Sydney property prices drop Here’s what comes next

By: Niro Thambipillay

November 11, 2024

It’s true. Sydney property prices have dropped for the first time since January 2023. Today, I’m going to talk about what this means for property prices going forwards, and I’m going to share with you two different strategies you could use to take advantage of this, depending on what your goals are.

Let’s dive in. Hello, it’s Niro here. Sydney houses have joined those in Melbourne in losing value as a slowdown in population growth and a jump in properties on the market finally put the brakes on ever increasing prices. It was the first monthly fall in Sydney house values since the start of 2023.

Despite the drop, the median value of a Sydney home remains out of the reach of most at $1.48 million dollars up 3.9% over the past year. So what that tells you is that even though the Sydney market isn’t rising rapidly, and yes, there was a slight drop last month, property prices today are still higher than they were at the start of this year.

So the question then is, how much did property prices drop last month? It was all over 0.1%. The minus 0.1% fall in Sydney home values was the first monthly decline since January 2023 following a short but sharp minus 12.4% drop in values between February 2022 and January 2023. So during that 11 month period property prices in Sydney fell on average, about 1% per month.

Today, we’re talking about prices dropping 0.1%. But it’s the next statement that’s really pertinent. Weaker conditions have been led by the most expensive areas of the market, with a minus 0 6% fall in upper quartile house prices. Values over the month, and a minus 1.1% drop over the past three months.

Now the upper quartile of properties is referring to the most expensive 25% of properties in Sydney. We’re talking the top end of town. In comparison, Sydney’s lower quartile house and unit values both recorded a half a percent rise in values in October. CoreLogic’s research director, Tim Lawless, notes that the stronger performance across the more affordable end of the market is a consistent theme across the capital cities.

A combination of less borrowing capacity and broader affordability challenges has As well as a higher than average share of investors and first homebuyers in the market is the most likely explanation for stronger conditions across the lower value cohorts of the market. Now this result, it comes as no surprise to me because this was expected based on the data we’d been seeing for the last few months.

For example, When we look at the quarterly change in property prices for the three months to September with data from CoreLogic, we can see that in Sydney it was the most expensive 25% of properties that were falling in value, whereas the mid range and more affordable properties by Sydney standards were still rising.

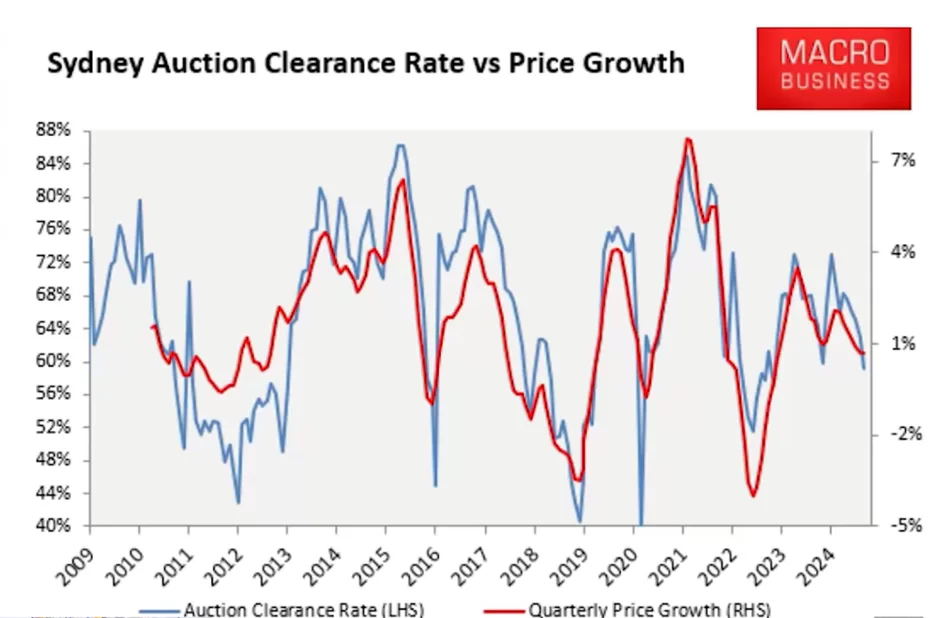

Secondly, We saw that auction clearance rates were starting to fall below their really high levels of 70%. Now they were starting to fall below 65%, and I’ve spoken in the past about how auction clearance rates in our more auction heavy markets Primarily, Sydney and Melbourne are a great lead indicator for what’s likely to happen to property prices going forwards.

This chart from Macro Business shows it quite clearly.

You have the blue line, which is the auction clearance rate, and the red line, which looks at quarterly price growth. And what you can see is that the red line, the price growth line, follows auction clearance rates. And as auction clearance rates start to fall, Property price growth starts to fall.

When auction clearance rates start to rise, property price growth starts to rise. It’s a great indicator for markets like Sydney and Melbourne. However, it does not apply to other markets like some of our smaller capital cities or regional markets which don’t really use auctions very much. And the third reason the slowdown in price growth in Sydney was expected is because of the increase in listings.

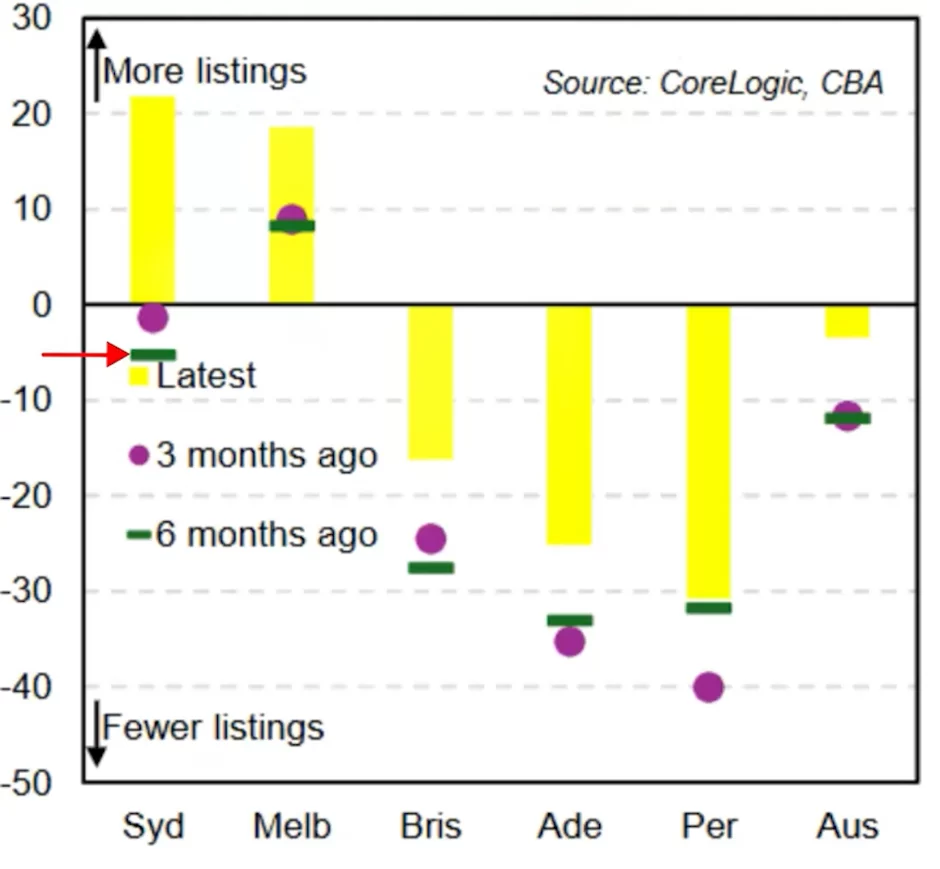

Have a look at this chart. Here we have data from CoreLogic and CBA looking at the total listings, and more importantly, the percentage deviation from the five year average.

What you can see is that Sydney right now, The latest data, which is the yellow bar, is showing a 20% plus increase in listings, 20% increase in standard deviation from the 5 year average, whereas just 3 months ago it was in line with the 5 year average, and 6 months ago the green line was actually below the 5 year average, showing that 6 months ago we had less listings than the 5 year average.

Today, we’re well above that. So the question is, with price growth slowing, certain suburbs falling in value, auction clearance rates starting to fall, and more listings coming on the market, how should you take advantage of this? Well, it really depends on what you’re trying to do. First of all, if you’re someone who wants to buy in Sydney, either it’s an investment property or your own home, now might be a great time to buy.

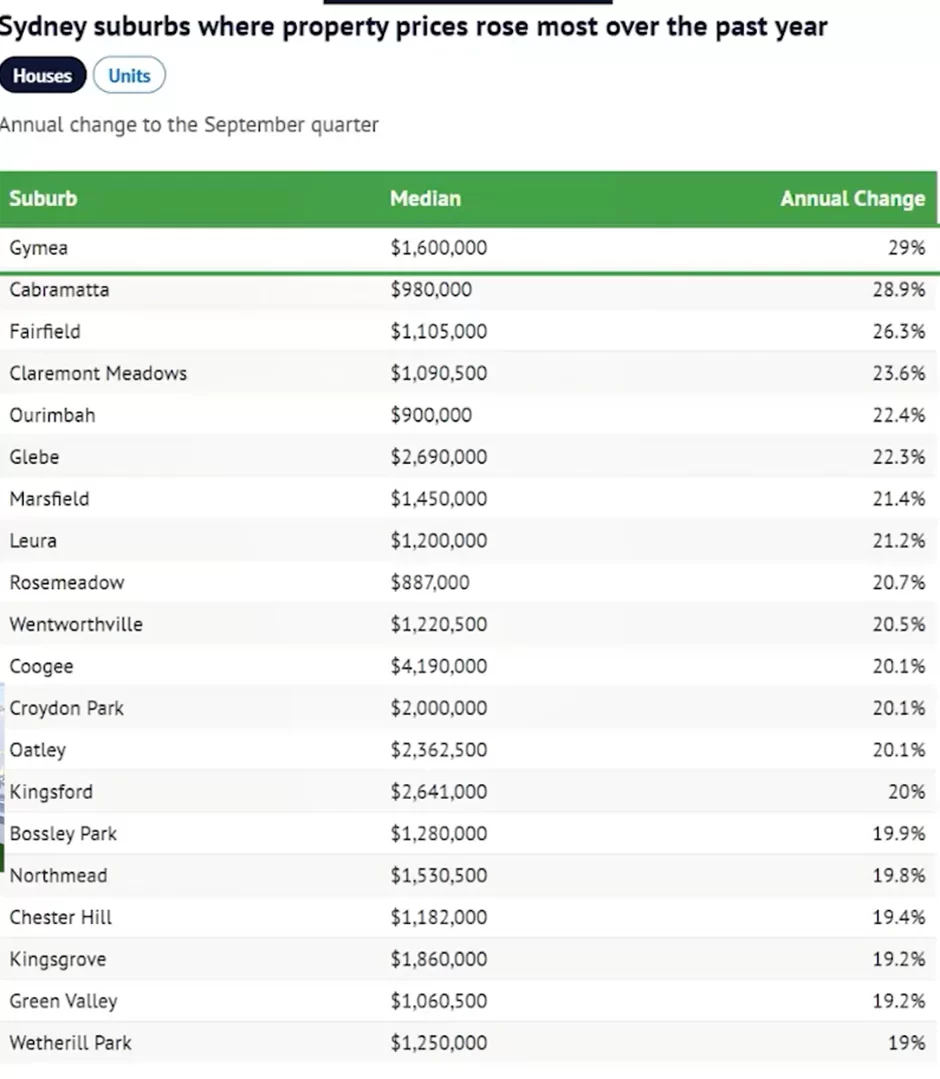

However, the price falls in Sydney are not universal. Here we have data from Domain showing Sydney suburb where property prices rose the most over the past year.

You can see Gymea, Median price $1.6 million, rose 29% in the last 12 months. Cabramatta, median price $980,000, rose 28.9%. Fairfield, 26.3%. So what you can see is that there have been several suburbs that have risen in value significantly, and a lot of these suburbs are continuing to rise in value.

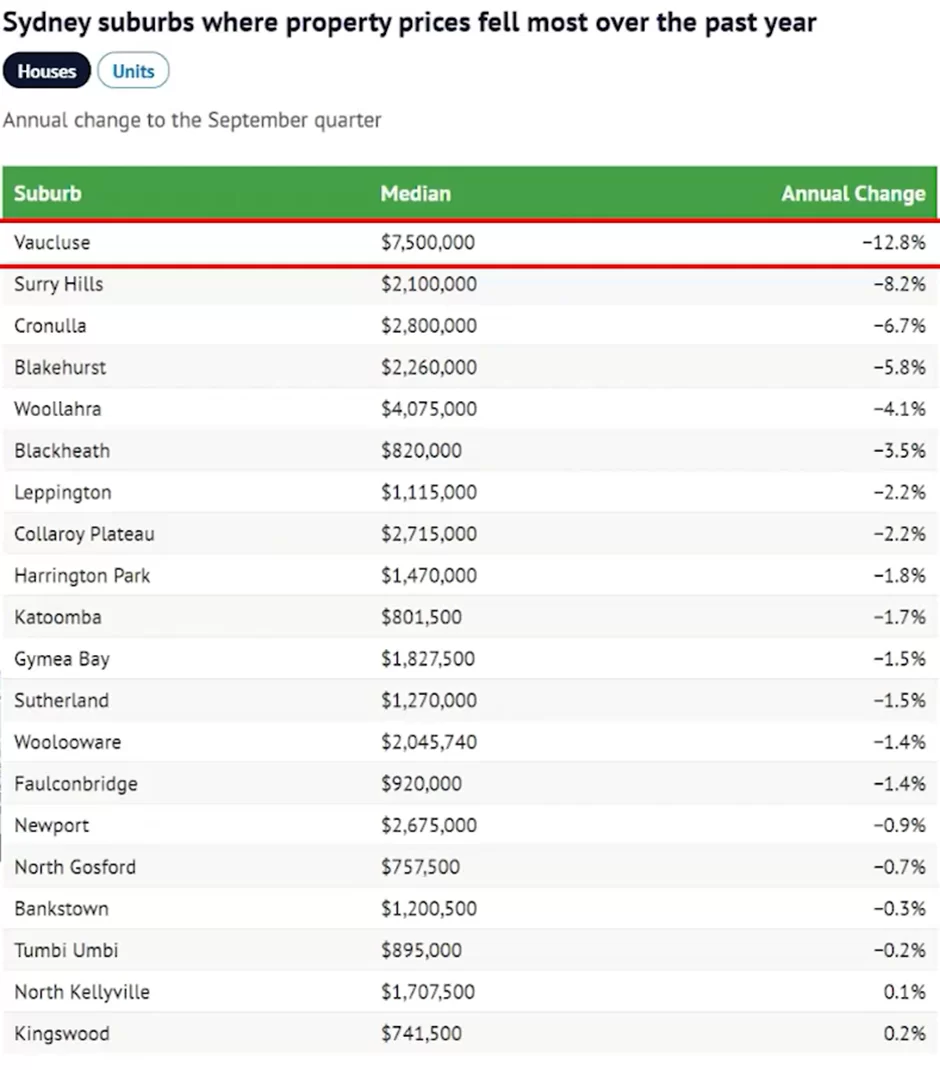

Now, on the flip side, When we look at this table

which looks at Sydney suburbs, where property prices have fallen the most, we can see that it’s led by Borkloose, which does have a median price point of $7.5 million. Prices have dropped 12. 8% over the last 12 months. Surrey Hills, prices have dropped 8.2%. Cronulla, 6.7%. What that shows you is that different suburbs are performing differently. So, if you’re looking to buy in a suburb where prices are rising Right now, it could be a great time to buy because it’s more than likely that property prices will be higher in those suburbs in 12 months time than it is right now.

If you’re looking to buy in an area where property prices have fallen, you need to then ask yourself, well, do you think prices are likely to fall more? Well, then maybe you should wait. Or, maybe now is a great time to buy and grab a bargain because, especially if you’re looking to buy in the long term, maybe prices won’t be high in those suburbs in six months time.

But what about six years time, or 10 years time? You see, I believe that the Sydney property market is just taking a breather in general. It’s not going to crash. I shared with you CoreLogic data before how Sydney property prices dropped 12.4% from February 2022 until January 2023, so over an 11 month period, mainly driven by interest rates rising, and then prices started to rise, then are higher than they were before interest rates started to rise.

Yet, what’s likely to happen though to Sydney property prices when interest rates fall? My belief is that you’re going to have people with more borrowing capacity wanting to buy properties, and that will see property prices rise. And we know that the inflation rate is well and truly within our target band.

Most banks are expecting interest rates to fall in February. So if you want to buy in Sydney, Depending on what suburb you want to buy in, now might be a great time to buy. But, is there another way you could play this? Absolutely, And this is the second strategy, especially if you’re looking to invest in property.

You could back a faster horse. You could buy in areas that are far cheaper than Sydney, which are rising a lot more right now. A lot of our smaller capital cities and larger regional areas where price growth is much faster than Sydney. You can get in at a much lower price point, $700,000, maybe even $600,000.

Get a much stronger rental return because there is such strong rental demand in these areas and you could really then get ahead of the curve, buy a property at a lesser price, lower risk, and then set yourself up for the future and perhaps get ahead of the Sydney market. But if you want to go down that path, you need to do your due diligence.

You need to really make sure you’re targeting the right areas because Not every area will rise faster than Sydney, so if you want help on how to find those areas, check out the link in the description below to get the audio version and digital version of my book here. Otherwise, I’ll see you next time.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.