Major accounting firm reveals nasty truth about the property market

By: Niro Thambipillay

January 31, 2025

KPMG have come out and said they have some major concerns about the property market. Today, I’m going to outline what those concerns are, why KPMG say that property price rises cannot be stopped, and then I’m going to go through the data to see if what they have to say. is correct.

Let’s dive in. Hello, it’s Niro here and if you’re new to my channel, hit that subscribe button because I talk about all things related to the Australian property market and the economy. KPMG have issued their residential market outlook for 2025. While property prices are expensive right now, they say that prices will only get more expensive.

Sydney, Melbourne to lead house price gains next year, KPMG. Melbourne’s house prices are tipped to climb 3.5% this year, that’s 2025, rebounding for the first time since last February, and slightly outpacing Sydney, fuelled by improved housing affordability after five years of sluggish growth. KPMG predicts Sydney’s housing values are expected to increase by 3.3%, which is also higher than the 2.5% gain last year. Yes. So, if you’re someone who thought, oh, look, the Sydney property market and the Melbourne property markets are going to fall further especially after what happened last year, KPMG are saying that is not going to happen and I’ll share with you in a moment what the data says to support their claims.

KPMG chief economist Brendan Wrynn said although parts of Melbourne’s housing market remained weak the cumulative effect of the expected rate cuts would spark stronger growth this year. I totally agree with that. You can’t just say, is the Melbourne market now a weak market or a strong market? Suburb selection in Melbourne is crucial.

He also expects Sydney’s status as a major job hub, along with housing supply shortages, to offset the current challenge of poor affordability. By December next year, Sydney is predicted to reclaim its top position, with house prices expected to jump 7.8%, more than double this year’s increase, followed by Melbourne’s 6% gain.

So, what this means is although affordability in Australia is worsening and so many of the naysayers will say that that means that property prices will fall, that’s not going to be the case.

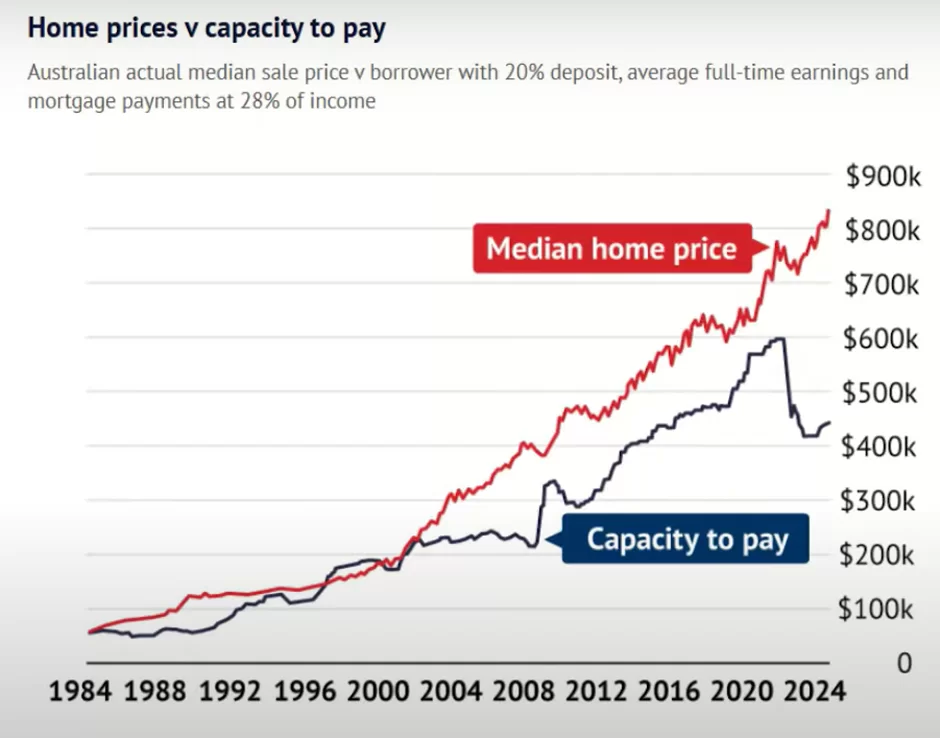

Yes, affordability is falling. We can see that from this chart –

where house prices have risen quite considerably while the capacity of the average Australian to pay for properties has fallen away. As we can see in this next chart –

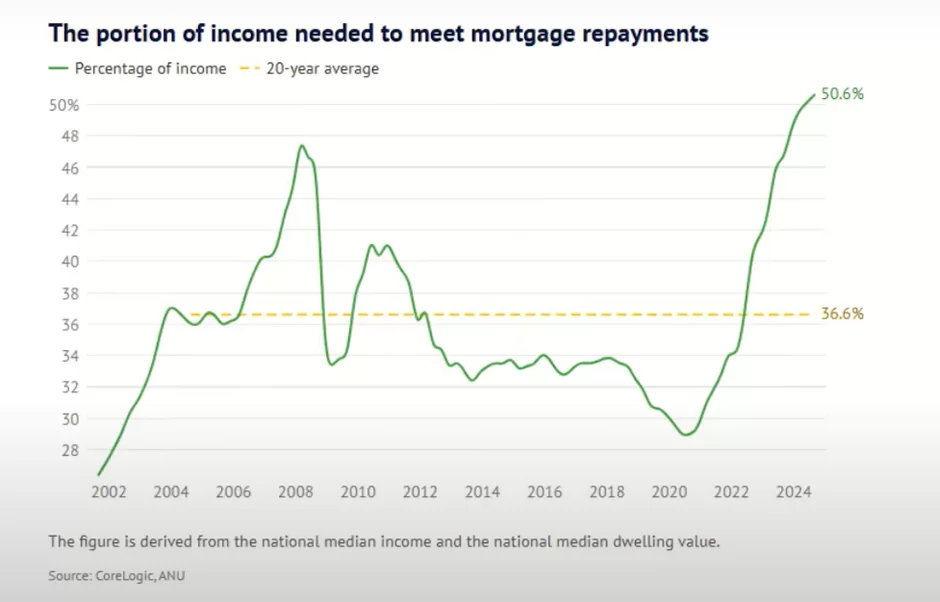

the portion of income needed to pay for mortgage payments is well above the 20-year average.

In fact, it’s now above 50% of people’s income, which is now going towards mortgages. So yes, affordability is an issue. But what KPMG is saying is that the housing shortage in this country is actually a more dominant factor. KPMG acknowledges that is not a good thing for the average Australian.

KPMG chief economist Brendan Wrynn warned that not enough homes had been built for the Australian population and said more supply was needed. We have massive concerns about the housing market. He said, it’s not a new problem. It’s been a problem building for decades. Housing is the number one policy problem in this country.

RIN expected Sydney and Melbourne’s house prices would fall until rates were cut and any growth over the year would be recorded after the cash rate fell. And after the latest inflation data, that was released at the end of January. Many lenders are expecting interest rates to be cut from February.

Others are saying it could be May. Either way, interest rate cuts are locked in for 2025 and that means that Property prices are likely to keep rising. Now, while all the talk in the headlines has been about the Sydney and Melbourne markets, let’s have a look at the full list of predictions from KPMG. In 2025, they expect the Perth market to rise by 4%, Melbourne and Canberra to rise by 3.5%, Sydney 3.3%, then Brisbane 3.1%, Adelaide, Hobart and Darwin to be a bit less.

But in 2026, they expect Perth to say roughly consistent at 4.6% growth, but then Melbourne 6.0, Canberra 3.5%, Sydney 7.8%, Brisbane 5 6%, Adelaide, Hobart, Darwin to be less. Now there are a few takeaway messages from this.

Number one, interest rate cuts are expected to boost property prices because people’s borrowing capacities will increase. This is something I’ve spoken about at length in the past, and with interest rates cuts now virtually being locked in, if you’re thinking about buying a property, it certainly seems like now would be a great opportunity to get in before the rate cuts actually happen, before so many other people’s borrowing capacities increase and then that drives property prices up.

So, you have a first mover advantage here. However, what about the fact that affordability though is still so bad? Surely then that means that property prices can’t rise. Well, as I said earlier on, it all comes down to the property shortage. As you can see here dwelling commencement so, the number of properties being built in Australia is still on a downwards trend.

We’re building fewer properties than we’ve done in the past. Yet our population growth is massive. Sure, it’s fallen slightly from where it was maybe last year, but it’s still well above long term average levels. So, we have more people coming into the country, but we have fewer and fewer properties being built.

That means the gap between demand and supply is only going to get bigger over time pointing towards property prices rising because we won’t have enough properties for everybody who wants to live in Australia. So therefore, when it comes to an affordability perspective, you only need to look at, well, are there enough? people who can afford the limited number of properties in Australia. If their answer is yes, and it clearly is because we see how much property prices are rising across the country, then prices will rise. That’s just basic economics. Now, I’m not saying it’s right, but what I am saying is that if you’re someone who can afford property, it certainly makes sense to jump in now because prices will keep rising.

As KPMG said, nothing can stop property prices rising. And the worst thing for many people is that you don’t want to be in a position where you can afford to buy a property you choose not to. And then you look back, one year, two years, five years down the track with regret, wishing you’d bought as much investment property as you possibly could have when you could have afforded to.

So don’t let that regret be with you. It can’t go back in time. So, there is definitely a clear opportunity. The data doesn’t lie. I expect property prices to be higher at the end of 2025 than they are right now. But again, don’t be led blindly by those property price predictions from KPMG. They’re generalized for the city.

In each area, suburb selection is crucial. Different areas will outperform others, even within a particular city market. So, you want to do your due diligence. Look at the areas where there is massive undersupply, where there are more buyers than properties available for sale. And look, if you want help with that, check out the link in the description below to get total for free the audio version and digital version of my book here. Otherwise, I’ll see you next time.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.