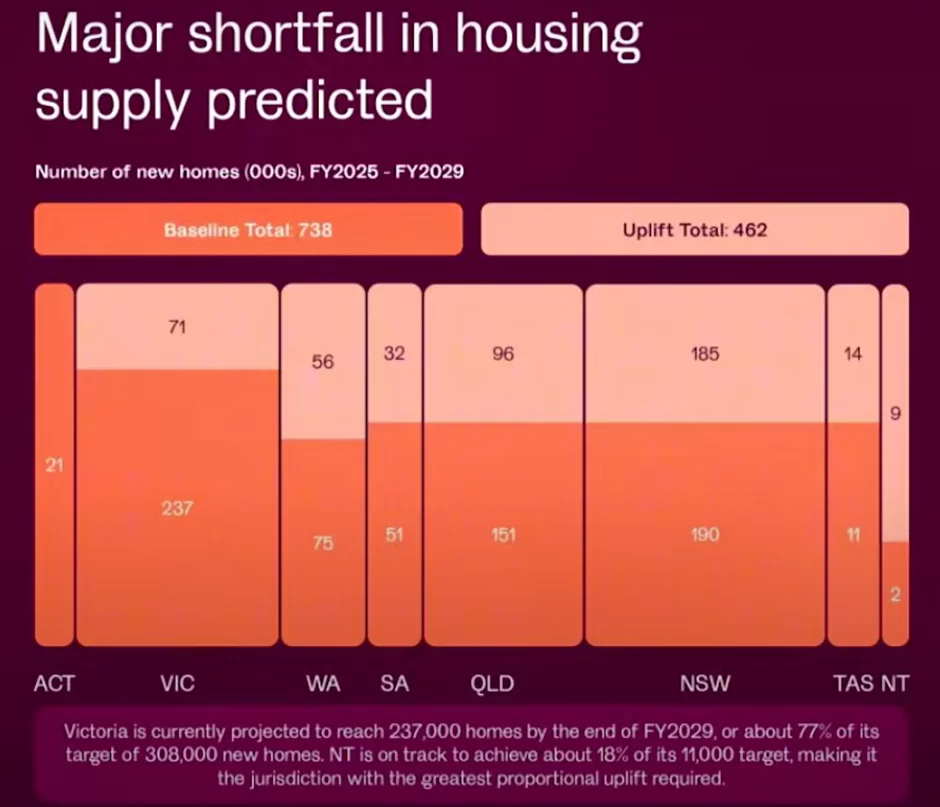

Major shortfall in housing supply predicted. This data is from the property council. So what we can see here.

In this chart is that the dark orange sections, that’s how many new homes are set to be built. The lighter orange sections at the top shows the shortfall.

So, what we’re seeing here is that Victoria, for example, is currently projected to reach 237,000 homes by the end of the 2029 financial year, or about. 77 % of its target of 308,000 new homes. The Northern Territory is on track to achieve about 18% of its 11,000 targets, making it the jurisdiction with the greatest proportional uplift required. But the key takeaway here is that when we look at every single state and territory, With the exception of the Australian Capital Territory, or ACT, there is a significant shortfall of the number of homes needed in every single state around Australia.

Now, regardless of what you might think about how expensive property prices are right now, the fact is that when we have such a supply shortage, when we have demand being so much higher than supply, property prices are likely to rise.

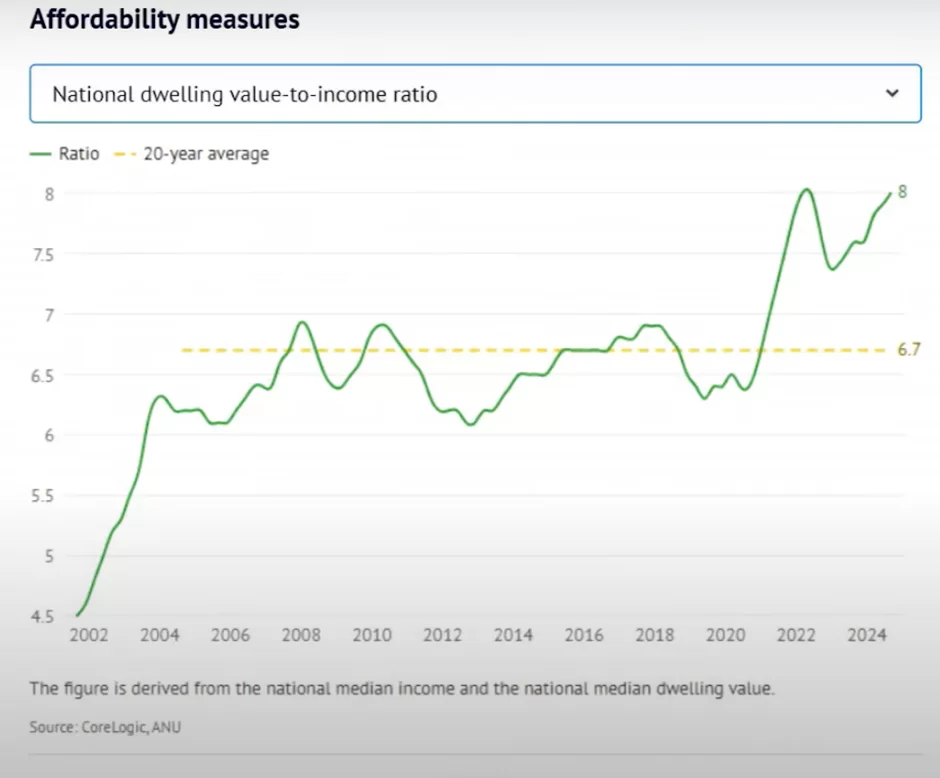

But the question then is, well, what does that mean for affordability? Well, recently, Domain published a series of charts that show just how bad affordability already is in Australia. Here we can see the national dwelling value to income ratio.

What you can see is that the 20-year average is that the national dwelling value versus income should be about 6.7 times. At the moment, we’re sitting at 8 times. This is nationally, there are certainly some areas around the country where this gap is much bigger. Then we look at the time it takes to save a deposit. We can see right now it’s 10.6 years, which is almost the equal highest it’s ever been. The highest being back in 2022.

Then we look at the portion of income needed to meet mortgage repayments. When we look at the long term average, we can see it’s sitting at about 36.6%. So just over one third of people’s incomes. Right now It’s sitting at 50.6%, So more than half of a household income is going towards mortgage payments. Its bad news for tenants as well, we can see here that the percentage of household income spent on rent, it’s currently sitting at 33% on a national basis.

Again, it’s much higher in certain pockets around the country, but still, it’s well above the 20-year average of 29%. So, with affordability getting worse, how can property prices keep rising? Well, as I said earlier on, it’s purely because there’s more demand than supply, which means that more people will miss out, more people will not be able to afford property.

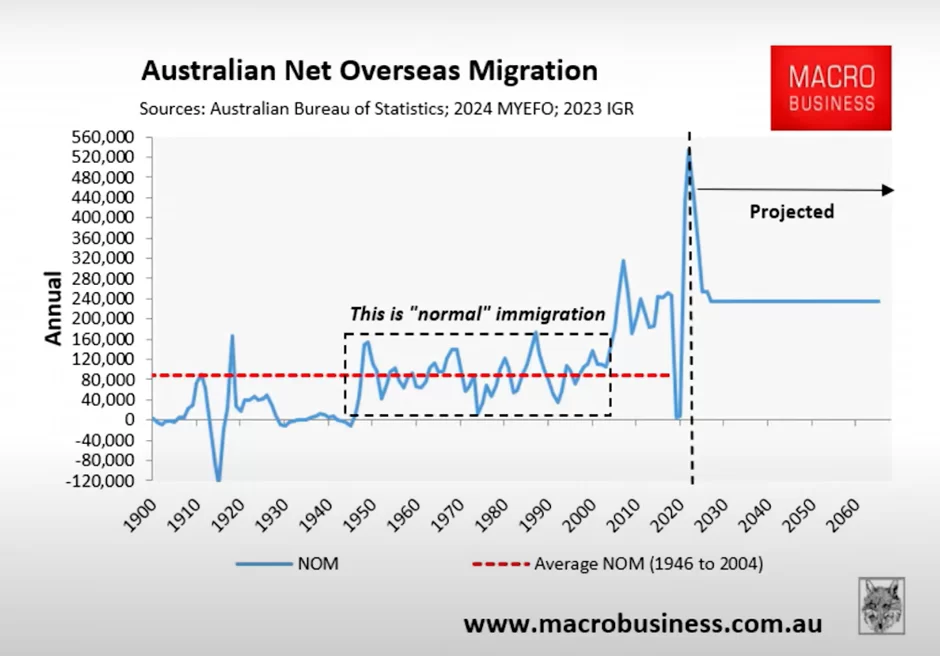

But there will be enough buyers for the number of properties available and looking at migration levels and what they’re projected to continue at going forwards. The likelihood is that demand is going to stay higher than supply, which means prices are likely to rise.

So, then the key question for you is, should you buy now? Should you wait? Well, the answer to that question is this. In my opinion, you should be looking to buy property, whether it’s your own home or whether it’s an investment property, as soon as you can afford to buy property in an area where demand is higher than supply. That’s the key criteria.

So, for example, if you can only afford property at say $300,000 right now, and you can only afford to buy in areas where maybe there’s a local pub and not a lot else happening in the area. Maybe then it might be worth you continuing to save. But if you’re someone who can afford $600,000 or certainly $700,000 and above, the likelihood is that the sooner you buy in the right areas, the more money you will make.

Choosing to wait, choosing to try and save more money, unless you’re on an extraordinary high income, the odds are that you’re just going to fall further and further behind. If you want help to work out, well, where are the best areas for you to buy for your budget, where demand is likely to be much higher than supply, giving you the best chances of capital growth, check out the link in the description below to get total for free the audio version and digital version of my book.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.