Major Lenders Cut Interest Rates. It’s Started

By: Niro Thambipillay

October 14, 2024

It’s started. Major lenders around Australia are dropping some of their interest rates. Central banks around the world are dropping their interest rates. The RBA has slightly changed its tune since its last meeting. So, what does this all mean, interest rates going forwards? What does it mean for the economy? What does it mean for property prices?

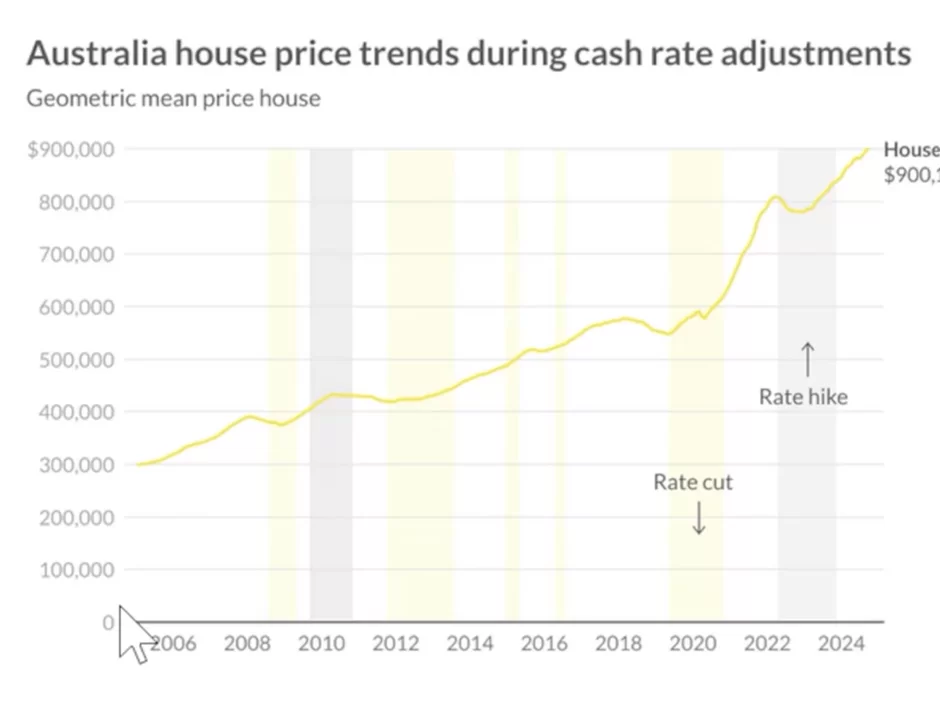

We have a lot to cover. So let’s dive in. Hello, it’s Niro here. Let’s begin by looking at what’s happened to Australian house prices when interest rates have either dropped or been increased. So here we have data the source is Neoval and the RBA. It’s been put together by Ray White.

It’s tracking house prices from 2006. So, what you can see here is that in 2009, this vertical bar here was when interest rates were cut. And what happened? Well, property prices were actually falling just when interest rates were cut. Shortly afterwards, they took off again. Then in 2012, we had some other interest rate cuts.

Property prices fell. started to, to rise. Same in this shorter period here, 2015, and this one in a lot of sort of 2016, 2017. And then we also saw the rate cuts as a result of the pandemic in around 2020, and we saw what property prices did, and they kept rising. Now, in the 2022 – 2023 rate hiking cycle, we saw that property prices dropped slightly.

But then have taken off completely. So, what this shows you is that interest rates alone are not the key determinant of what happens to property prices. Yes, it’s a big factor, but why? Well, because people’s borrowing capacities increase. And as long as there’s a shortage of properties, then more people are able to jump into the market, increasing demand over supply, putting upwards pressure on property prices.

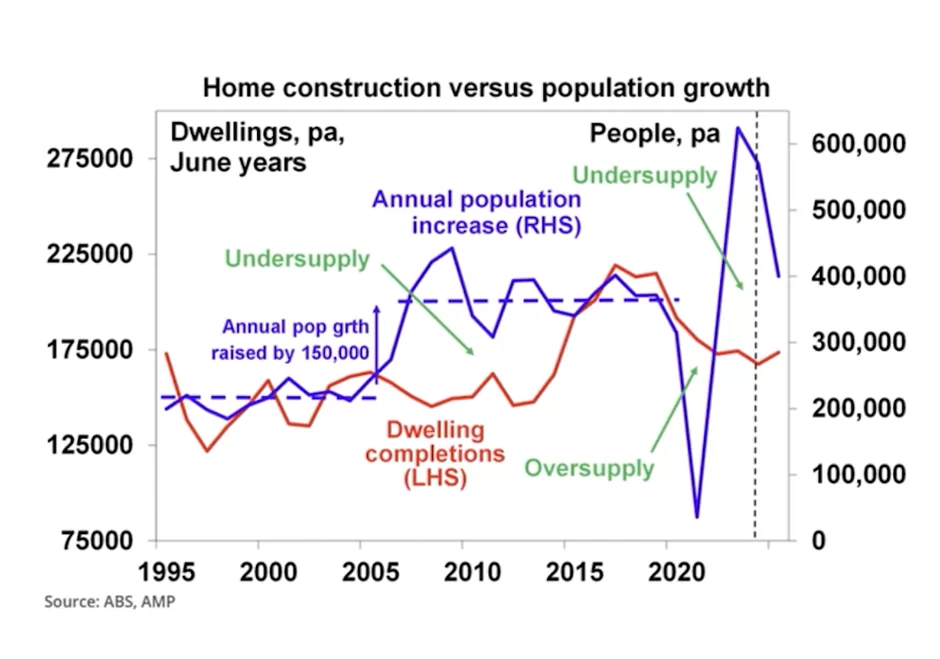

So, the question is, do we have a shortage of properties in Australia? If you’ve been following me for any length of time, you know that I’ve talked about how big the shortage is. As you can see in this chart,

it’s approaching nearly 300,000 on a nationwide level. So, we do have a shortage of properties and when interest rates fall, it will almost certainly drive prices up even higher than they are right now.

But why are major lenders dropping interest rates on some of their fixed rate properties? products, especially when at the last RBA meeting, the RBA governor said that rate cuts were not something they were considering. It’s simple. It’s because they have seen the, the data. The major lenders know that our inflation right now is within the RBA’s target band.

We are seeing virtually zero inflation. economic growth so they know that interest rates are going to fall. And what they’re hoping is that some people who see fixed rates being dropped by banks will go and try and lock in their rate. The big banks are playing the game of interest rate arbitrage, which means they’re trying to profit over the long term.

by dropping rates right now before the RBA does because they know that there is a small segment of the population that are quite likely to go in and take advantage of those locked interest rates. Now, we also know that the US Federal Reserve have cut their interest rates, but not just them. So has the European Central Bank, the Swiss bank, the Swedish bank, the Bank of Canada.

So multiple countries around the world have started dropping their interest rates. Now Australia hasn’t and that doesn’t really surprise me because we were one of the last countries to start increasing rates and battling inflation, So we’ll probably be the last to actually make interest rates fall.

The problem though for the country is that if our Reserve Bank Does not cut rates soon, it will actually put further downwards pressure on our economy Why? Because our dollar will rise in value. Now, if you’re someone who’s thinking about traveling overseas, that could be a good thing, but from an economic perspective, it actually isn’t.

Why? Because our cost of exports rise. The way to look at it is exports is things we sell to other countries and imports are things that we buy from other countries. So, what happens if the cost of things that we sell goes up? Rises because of Australian dollar becomes more expensive. Well, then other countries choose not to buy our stuff. We actually end up exporting less which means that we end up making less revenue as a country while potentially importing the same amount or maybe even Importing more because we can afford to buy more stuff because that currency is stronger that will then cause inflation The current account deficit in the country to get worse.

Essentially it means that a federal budget will struggle to stay in surplus. So, interest rates are going to fall. We’ve even seen our own reserve bank of Australia come out and admit that interest rates are more likely to fall then not. September RBA board minutes omit the recent RBA’s forward guidance. The September board minutes are a lot less hawkish than the August minutes.

What does hawkish mean? If the RBA is known as hawkish, what that means is they’re pointing to its interest rates being increased. If the RBA is considered dovish, it means that they’re indicating that interest rates are likely to fall. Expressed another way, The minutes today have made a dovish tilt to the RBA’s communication strategy on the outlook for monetary policy.

The final paragraph in the August board minutes stated that Based on the information available at the time of the meeting, it was unlikely that the cash rate target would be reduced in the short term and that it was not possible to either rule in or rule out future changes in the cash rate target.

The final paragraph in today’s minute, so now we’re looking at September’s RBA minutes, so one month after the last RBA meeting and what that noted was that it was not possible to either rule in or rule out future changes in the cash rate target at this time. Put simply, the September board minutes have removed the line that said it was unlikely that the cash rate target would be reduced in the short term.

We view this change as significant. The board has now backpedalled from its forward guidance. So, what that means is that the RBA is saying rates are either going to stay on hold or they’re going to fall. There’s no more talk of interest rates being increased. But here’s what’s really interesting when the RBA, not if, but when the RBA starts cutting rates in Australia, they won’t just give us one cut.

Most experts are expecting a series of interest rate cuts to really invigorate the economy. And that could really put some rocket fuel under our property prices. An expected barrage of interest rate cuts next year in Australia Could reignite another nationwide property boom experts claim. ASX RBA target rate tracker published at the end of each trading day yesterday revealed Australian financial markets have begun pricing in four interest rate cuts within the next 12 months.

So assuming each rate cut is 0. 25 of a percent, that means that ASX A rate cut of a full percent in the next 12 months is expected. The RBA is expected to first cut interest rates by 25 basis points in February with three more by August, according to the market expectations. Now, what’s interesting is that CBA are still expecting rate cuts by Christmas of this year, and they’re actually expecting more than four rate cuts from when the RBA begins its rate cutting cycle.

But first home buyers have been warned that the cuts could do as much harm as good by increasing competition for housing and pushing prices up. SQM research director, Louis Christopher said four cuts next year, while still a more remote possibility would cause a huge rebound in property markets that had recently been weaker.

This included Melbourne and Sydney. There is a strong history of rate cuts stimulating housing demand. He said, noting that new cuts would unleash a lot of pent-up demand from buyers. And I shared that data with you at the start showing that whenever rates are cut, property prices start to rise shortly afterwards.

Now, many of the predictions about interest rates being cut by the RBA are coming because several lenders cut fixed and variable home loan rates for both owner occupiers and investors in early September. Experts said Cuts to fixed rates were often an indication that banks expected variable rates to be lower in the coming months.

So there you go. That’s why I said that if you don’t need to, now is not the time to go and re fix the interest rate on your mortgage because even the banks are expecting lower rates. rate cuts to come. That’s why they’re actually trying to lower the fixed rate product to try and get some people in who perhaps don’t understand what’s going on in the wider economy.

So interest rate cuts are coming. This is going to be good news for many people with a mortgage. It’s going to be good news for many people who will see their borrowing capacities increase, and it will be good news for property prices for anybody who’s already got a property. But for anybody who wants to wait until next year, who wants to wait for there to be a sign that there’s a perfect time to buy, the odds are that they will end up paying a lot more for properties than if they bought right now.

But again, that does not mean that you can buy Everywhere. I say this so often because not everywhere will property prices rise, even though people say, Oh, Sydney will then be great. And Melbourne will now be great. Not everywhere, because they’re in certain areas where the government is trying to make housing more affordable, and they’re going to increase the density of housing in those particular areas, which will then compromise on capital growth.

So due diligence is going to be even more important. You don’t just go and buy blindly because interest rates are expected to fall and the median house price in Australia will continue to keep rising. Do your due diligence. And if you want help with that, check out the link in the description below to get the audio version and digital version of my book here. It’s a full property investing blueprint based on my now 22 years of property investing experience.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.