Many people will be caught unaware says CBA

By: Niro Thambipillay

February 7, 2025

The Commonwealth Bank has come out with a surprising prediction for what’s going to happen to property prices in 2025. Today I’m going to outline what that prediction is, why I think it’s actually undercooked and what the data says is more likely going to happen to property prices this year.

Let’s dive in. Hello, it’s Niro here and if you’re new to my channel, hit that subscribe button because I talk about all things related to the Australian property market and the economy. ComBank predicts FOMO will leave house prices up at end of year despite rate cuts. Australia’s biggest bank says there may be some brief relief for those priced out of owning a home.

But there could be a brutal side effect to cutting rates. Don’t you love it? How scary all this language appears to be. Let’s keep going. Australia’s biggest bank is betting house prices will fall in early 2025 but rise again later in the year and finish 4% higher than 2024 prices overall.

Yes, that’s right CBA says, house prices will finish the year off higher than they started. Commonwealth Bank, head of Australian Economics. Gareth Ed says house prices will fall in the coming months despite a highly anticipated interest rate cut. I’ll show you in a moment why I think the anticipated rate cut might be contributing to house prices slowing down in multiple areas around the country.

Momentum has cooled when looking at the pace of home price growth over the past year. In turn, rental growth is also moderating in most parts of the country, Mr Aird said. It is not unusual to see some fatigue creep into the national housing market, given affordability remains stretched on most conventional metrics.

The housing market is a momentum market, and if buyer appetite responds quickly to an interest rate cut, it is possible that fear of missing out once again becomes a key theme in the market. Now this next point is crucial. Australia’s financial sector is predicting no more than 4 rate cuts this year as a reaction to the RBA deliberately not raising the cash rate high by relative global standards.

But because the RBA left the door open for rate hikes throughout 2024, would be home buyers were apprehensive Mr Aird said.

Now let’s unpack what CBA had to say. Number one, many buyers are apprehensive because the RBA left the door open to interest rate cuts. What that means is there was often a message coming through from the RBA and the mainstream media that interest rate cuts could happen in 2024, they didn’t.

Now, we’re seeing that message again, that the RBA could drop interest rates, but many people don’t believe them. You can’t blame them, really, when the RBA keeps backtracking on what it says at previous statements. So, therefore, many people are sitting on the sidelines waiting until after interest rates fall to then jump into the property market because almost everyone knows that when rates fall, the property market will stabilize and strengthen.

Property prices are more likely to keep rising as interest rates fall. So, number one, you’ve got fewer people going into the market right now. Now, that’s a major reason why we are seeing property prices slow across multiple markets. In fact, if we look at the latest data about the property market from CoreLogic, we see there’s not much actually happening right now.

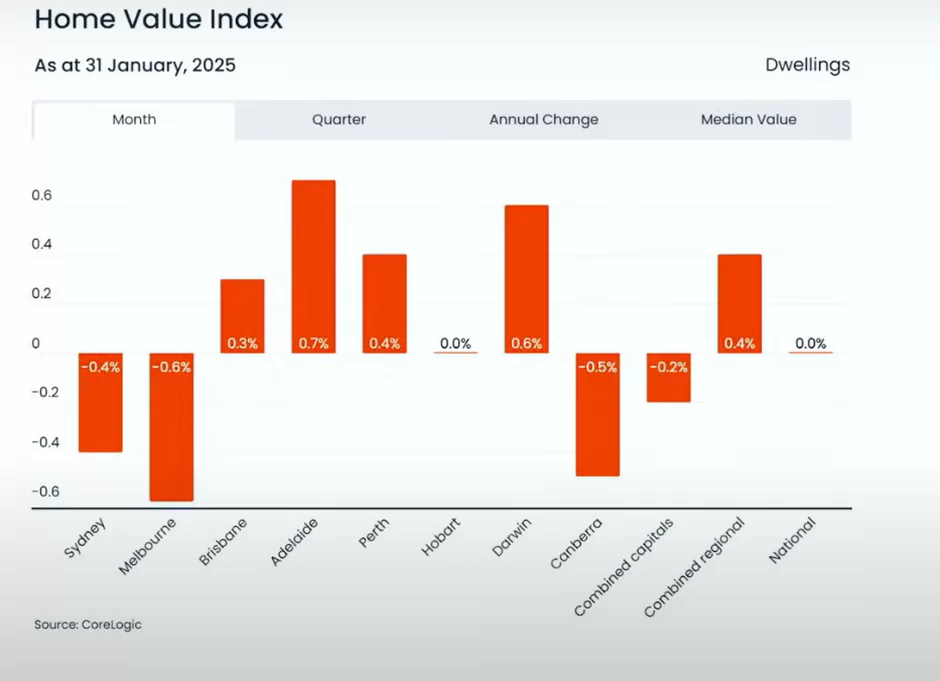

National dwelling values were steady in January, so they dropped 0.03%. We’re splitting hairs here. Essentially, property prices are flat with the headline result weighed down by the capital cities where values fell 0.2%. Again, nothing really to worry about here. And if we then look at the actual data for January,

we can see that property prices in Sydney fell 0.4%, Melbourne 0.6%, but then Brisbane, Adelaide and Perth rose in value, although Perth has seen the biggest slowdown in terms of its rate of price growth of all the smaller capital cities. Then we see Hobart dead flat, Darwin 0.6%, Canberra fell 0.5%. That’s how CoreLogic then determined that the combined capitals fell 0.2%.

However, Combined regional markets. Now, this is the aggregate of all regional markets. It’s not saying that every regional market performed this way, but combined regional markets rose 0.4%. So, what this data shows you is that even though there’s lots of articles about so called increased listings, especially in Sydney and Melbourne, property prices are essentially flat.

Now again, this data is aggregate city data. If you break it down suburb by suburb, you will actually find in all the markets that I just went through, there will be suburbs that are rising in value right now, and suburbs that are falling in value. But then coming back to what CBA said. They said they expect property prices to be 4% higher overall.

Now, they’re basing that off interest rates being cut. As we saw, the bond market predicts the RBA will lower the cash rate from 4.35% right now to 3.4 % by next year. The end of this year, the markets forecast then that the cash rate will settle at around 3.3% by the middle of next year.

So, we are looking at potentially four rate cuts this year. Now here’s why that matters. I recently spoke to a well renowned broker in Australia and what he shared with me was that when interest rates fall by 0.25% people’s borrowing capacities can increase from 2.5% to potentially 5% just depending on their unique situation.

So, let’s say, be conservative, let’s say 2.5%. Now, what if then we get two rate cuts each of 0.25%? So that means a 0.5% cut in Interest rates in total over a number of months that would lead to at least a 5% increase in people’s borrowing capacities.

Now let’s say we get four rate cuts this year. That means that people’s borrowing capacities could. Increase by 10% or more so that then means that if someone can currently afford to buy a property for say $700,000 by the time the rate cuts all come through, they could potentially buy up to $770,000 now that’s $70,000 increase.

Now consider this there are many markets right now where there are more buyers out there than potential properties for sale. It’s not the case everywhere, but there are multiple markets where this is happening. Now you’ve got certain buyers who are sitting out of the market who can afford property, but they just want to see when the RBA cuts, they want to see that first rate cut, then they’re going to Jump into the market that will further increase buyers further increase in the gap of demand over supply then as interest rate cuts do come through we’re not going to see all this in one hit. They will come through over a number of months other people’s borrowing capacities who want to buy property right now but can’t afford to they will increase and a certain percentage of them will be able to jump into the property market as well.

So, you have demand factors continuing to increase in areas where there’s already an undersupply of property. So, if we do get these, say, three or four rate cuts. We’re not going to see property prices rise 4%. We will see property prices rise by potentially 10% or more in these areas because these areas are already flat.

You saw from the data that most markets are essentially not doing anything. Some are slightly rising, some are slightly falling, but you can essentially say the Australian market is flat. And I think that’s for two reasons. Number one, we’re looking at January’s data, which is just after Christmas and the New Year’s break people are now just coming back from holiday mode, both sellers and buyers.

So, it’ll be interesting to see what February’s data holds. But secondly, there are many people who are just waiting for interest rates to be cut. So, from what I can see here and what the data shows, that we’re in what I would call a relatively shallow downturn.

Here’s what CoreLogic had to say. A shallow downturn? Factoring in the downward revision to previous months, CoreLogic’s National Home Value Index, HVI, is now down just 0.3% from the record highs recorded in October last year. With the first rate cut likely to be imminent, alongside improving consumer sentiment, that means that more and more people out there expect property prices to rise and expect that now is a good time to actually buy property.

We could see some renewed support for housing prices over the coming months. Lower mortgage rates and a subsequent lift in borrowing capacity as well as an undersupply of newly built Housing could be setting the foundations of a relatively shallow housing downturn Mr Lawless said. So, if you’re someone who thinks that property prices are going to crash the data shows that’s not going to happen It’s essentially the property market taking a breather before price rises.

Finally, consider this let’s say you’re someone who can afford a property for $700,000. You choose to wait, say, 6 months for the interest rates to be cut. Let’s say interest rates are cut by 0.25% over that 6 month, uh, period, and you’re looking to borrow 80% of $700,000, which is $560,000.

So that’s your loan and no matter what your interest rate is at 0.25% reduction would mean you would have saved $1,400 over a year interest costs over six months. You would have saved $700 by not buying now and waiting for interest rates to be cut. But on the flip side, imagine if that $700,000 property only rose by let’s say 3% in the coming six months.

Now that’s not a great performing area and we’re certainly finding properties for our clients that are performing a lot better than that. But let’s just say the. properties that you’re looking at might rise 3% over that same six-month period that you’re waiting for interest rate cuts to come through.

3% of $700,000 is $21,000. So, let me ask you, what’s better? Making $21,000 in capital gain on an investment property? Versus saving seven hundred dollars in interest costs by waiting. Many people who are waiting to get into the property market have not done the numbers just even at a higher level like I’ve just done for you.

You need to understand that with the shortage of properties and with the fact that there’s so many people waiting to jump into the property market. Once rate cuts happen, it’s no wonder major lenders like the Commonwealth Bank are expecting property prices to rise. But personally, based on the data and the shortage of properties we have, I think a 4% growth rate is undercooked.

I expect there’ll be many areas around Australia where you will see property prices rise by 10% or more in 2025. And look, if you want help to work out where are these areas, check out the link in the description below to get total for free the audio version and digital version of my book here. Otherwise, I’ll see you next time.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.