Property Prices to rise in 2025 (8 Factors that point to this)

By: Niro Thambipillay

November 21, 2024

If you’re someone who’s confused or concerned about what’s going to happen to property prices, I don’t blame you. You see, on one hand, you’re seeing headlines that property prices are on the cusp of another boom. On the other hand, you’re seeing headlines that listings are increasing, and sellers are struggling.

These are two very conflicting opinions. So, if you want clarity around what’s about to happen to property prices today, I’m going to share with you eight factors that you need to consider, and that will give you total clarity around what’s about to happen. Now, none of these factors are based on the hate I know I’m about to get in the comments.

None of this is based around what Uncle John or maybe your friends tell you on a Sunday barbecue. All of this is based on fundamental economics.

Hello, it’s Niro here. Now, before I go into these eight factors, let me share with you a new trend that’s appearing in the property market that most people have missed.

Cast your mind back to the headlines of 12 months ago. We were seeing things like this. I’ve never seen anything like this. Mark Burris grim prediction or it’s a train wreck. Millions of Aussies doomed by the latest rate hike now spending more than they earn. So, the headlines were all about doom and gloom, property price growth slowing.

And yet, what did I say? 12 months ago, I said that there’s a significant property price boom brewing. It would start from the new year. And what happened in 2024? Property prices started taking off in the first half of this year, but now they’ve started to slow. Let’s go back one more year. So, towards the end of 2022, interest rates were being increased quite significantly, prices were falling, and yet I came out and said that prices would again start to rise from the start of the new year.

And what happened? And I’m From February 2023, prices rebounded and took off across multiple areas. So, we’re starting to see a pattern. Price growth slowing, maybe falling as we get towards the end of the year before rebounding in the new year. Now that’s just an observation. You can’t make your decisions based on what’s happened in the last couple of years and say, Oh, just because prices have slowed going into Christmas and then rebounded again, that’s what’s going to happen in 2025.

We need to look at more fundamental factors. So, let’s begin by looking at these eight different factors. And all of these factors have to do with demand and supply, the fundamentals of economics, which says that when demand is higher than supply, all else being equal, prices tend to rise in anything, and when supply is greater than demand, prices tend to fall.

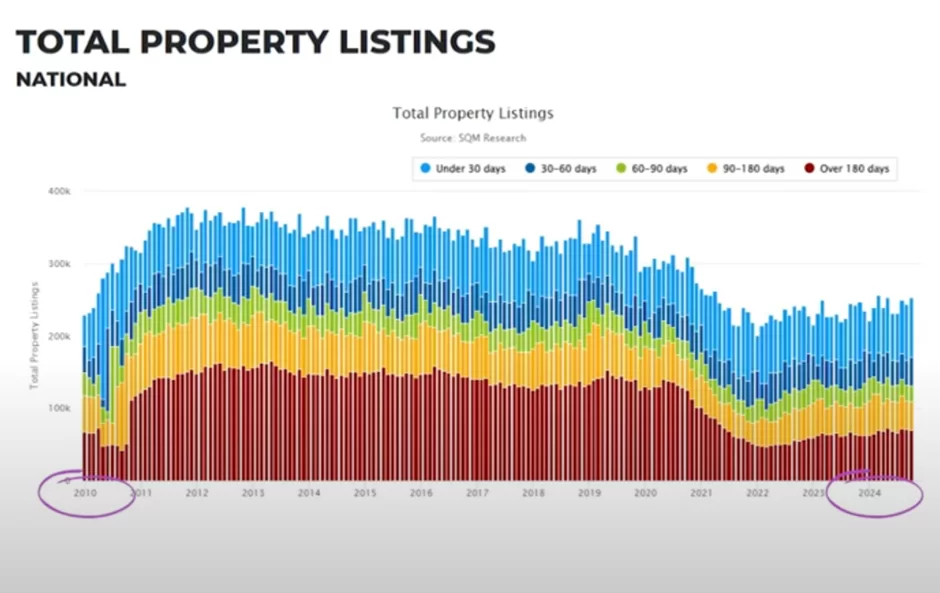

So, let’s have a look at these eight factors. Number one, Properties for sale or listings. We’re seeing a number of headlines talking about how more sellers are selling right now, but let’s actually have a look at the data. Here we have the total property listings across the country going from 2024 all the way back to 2010.

So if we look at what’s happening right now, we can see that sure there has been a slight increase in listings across the country say right now. Compared to say 2023 or 2022 but look at where we are compared to the number of properties that were available for sale between 2012 and 2019, we’re well below long term averages.

So what that shows you is that we have. Fewer properties for sale than we did several years ago. So that would indicate that if the population was still the same as it was several years ago, property prices would rise because we don’t have enough properties for sale. But you and I both know that the population of Australia is much higher now than it was a few years ago.

I will go into that in a bit more detail. But the fact is that supply in terms of the number of properties available for sale is still lower then long term averages across the country. But of course, you’re not going to buy a property anywhere in the country. You’re going to buy in a particular market. So, you need to break it down.

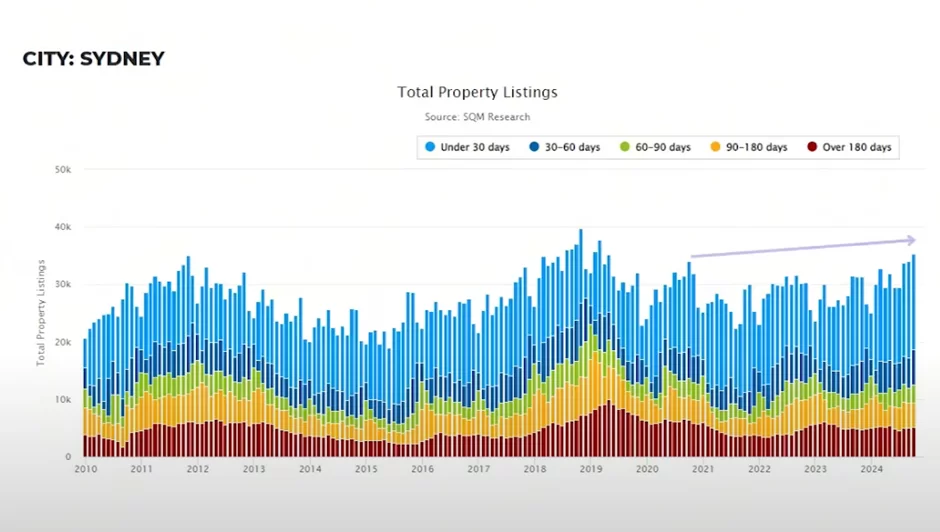

When we look at number of listings in Sydney,

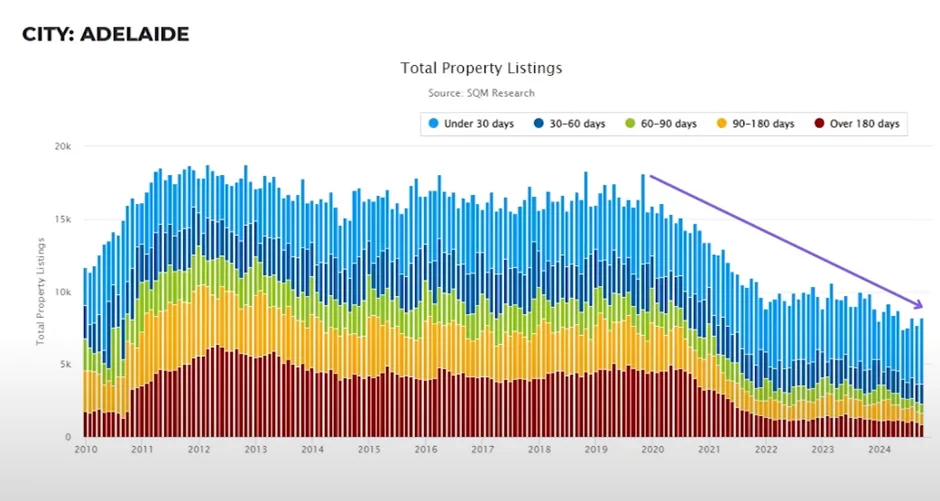

we can see that we are at higher levels than average. Hence price growth in Sydney is slowing, but look at Adelaide,

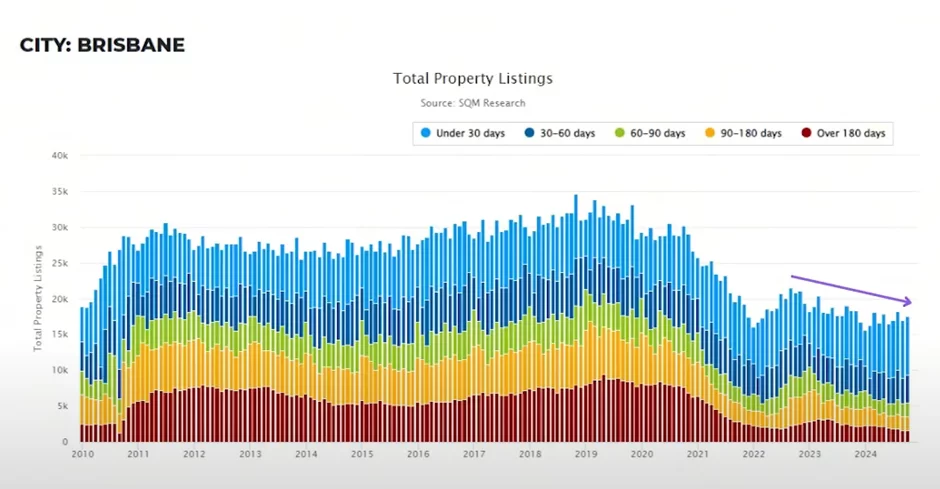

where listings right now are far lower than they were a few years ago. So not enough supply in Adelaide, for example, and the same is true for Brisbane.

You can see here in this chart that listings are much lower than they were a few years ago.

So yes, you need to break this down market by market, but on a nationwide level, as I showed earlier on, we have fewer properties available for sale than in the past, this is a factor pointing towards lower supply going forwards.

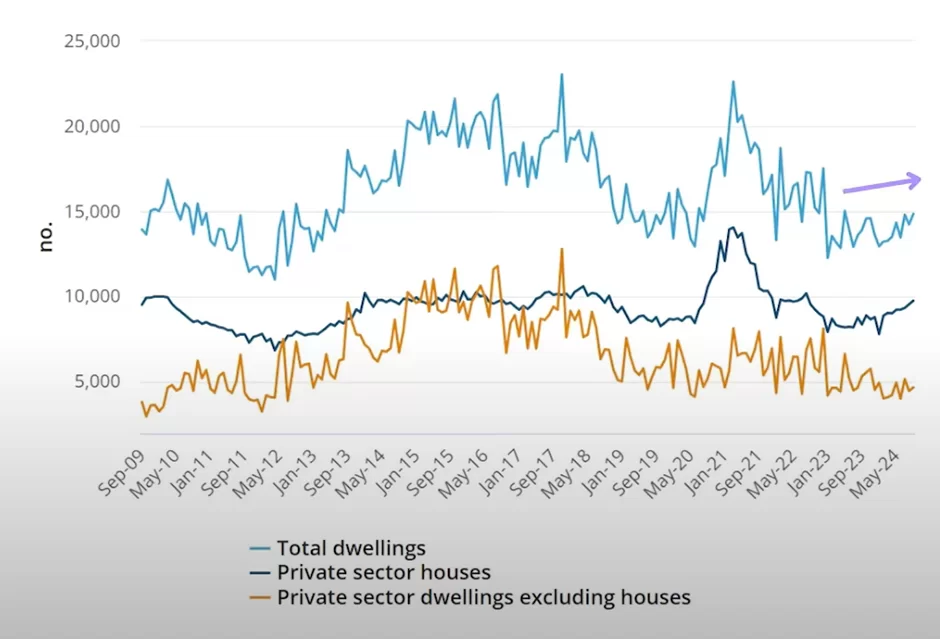

The second factor to consider is building approvals. We can see here from the data from the Australian Bureau of Statistics that, yes, there has been a short-term increase. increase in the number of properties being built, which is great. Except when we look at the numbers, we can see that in September of 2024, the total dwellings being approved was under 15,000.

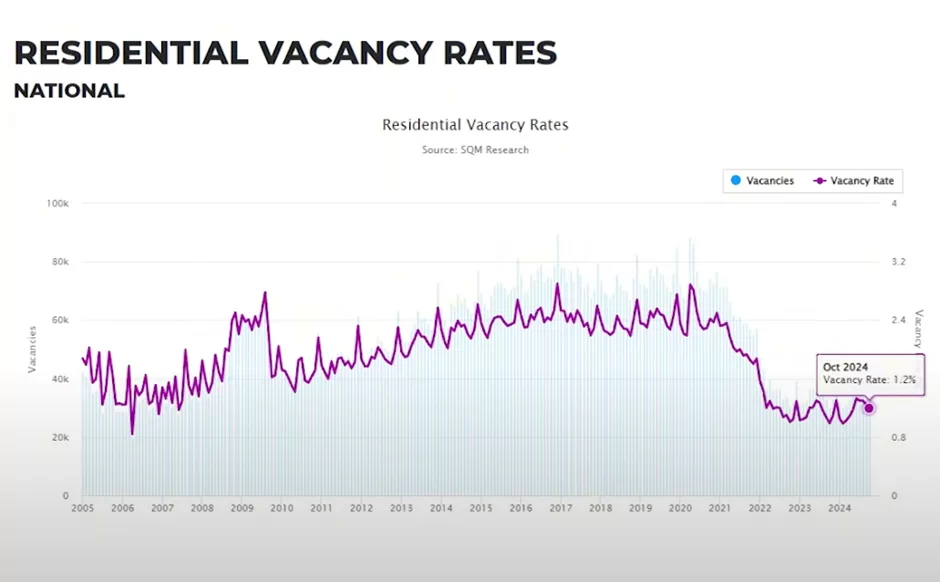

Yet, if we go back and look at the number of properties being approved 10 years ago, we can see that we were approving over 16,000 properties every month. So, we were building more properties 10 years ago than we are right now. So, this is a second factor. Pointing towards falling supply. Number three, if we look at vacancy rates across the country,

we can see that they’re sitting at 1.2%. Okay, that might be slightly higher than what it was earlier on this year, but it’s well below the long-term average, as you can see from this chart. So, what that means is that we have fewer properties available for rent in the country than we did just a few years ago, all the while our population is continuing to grow.

So again, that indicates that there’s not enough supply this time from a rental perspective, which will drive rents higher. Number four is what I call sentiment. And what I mean by that is how do sellers feel? How confident are sellers about getting the maximum price for their property? And when they see headlines like this pointing towards potentially property prices falling, what do you think many sellers are going to do?

They’re going to delay the sale of their property. You see, because buying a property is a big deal, but for many owner occupiers, selling is an even bigger deal because they’ve got to spend ages getting their property ready for sale. Then they’ve got to work out where are they going to move to. It’s a much bigger decision.

And when they see negative sentiment about it, In the market, when the media is talking about bad news, many sellers choose to delay the sale of their property. That’s part of the reason why we’re actually seeing, in my opinion, more properties for sale right now than earlier on this year. Because again, 12 months ago, we saw that negative sentiment.

And so many sellers chose not to sell their property at the start of 2024 and have now seen an, Oh, look, prices have actually risen. They’re higher now across most of the country than they were at the start of this year. And they’re now putting their properties on sale. But then many people who were thinking about selling in the new year will again, go through this process.They will delay selling their properties and that will tighten the available supply on the market.

Again, pointing towards more supply. Shortages. Number five. We know that our population growth remains elevated. Sure, it’s not at all-time highs like it was in 2023, but population growth is still growing faster than long term averages, faster than we can build enough properties, and there already are not enough properties for sale.

So, when we have this elevated level of demand from population growth, it’s going to put upwards pressure on rent, first and foremost. And there are going to be many areas around Australia where you will have more buyers than available properties for sale. Number six, employment remains stubbornly strong as the RBA continues to tell us.

What this shows is that even though unemployment is at 4.1% It’s not rising as fast as the RBA expected. And even though I personally expect unemployment to increase, we’re not going to reach the record levels we’ve seen in this country in the past. And there’ve been multiple times in Australia when unemployment has been over 5 % and even 6% and yet property prices have continued to rise.

Here we are unemployment at 4.1% Even if it rises, there are still enough people employed who can afford properties. Number seven, we know that inflation is falling. I’ve spoken about this many times before. We’re already pretty close to the RBA’s target band. So, it’s only a matter of time before interest rates are cut.

Everyone’s debating about when that’s going to happen. I don’t have a crystal ball, but I do expect that interest rates will be cut in 2020. When that happens, it will be easier for existing mortgage holders to hold onto their properties. Their cashflow will improve. So, you’re going to see distress sales fall away, although they’re not exactly at very high levels right now on a national level.

Yes, there are some pockets, but you’re always going to have that on a national level. Distress sales are not that high and they’re going to reduce. But then this leads to number eight, which is when interest rates fall. You have borrowing capacities increase more people able to afford property than they can right now, which again, places more demand on the property market.

So, when we look at these eight factors ground in fundamental economics, to me, It shows that property prices are likely to rebound again in 2025 and I expect they will continue to keep growing until at least 2027. So, this short-term slowing down of growth could very easily be a seasonal factor. It’s now the third year in a row.

This has happened as we lead into Christmas, but that means that for a buyer, if you can see how strong the data is pointing towards property prices rising, now could be a great opportunity to go and get a bargain or get a property at a great deal before the market heats up again.

It’s clear the data shows that there are multiple areas doing very, very well. And although overall, I expect that the median property price in Australia will continue to rise and be higher in 12 month’s time than is right now, that will not apply everywhere. You do need to do your due diligence.

If you want help with that, check out the link in the description below. to get the audio version and digital version of my book here. Otherwise, I’ll see you next time.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.