The Australian Housing Market Just Got a Whole Lot Harder

By: Niro Thambipillay

July 12, 2024

The property market in Australia just got a whole lot harder. We’re starting to see headlines about certain capital cities are starting to fall in value. Mortgage arrears are starting to rise, and that the property boom might even be over. So today I’m going to take a deep dive into the Australian property market to show you exactly what’s happening so that you can make an informed decision.

But here’s a hint. The property market is splintering. Let’s dive in. Hello, it’s Niro here, if you’re new to my channel, hit that subscribe button because I talk about all things related to the Australian property market and the economy. Let’s begin by looking at what’s happening to our various property markets.

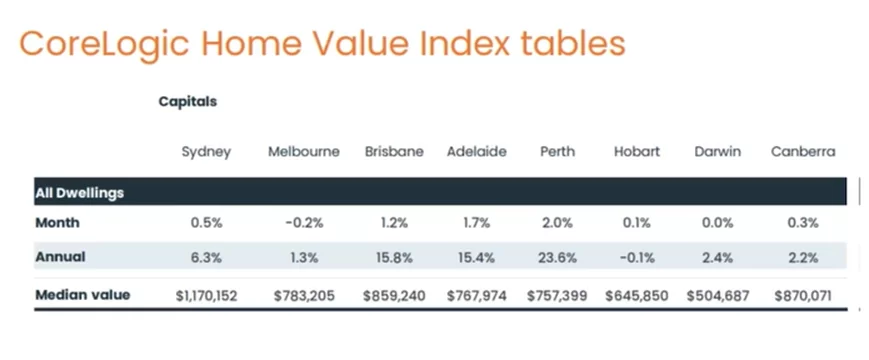

What we have here is the core logic home value index tables

What you can see is that Sydney property prices last month grew by 0.5%. It’s essentially a flat market right now, but for the last 12 months, property prices are up 6.3%. Melbourne last month, property prices dropped 0.2% and for the last 12 months, they’re only up 1.3% still lower than inflation. Melbourne is one of the weakest markets in the country. Then look at Brisbane. Ok, Last month, the median price rose 1.2%. For the last 12 months, the median price has risen 15. 8%. Adelaide, similar story. Last month, the median price rose by 1.7%. For the last 12 months, the median price in Adelaide has risen 15.4%.

Perth, still the strongest capital city market, although there are a few cracks appearing. But last month, Property prices rose 2.0 %. For the last 12 months, the median property price in Perth has risen an astonishing 23.6%. Then we have Hobart, Darwin and Canberra, all quite weak at the moment.

What about our regional markets? Well, they’re Regional New South Wales, the median property price only rose 0.3% last month, for the last 12 months, the median property price has risen 4.1%. Regional Victoria, going backwards, similar to Melbourne. Last month, the median property price dropped 0.3%. For the last 12 months, the median property price has dropped 0.5%.

Regional Queensland though, last month up 1% for the last 12 months, up 12.2%. Regional South Australia, up last month 1.1% for the last 12 months, up 11.3%. Regional WA up last month, 1.5 % for the last 12 months up 16.6%. So, what does that all tell you? Well, it tells you that if someone says, oh, the property market is crashing right now, they’re probably basing it on what’s happening in Melbourne or regional Victoria.

Although yes, those markets are struggling, but, saying that they’re crashing is a bit of a stretch. On the flip side, if someone tells you the property market is booming right now, buy anything that you can, they’re probably basing it on, for example, what’s happening in Perth. Now, everything I just went through, though, is what has happened to our various property markets.

The question, though, is what is about to happen. Before I address the negative headlines that we’re seeing in the mainstream media about arrears rising, interest rates rising, and the property market being in trouble. Let me share some basic facts about the Australian property market with you. First of all, we have a huge under supply of properties in this country.

We don’t have enough properties for everyone who wants to live here, and we’re not building enough either. A new home would have to be built every two minutes to accommodate current population growth and immigration intake, according to industry analysis of official statistics that warn the rapidly increasing housing shortfall is a driving force of inflationary pressures.

A record 547,300 migrants arrived in Australia in 2023, according to ABS data published last month. Based on official statistics of 2.5 people per household, 218,920 houses would have had to be built to accommodate the influx. This equates to 600 homes built every day, or 1 Property every 2.4 minutes, and this is before natural population growth is taken into account. When you consider our natural population growth, things are even worse. Housing Industry Association chief economist Tim Reardon said 120,000 homes would have to be built to accommodate natural population growth and replacement of aging stock, so that property is getting older before migration was even taken into account. So, that’s nearly 220,000 properties or specifically 218,920 properties needed for the migration we received in 2023 plus 120,000 properties we need just for our natural population growth. So that. Nearly 340,000 properties needed across Australia before taking into account the migration we received in 2024.

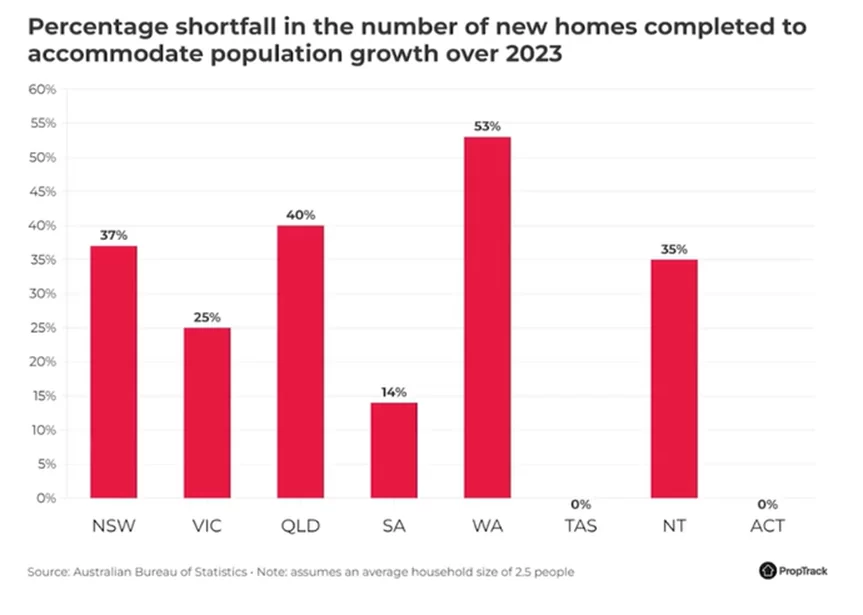

There is clearly a massive shortfall, but that shortfall is not spread equally across the country, especially when it comes to the building of new homes. This chart illustrates

percentage shortfall in the number of new homes completed to accommodate the population growth over 2023. So, in New South Wales, we fell short by 37%

In Victoria, we They fell short by 25%. Queensland, the shortfall was 40%. South Australia, 14% and then WA had the biggest at 53%. So, although the shortfalls differ across the states and territories, with only Tasmania and ACT building enough properties, what’s interesting though, is that the size of the shortfall does not necessarily relate to the size of the property price growth.

For example, you can see that Victoria has a bigger shortfall in terms of needed. properties being built than South Australia, but the property market in South Australia is rocketing along while in Victoria, it’s actually on the decline. So, there’s clearly other factors that we need to consider, which I’ll come to in just a moment.

But the fact is on a nationwide level, we have a massive shortage of properties. Every time a property comes up for sale in many areas around the country, there are multiple buyers, multiple buyers, vying for that property. Many local real estate agents report having 10, 20, even over 50 offers being made on properties they have for sale.

Recently, we looked at a property for a client and we chose not to make an offer because there were over 68 offers on that particular property. The biggest challenge many real estate agents have right now is that they don’t have enough properties for sale. An agent I spoke to recently who has been in the game for 16 years said, Niro, I’m homeless right now.

What he meant by that is he literally had zero properties for sale right now. His question was, where do I get my next listing from? Because a real estate agent’s challenge right now is not selling a property in this stronger market. It’s actually finding properties for sale when there is that kind of shortage of available properties in Australia, how can property prices fall when there is such massive demand versus supply?

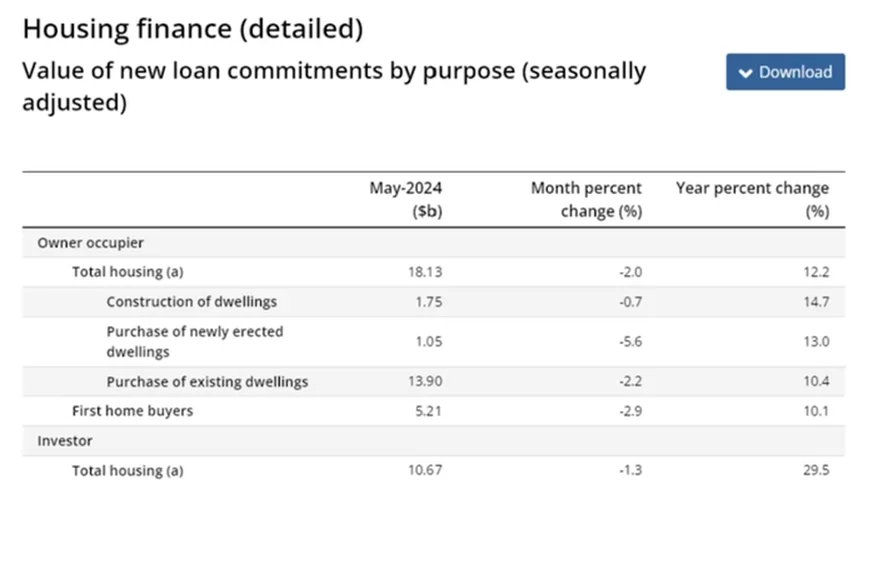

It’s only going to keep forcing property prices higher on a nationwide level. So, the question though is, is demand starting to fall? Well, let’s We are starting to see headlines now about fewer people taking out loans in general. What we have here is a table from the Australian Bureau of Statistics looking at housing finance.

What we can see is that for May, which is the most recent data we have for owner occupiers, the total amount of loans taken out dropped by 2%. For the year though, it’s still up 12.2%. But again, if we then drill down into the data, we start to see a more accurate picture. You can see here

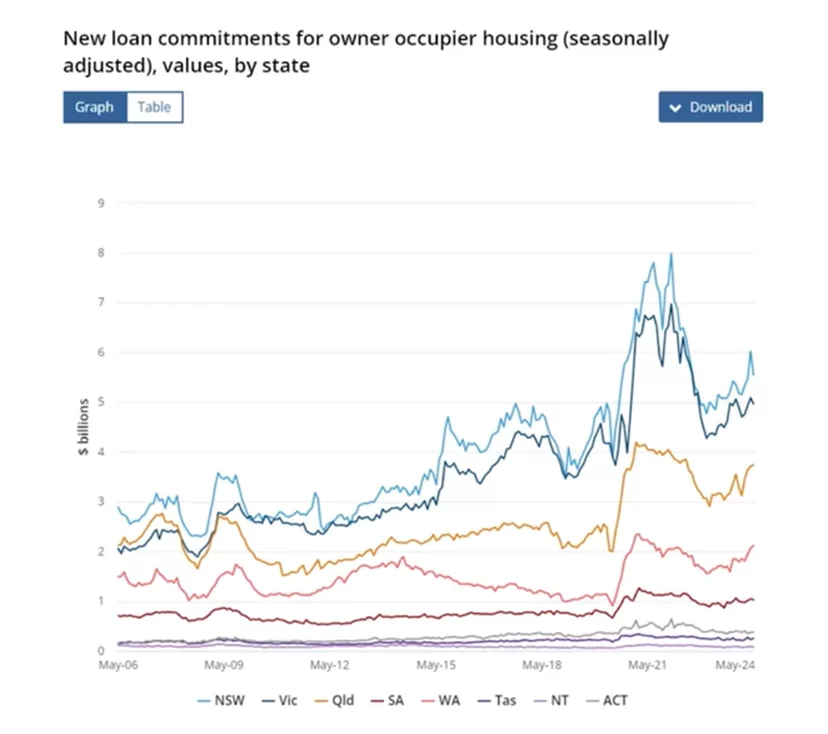

when we look at new loan commitments for owner occupier housing divided up by states, what you can see is that, yes, in New South Wales, loan commitments from owner occupiers are starting to drop.

They’re also dropping in Victoria, but then Queensland is on the increase. Western Australia is on the increase, South Australia plus all the other states are staying consistent. Demand is staying strong, but then what about mortgage arrears? We’re seeing headlines that mortgage arrears are now at the highest they’ve been at for over eight years.

Won’t this then make the market crash? Well, again, there are two things here to consider. First of all, something I said earlier on, we have a massive shortfall of properties in Australia. For almost every property that comes on the market, there are multiple buyers. So that means that you’re not then looking to negotiate with the vendor in many cases in markets around Australia, rather you’re competing with other buyers.

So, the vendor’s motivation, the fact that the seller might be in mortgage stress is almost irrelevant. The fact that you’re competing with other buyers will continue to push property prices higher of course, this will differ from state to state, but the shortfall of properties will be a bigger factor than mortgage arrears.

Secondly, when you break down the mortgage arrears, what you find is that this increase in arrears is confined to certain states. Mainly, our more expensive ones, New South Wales and Victoria, we’re not seeing similar increases in states of Queensland, South Australia, Western Australia, for example. So, what’s the takeaway message from all the data that I’ve shared today?

Simply this, the shortfall in properties is the biggest determining factor of what will happen to property prices in general across our country. I expect the median house price in Australia will continue to rise. Well, that does not mean you can buy blindly, due diligence is more important than ever before.

Certain markets will continue to struggle while others will continue to rocket along. If you can find those markets, you will do exceptionally well. If you want help with that, check out the link below to get the audio version and digital version of my book here. It’s a full property investing blueprint based on my now 22 years of property investing experience.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.