Property Market Slows – What You Need to Know for 2025

By: Niro Thambipillay

December 19, 2024

It’s true. The property market is slowing as we come to the end of 2024. So today I’m going to do a deep dive into the property market. I’m going to share what I expect to happen to prices in 2025. Why I think all these negative headlines in the media are so overblown because we’ve actually seen this slowdown happen before and why, if you play this right, this could be one of your final opportunities to grab a great deal on a property.

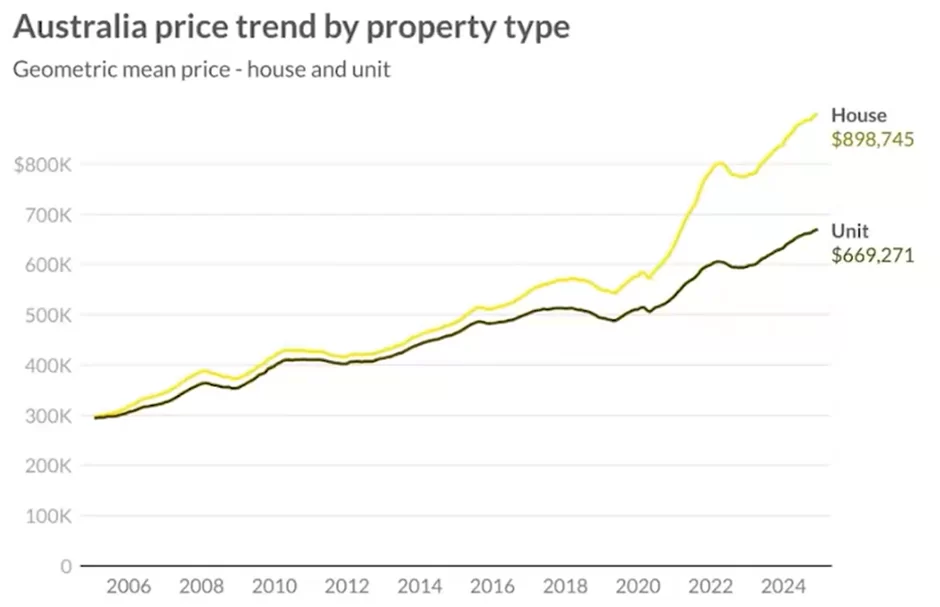

Let’s dive in. Hello, It’s Niro here let’s begin by looking at what house prices have done in the last 12 months-

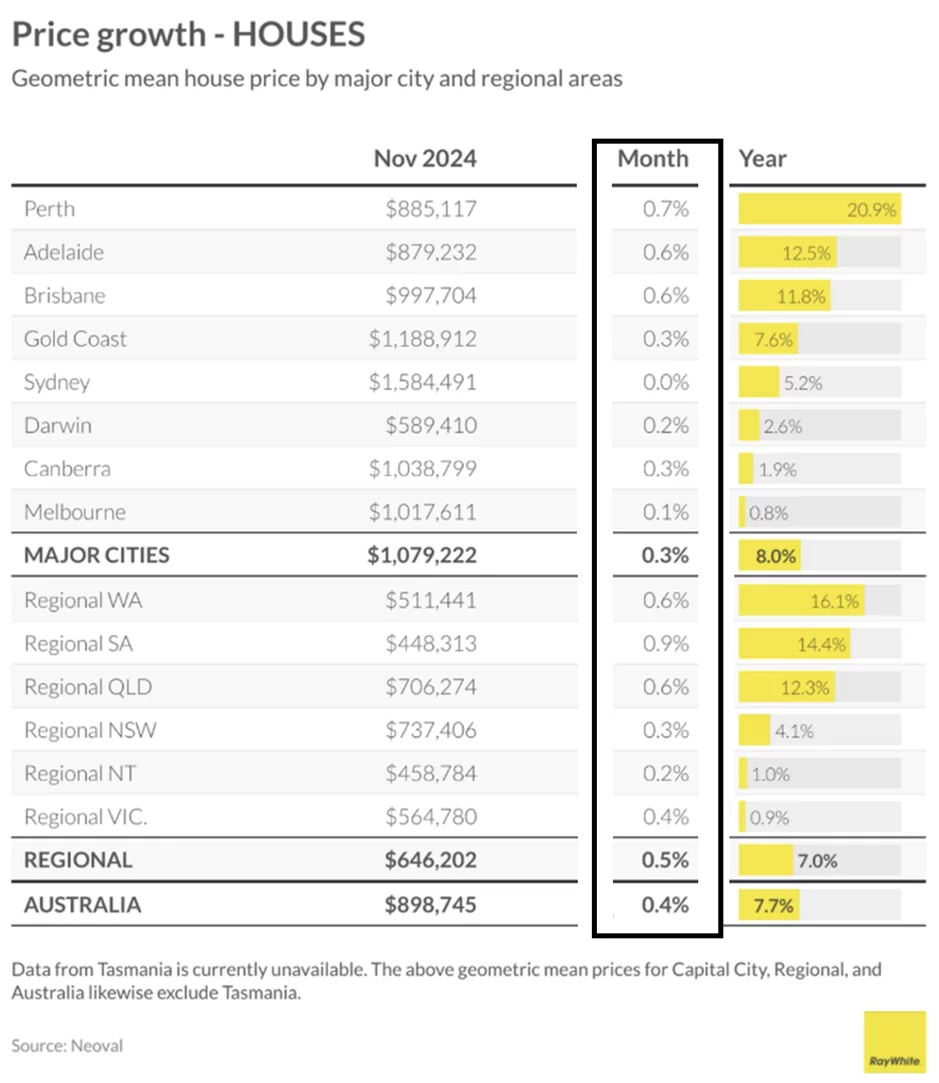

This data has been put out by ray white and what we can see is when you look at the price growth we can see that the Perth market in the 12 months to the end of November 2024 has been the best performing capital city market.

Price growth 20.9%, Adelaide 12.5%, Brisbane 11.8%, Gold Coast 7.6%, and Sydney 5.2%. All the other capital city markets, even though they may have gone slightly, they’ve all risen less than inflation. Then when we look at regional markets-

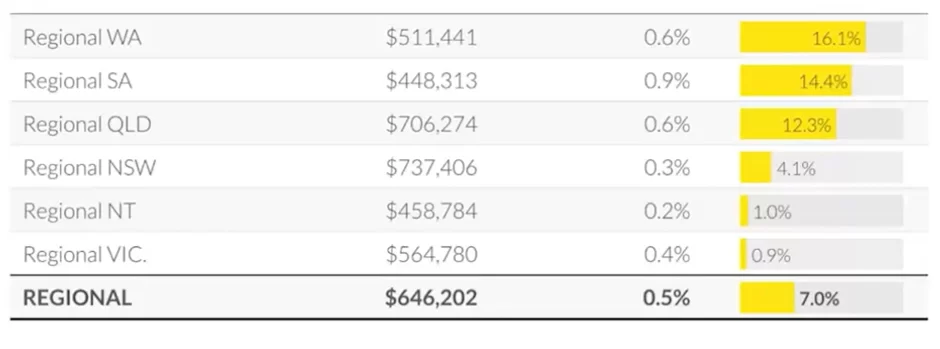

we can see that again, many markets have done really well. Regional Western Australia is up 16.1% in the last 12 months. Regional South Australia, 14.4% regional Queensland 12.3%. So essentially those three markets have outperformed many of our capital cities and going forwards I expect many of our regional markets to outperform some of our capital cities for a whole variety of reasons, but there’s no doubt that as you go down this table,

you can see that every single market has grown by less than 1% Capital growth rates are slowing. So the mainstream media is having a field day. Yes, they’re currently picking on Sydney and Melbourne, They are our two of our weaker markets, but also that’s where a large proportion of our population lives. However, the market is slowing on a nationwide level, even though prices are still rising.

So, the question then is, what does this mean for 2025? Well, the first thing is that a lot of these negative headlines, they seem to be a bit of a rehash from headlines we’ve seen before. Here’s an article from November of 2023, talking about property prices. It says, can house prices keep on rising or will higher mortgage costs finally kill off the recovery?

This article then goes on to talk about what certain experts have to say about the property market. I think further interest rate increases are going to have a bigger negative impact on the housing market than the past ones, says Warren Hogan, economic advisor at Judo Bank. This market has not really been tested by a genuinely weak economy, where people are losing their job or worried about their job, and I fear that’s part of the economic environment we’ll see in 2024.

So, I think the Australian residential property market is on borrowed time. I’m not expecting a major crash, but I think prices will slip back to where they were at the start of the year, if not a bit lower at the end of next year. So, what this person is saying is that he expected in 2024 prices to fall back to where they were at the start of 2023. And did that happen? No. Sure, price growth was different across different markets, but if we just average out our capital city, house prices are up 8% on average to the 12 months to the end of November and regional markets are up on average 7%. Yes, there are massive differences depending on which markets you’re targeting, but on average, property prices are higher in regional markets and capital cities. If we go back then 12 months earlier to the end of 2022, this was a time period, if you might recall, when interest rates were being increased almost on a monthly basis.

And so many people said property prices were going to crash. I for example, came out and said, no, I expect prices will rise in 2023. I even went and bought a significant amount of property at the start of 2023. And what happened? Prices rose significantly. So, we’re certainly starting to see this as a bit of a seasonal trend.

Property price growth slows as we come into Christmas and perhaps the very early months of the following year. And then prices seem to go back to what they were doing based on the fundamental conditions. And what are the fundamental conditions in Australia? Essentially, we don’t have enough properties in Australia for our growing population.

Overseas migration is continuing to remain at elevated levels, well above our long-term average. The number of houses being built is still well below our long-term average, well below target, so not enough houses for sale, which means supply is falling relative to demand, because we’ve got more and more people who need property in Australia.

That gap between demand and supply is still quite large, which means that to me, property prices are likely to keep rising, but they’re not going to rise everywhere. Also, here’s something else to consider. At the end of last year, or the end of the previous year. There was next to no talk about interest rates being cut.

All the negative news was about interest rates being increased, which is going to place more of a burden on people and they would struggle to hold on to their properties. But what’s the talk right now? We know that interest rates are going to be cut. The only question is, are they going to be cut in February? Are they going to be cut in May? How many interest rate cuts are we going to have? All of these are details that are important.

But it does not change the fact that based on where inflation is right now, based on the current weakness in the economy, interest rates are more than likely going to fall and fall multiple times in 2025.

When that happens, it’s not as if then a whole number of new properties can be built overnight to fix our supply issues. No, it takes time to build properties. I’m saying the obvious here. However, overnight demand can increase because as soon as interest rates start to fall and then as soon as the banks pass on the RBA’s interest rate cuts, people’s borrowing capacities increase.

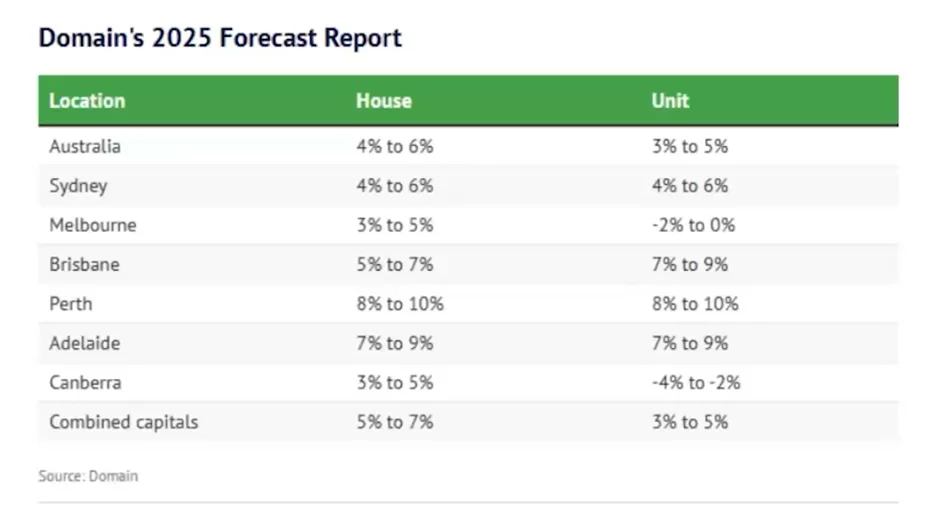

So, then you got more demand coming onto the market while we still have inadequate supply. That’s one of the reasons why I’m planning on buying again quite significantly in the in the first couple of months of 2025. I believe there’s a major opportunity coming and it’s not just me. Have a look at these price predictions from Domain which historically have always been conservative –

Australia as a whole house prices are expected to rise between four and six percent. Sydney the same. Melbourne a little bit less at three to five percent. Brisbane, 5-7%, Perth, 8-10%, Adelaide, 7-9%, Canberra, again, not doing that well, but still prices rising anywhere from 3-5%. Now these predictions are just taking all of Australia, or all of Sydney, or all of Brisbane.

They’re not drilling down into suburb specific data. Because if you do, I am very confident you will find areas that are set to far outperform these averages. I expect there will be multiple locations around the country where house prices could rise 10% or more in 2025 based on the supply shortage we have, and interest rates being cut.

So, I think that the first quarter of 2025 could be your last opportunity to grab a great deal on a property before prices rise significantly in multiple areas. Now, of course you can’t afford to buy blindly. You do need to do your due diligence. If you want help with that, check out the link in the description below to get the audio version and digital version of my book here.

But at the same time, you do not want to be someone who believes articles like this. Should I buy a house now or wait for interest rates to fall? This was published in February of 2024. There are many people who could afford to buy an investment property who would have chosen to wait for interest rates to fall thinking they’ll get a better deal and yet where are we at right now in most markets around the country prices are higher than they were at the start of this year that will continue I expect that property prices in most areas of the country will be significantly higher in 12 months’ time than they are right now.

That’s why this temporary slowdown in the property market that we’re seeing across multiple areas presents a great opportunity for you to grab a bargain in the first quarter of 2025.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.