New Storm about to hit Australian property market

By: Niro Thambipillay

October 4, 2024

There’s a new storm coming to the Australian property market. As a result, some people are going to lose a lot of money. Some people will miss out on a lot of money. And finally, some people will make a lot of money. Today, I’m going to share with you a number of charts, a whole bunch of data, so that hopefully you can take maximum benefit of the coming storm.

Let’s dive in. Hello, it’s Niro here, founder of the Investment Rise Buyers Agency. And if you’re new to my channel, hit that subscribe button, because I talk about all things related to the Australian property market and the economy. Right now, we’re seeing a lot of negativity in the media about the property market. Auction clearance rates fall as volumes rise across Australian capitals.

House price growth to soften as spring swings in favour of buyers. Sydney’s home values on course to fall in the coming months. When you see negative headlines like this, it can certainly seem scary, it can seem that maybe that will Property crash that people have been talking about for years is finally about to happen to the Australian property market.

So instead of worrying about those headlines, let’s have a look at some data, shall we? Household wealth up 1.5% in June quarter. Household wealth rose for the seventh consecutive quarter of June up 1.5% or $250 billion in June 2024, according to figures released today by the Australian Bureau of Statistics, and this was released at the end of September.

Total household wealth was $16.5 Trillion dollars in the June quarter, which was 9.3% or $1.4 trillion dollars higher than a year ago. Now, there’s no doubt that with the current cost of living crisis, there is a segment of our population that is struggling. But, If we look at the aggregate household wealth, it clearly shows that Australians are richer now than they were 12 months ago.

So, when homeowners, mortgage holders, on average, are wealthier today than they were 12 months ago, why are property prices now going to crash all of a sudden, at least on a macro level? It doesn’t make sense. But then, when you see what I’m about to show you, It might totally change your perception of the property market.

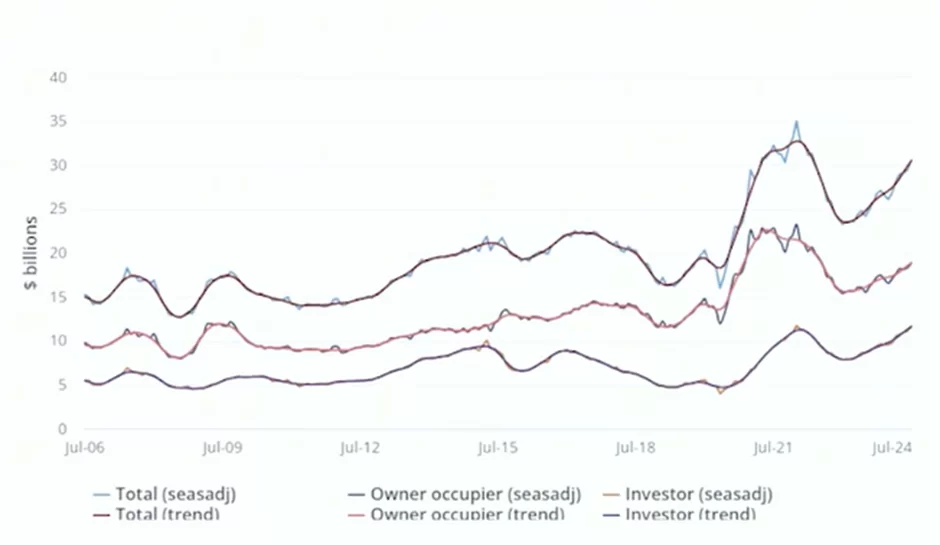

When we look at the latest data from the ABS about housing finance,

what we see is that more people are taking out loans than 12 months ago, and the difference is quite significant. For total housing, it’s up to $30.6 billion, which is 26.5% higher compared to a year ago. When we look at owner occupier housing, it’s up to $18.9 billion in terms of new loan commitments. That’s 21.4% higher compared to a year ago. And property investors, investor housing loan is up to $11.7 billion. That’s 35.4% higher compared to a year ago. And you can see that in the charts with all these trend lines going upwards quite steeply.

So when you now have so much extra demand on housing, because that’s what new loan commitments are. These are people taking out loans to buy properties, whether it’s owner occupiers, whether it’s investors. And these are people who are not worried about the economic uncertainty. They’re not necessarily concerned by the high interest rates.

They just want to get into the property market now because they can see how much property prices have risen and they’re actually worried that property prices will rise further next year. And they’re going to miss out. And when you see the rest of the data, I’m about to show you. You might start to see why they’re correct.

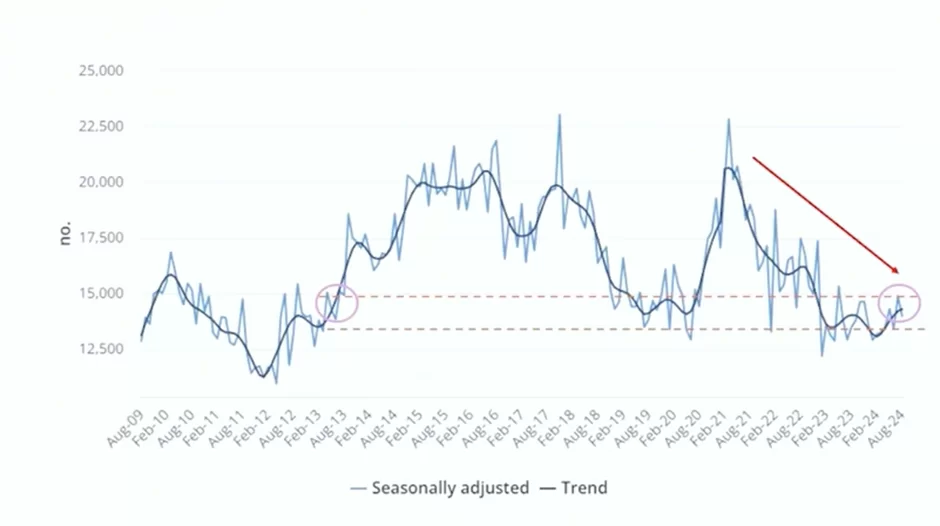

So the next thing to consider is housing supply new builds. Remember the federal government has a target of building 1.2 million homes in five years. If we work that out as an annual average, that’s 240,000 properties per year. And are they on track to do that? Not even close. Dwelling approvals fall in August.

The total number of dwellings approved fell 6.1% in August to 13,991. Let’s say 14,000. Remember the federal government wants to build, as I said, 240,000 properties per year on average. So if we divide that by 12, they should be building about 20,000 properties per month. And here we are. building only 14,000 properties. We’re well below target.

We can see that here in the trend line with this red line that I’ve drawn showing the building approvals are falling.

In fact, what’s really scary is that sure we may not be building at all time lows, which is back in sort of 2012, but the number of properties being built right now is is equivalent to where we were at back in 2013.

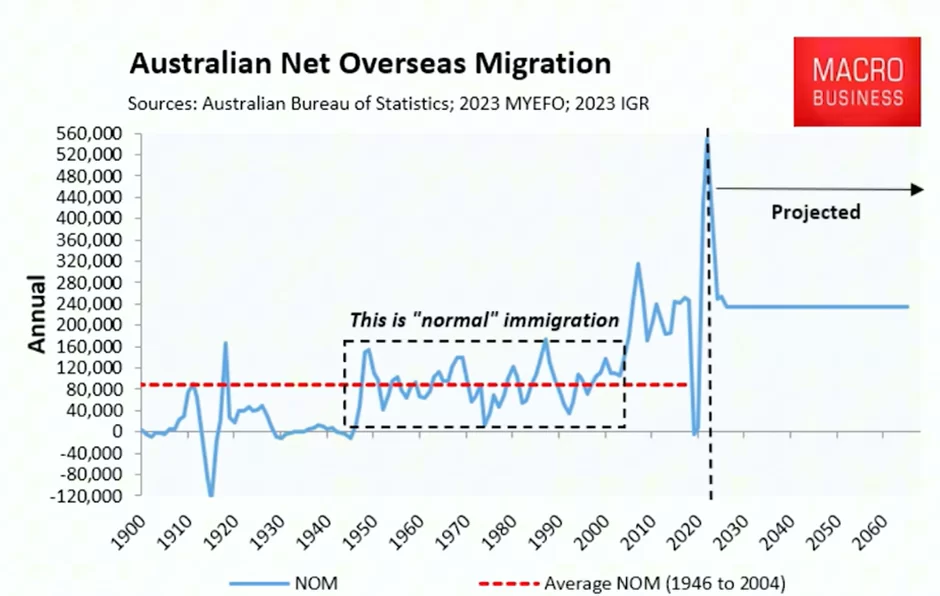

So that’s 11 years ago. That’s how little we’re building. And yet our population is growing well above long term averages.

That’s only going to place more demand on both the rental market and property prices. Now we’re seeing headlines though, in the media about how there’s more properties on the market, more sellers are looking to sell, which could affect property price growth.

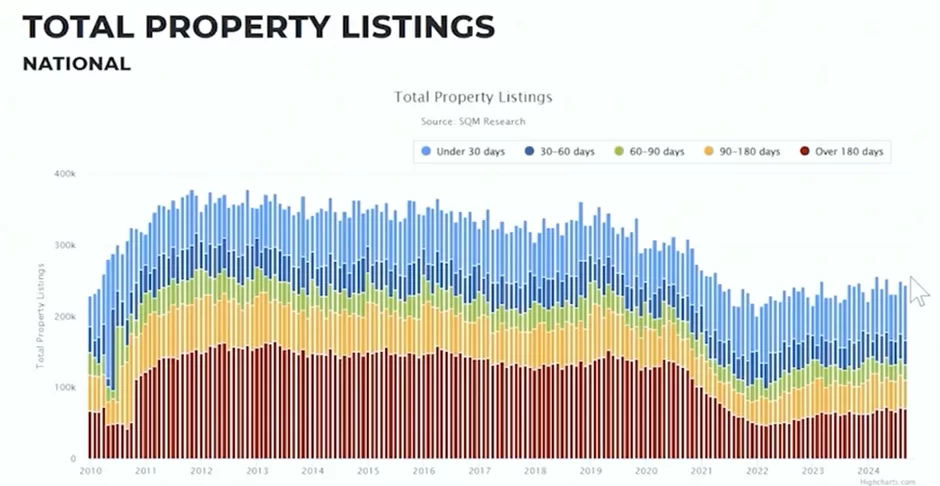

And again, when we look at the data, that’s only half right here, we’re looking at total property listings on a nationwide basis

Sure, if we look at 2024 here, okay, it might be higher than what was happening in 2023 or 2022, which was the recent lows. But look at the trend line here. We can see it’s actually falling away, but even if we ignore that and just look at it more holistically, we can see that listings right now, that’s properties available for sale on the market is well below where we were at from 2012 to 2019.

So we were Properties available for sale on a nationwide basis are well below long term averages, which means we just don’t have enough supply, especially when you consider what I showed you earlier on, that building approvals are falling. But this is on a nationwide basis. If I just look at a couple of major markets right now, and I could keep drilling down, you’ll see that this is not the case at all.

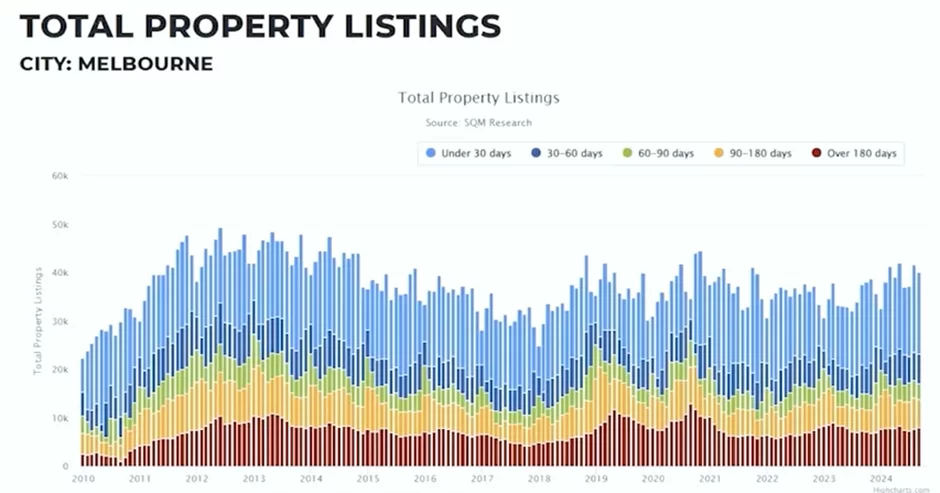

If I look at total property listings for Melbourne,

what you can see here is that essentially the number of properties for sale is sitting at the highest levels it’s been at for some years. Okay. We’re certainly not looking at the lows, which was around about the 2017 – 2018 level. We are sitting at roughly long term average rates based on the data.

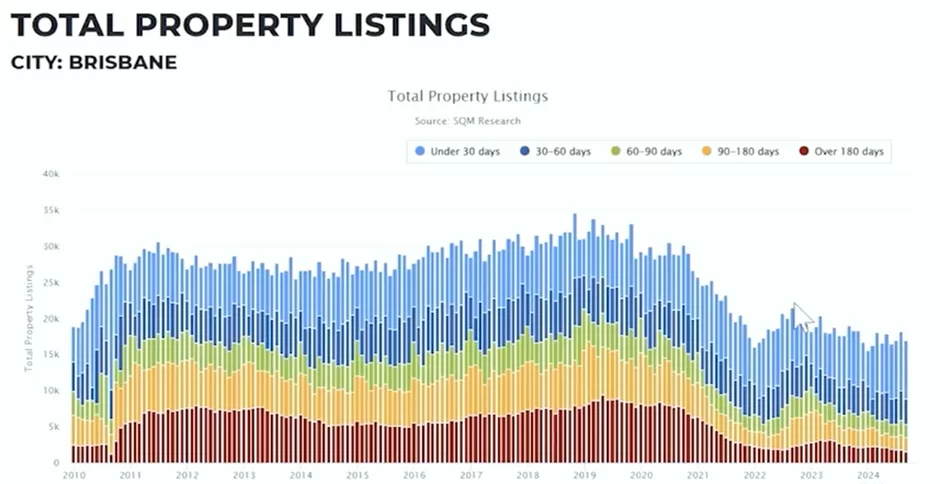

And that’s one of the reasons why when there’s so much supply on the market, price growth in Melbourne, isn’t that great right now, but then have a look at Brisbane here.

So here we are, total number of properties for sale and okay the, the short-term trends are from 2022. Looks like it’s falling away, but even if we look at it, for over the last several years, you can see that the levels of properties for sale here are well below where we were at in between 2012 to 2016. So again, not enough supply.

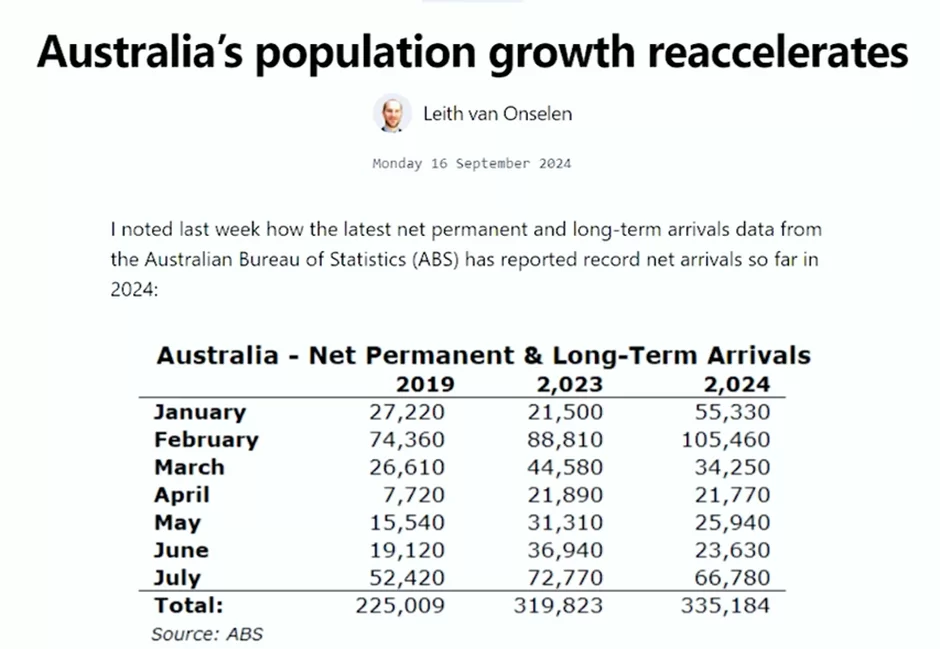

Now there’s two other factors we need to consider. First of all, population growth. Australia’s population growth re accelerates. Here we have data

the sources, the Australian Bureau of Statistics. And what we can see here is that if we look at the net growth Permanent and long-term arrivals into Australia for the first seven months of the 2023 calendar year versus the 2024 calendar year.

We can see that more people have actually arrived into Australia in 2024 versus 2023. And 2023 was a record year in terms of our population growth and population growth was supposed to be slowing down. Yet when we look at the actual data from the ABS, it shows it. Population growth is staying as high and potentially even accelerating.

And you can see the numbers of arrivals into the country in the last two years are well above where we were at just in 2019 before the pandemic hit. So with all this demand on the market, both with people coming into the country, people living in Australia, taking out new loans and not enough support.

Even many people who are notoriously famous for saying the property market is going to crash are actually saying this is just a calm before the storm. Property prices are likely to increase once interest rates fall. Managing Director of SQM Research, Louis Christopher, says The market slightly favours buyers rather than vendors at present.

However, he expects the market to bounce when interest rates starts to fall. Sydney and Melbourne have swung to a slight buyer’s market. He said, note, he’s referring to Sydney and Melbourne, not some of the other capital cities or regional markets here. Sellers are having to become more negotiable, and buyers will look at this as a nice window until we see a cut in interest rates.

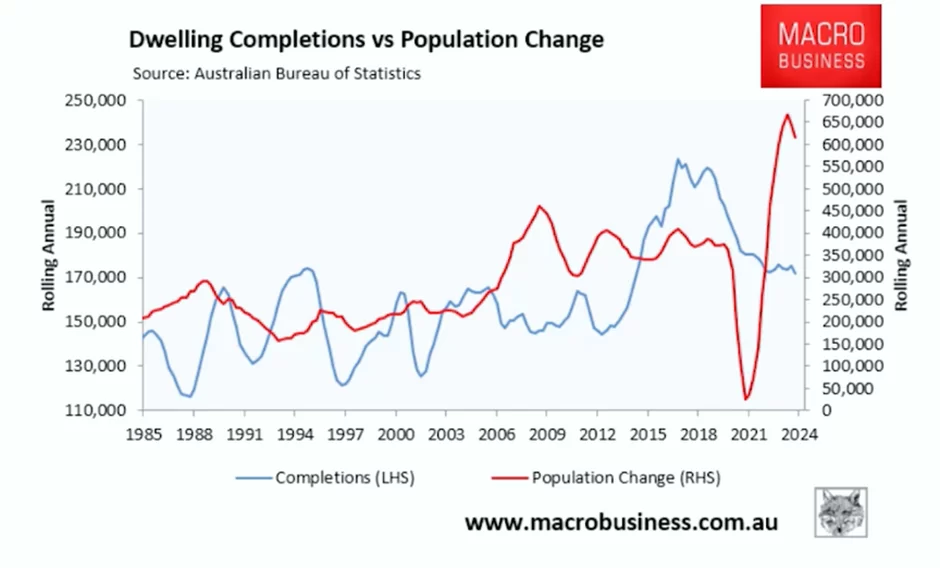

We are quite confident the market will bounce once we see the first. Interest rate cut. Christopher also noted that the fundamental imbalance between demand and supply has prevented price falls. And here we have a chart which tracks dwelling completions.

The blue line, you can see it’s falling away versus population change.

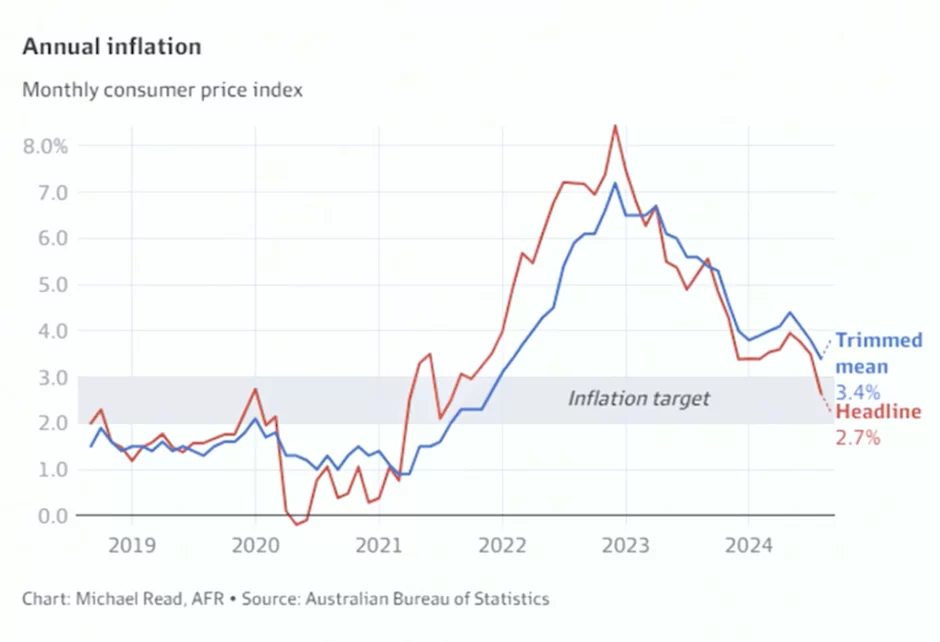

The red line, you can see how much faster population is growing versus the number of properties being built. So when are interest rates expected to fall? Well, we know that inflation is already in our target band. It just seems like the reserve bank is waiting to see if that’s going to be sustainable.

And if so, then interest rates will fall. Major lenders like the National Australia Bank have brought forward their prediction. So they used to say that interest rates would fall in May of next year. They’re now saying February. CBA is saying that interest rates could fall by Christmas. Either way, the takeaway message is simply this.

Don’t be put off by the negativity in the media. Yes, there might be a calm before the storm in certain markets like Sydney and Melbourne. That’s not necessarily the case everywhere, but regardless, the key message is this, if you can afford to buy a properties in the right areas, buying before Christmas could give you a huge advantage in terms of taking advantage of the next significant property uplift that I believe is coming from 2025.

But again, as you saw, you just can’t buy blindly. Certain markets have supply and demand metrics that are not in their favour and that applies at a CD level. but also, at a local government area level and even at a suburb level. So, the question is no longer, is now the right time to buy? The data clearly shows that it is.

However, the question now is where do you buy? How do you do your due diligence? How do you find the best places to buy? Because Every area is going to rise in value in this next storm that we are going to see in the property market. So, you need to do your research and if you want to help with that, check out the link in the description below to get the audio version and digital version of my book here. It’s a full property investing blueprint based on my now 22 years of property investing experience.

Otherwise, I’ll see you next time.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.