Property market to become unsustainable says RBA

By: Niro Thambipillay

December 3, 2024

If you think property prices are insanely high right now, the reserve bank of Australia has come out with a scary, shocking prediction about what could happen to property prices starting from as soon as the beginning of 2025. Today, I’m going to go through what that prediction is and what it might mean for you if you’re thinking about buying a property.

Hello, it’s Niro here. Something a lot of people don’t know is that the Reserve Bank of Australia, twice a year, releases a Financial Stability assessment, their assessment of different factors in the economy, and it’s a quite a lengthy report, and it contains a number of very relevant data points about the property market that might contradict what you’re hearing in the mainstream media or what friends and family are telling you.

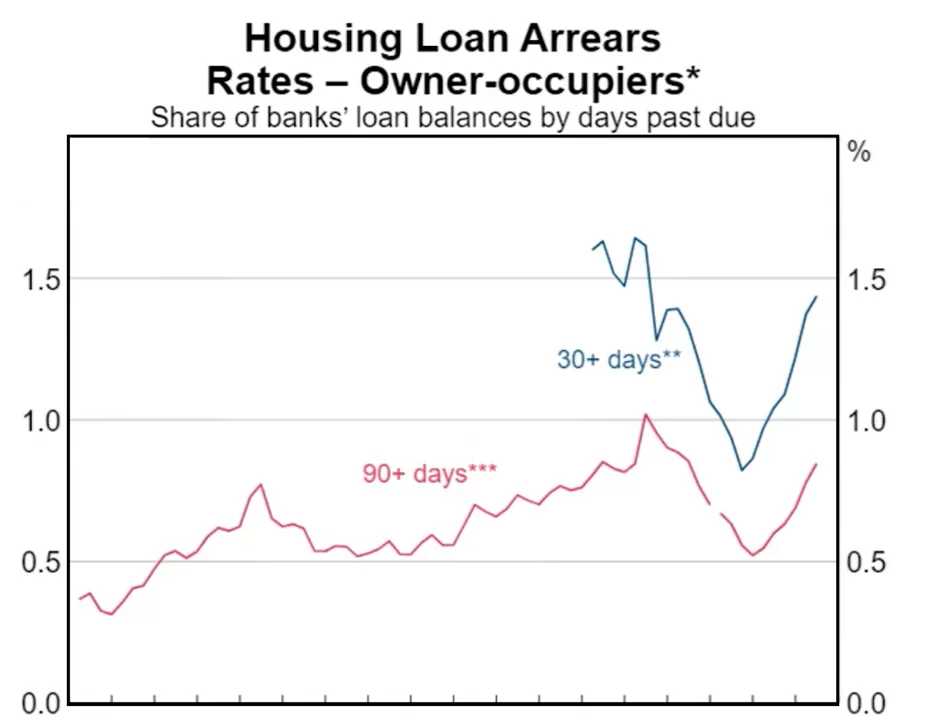

Right now, we’re seeing a number of headlines in the mainstream media talking about an increase in listings, increase in even distressed listings as more and more people are apparently struggling to pay their mortgages and putting their properties on the market. But when we look at the reserve bank’s financial stability review and look at the data contained within it, it paints a rather contrasting picture. When we look at this chart,

loans that are 90 days past their due date or even 30 days past their due dates are on the increase. There’s no doubting that. However, the question is, what are they increasing from?

They’re increasing from virtually all-time lows, which is back in 2022, when interest rates were at record lows. So yes, the number of people in financial distress is increasing from a couple of years ago. But when we look at what the data shows, we’re simply in line with where mortgage arrears were at before the pandemic.

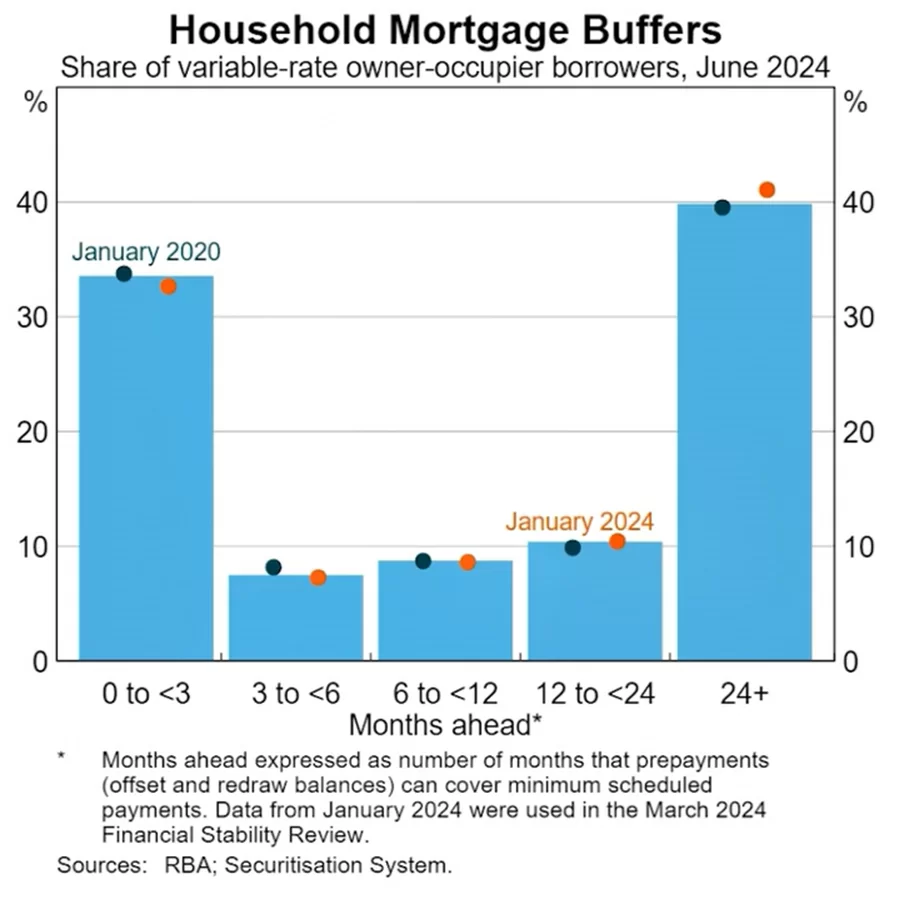

In fact, if we look at both the blue line and the red line, we can see that loan arrears right now are sitting round about where they were in 2019. Yet interest rates back then were so much lower than they are right now. And then when we look at household mortgage loans, Buffers-

what we can see is that the orange dot, which is tracking the data as of January of 2024 versus the green dot, which is tracking data as of January, 2020, we can see that mortgage buffers, people who are 12 months to 24 months, or people are even 24 months and above ahead on their mortgage.

So, the number of people who are at least one year ahead on their mortgage was higher in January of 2024. When interest rates are the highest, they’ve been at for over a decade, compared to January 2020. And if we look at distressed sales on a national basis, yes, on a month-to-month basis, they might be higher, but there’s still over 3 percent lower than they were at 12 months ago. So it’s clear that distress sales are not a major issue in the market right now on a national level.

Yes, there are certain pockets of the country where people are struggling more than others, particularly in certain areas around Sydney and Melbourne. But on a nationwide level, it’s not an issue. So, the market is far healthier than perhaps what you’re being led to believe. It’s what the RBA said could happen next that you should really pay attention to.

You see, the Reserve Bank essentially said that the Australian economy is quite resilient and will be quite resilient at least in the short term. However, what they then go on to say is that beyond the near term, resilience could be eroded if households respond to any actual or anticipated easing in financial conditions by taking on excessive debt.

Over the past two decades, the international experience has shown that That assets that are heavily reliant on debt funding, such as property, can also see unsustainable price rises. Okay, so what does it actually mean? Well, this article explains it better. Rate cuts may trigger unsustainable property price boom, RBA.

Falling interest rates could trigger a property price boom that encourages households to take on too much debt, raising the risk of a future market downturn that ravages the economy, the Reserve Bank of Australia has warned. So, what the RBA is saying is that When interest rates fall, not if, but when they fall, property prices are likely to rise quite substantially, but then there might be some sort of risk down the track.

Look, if you understand how property markets work, they don’t rise every day. Single year. Yes, over the medium to long term, the Australian median property price continues to increase. In fact, it’s now increased for 21 months in a row. Yes, the rate of increase though is starting to slow. What I expect to happen though is that when interest rates are cut, yes, property prices will rise and potentially quite steeply in multiple areas around the country.

But does that then make things unsustainable? Well, ask yourself this question. If property prices today. In multiple locations around the country are higher than they were in 2022 when interest rates were the lowest, they’ve ever been and now interest rates are at the highest they’ve ever been. Well, when interest rates fall, people’s affordability improves, existing mortgage holders don’t have as much financial stress because their month-to-month expenses reduces.

So then how is that going to create a downside risk? I do, however, agree that the price rises that are likely to happen will be unsustainable. What that means is that we are likely to see some steep. Property price rises in many areas starting again in 2025, but then the rate of property price increase will slow.

So, the unsustainable price increases that the RBA is talking about is valid. I personally don’t see a huge downside risk. What I see rather is that we’re going to see steep increases. And then property prices will keep increasing beyond what inflation is, but the rate of increase will slow down. So, to me, this presents a great opportunity if you can afford to buy now, or at least before February, which is when most major lenders are expecting interest rates to be cut because you can then get a steep increase in your property value. If you buy in the right location, which could then really help you either set yourself up for your future or perhaps catch up for some lost time.

You do need to do your due diligence. If you want help with that, check out the link in the description below. to get the audio version and digital version of my book here. Otherwise, I’ll see you next time.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.