Is Cyclone Alfred the Final Nail in the Coffin for Brisbane’s Property Market

By: Niro Thambipillay

March 12, 2025

Will Cyclone Alfred finally kill the Brisbane property market’s five-year growth cycle? Well, to answer that question, we’re going to first look at the three criteria we look at when identifying what’s likely to happen to a property market going forwards, and how does Brisbane and Queensland stack up against those criteria.

Number two, we’re going to look at Well, why is Brisbane losing its mantle as being one of the fastest growing property markets in Australia and what that actually means? And then finally, number three, we’re going to look at the likely impact Cyclone Alfred will have on Brisbane’s property market! Let’s dive in, Hello, it’s Niro here. If you’re new to my channel, hit that subscribe button because I talk about all things related to the Australian property market and the economy. Now before I talk about the likely impact Cyclone Alfred will have on the Brisbane property market, let’s have a look at where the market is in general.

Over the last five years, Brisbane median property price has risen 69.5% or around $367,000 according to CoreLogic. So, it’s had a huge run. But what’s likely to happen going forwards? Well, to answer that question, we need to look at three criteria.

Number one, demand from owner occupiers versus supply. So, what I mean by that is we want to see well how much demand is there from people who actually want to move and live in a particular area versus the amount of supply, be that the number of existing properties for sale or new properties being built and the data here paints it. It’s quite an interesting picture

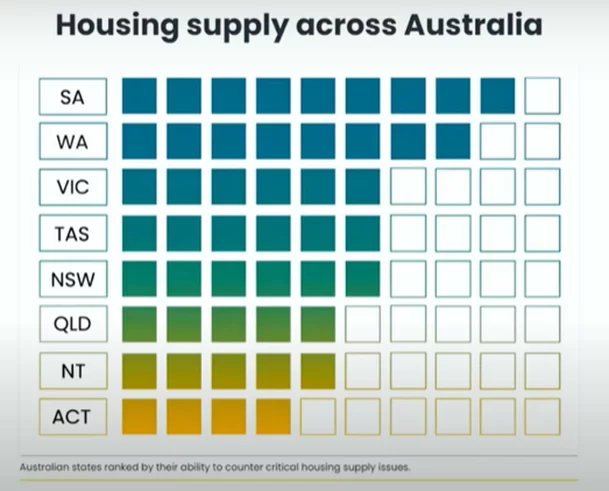

When we look at this scoreboard provided by HIA, or Housing Industry Association of Australia, which is looking at housing supply across Australia, we can see that none of the states are actually on track to meet target. However, Queensland is actually one of the worst performers in terms of increasing supply to meet demand.

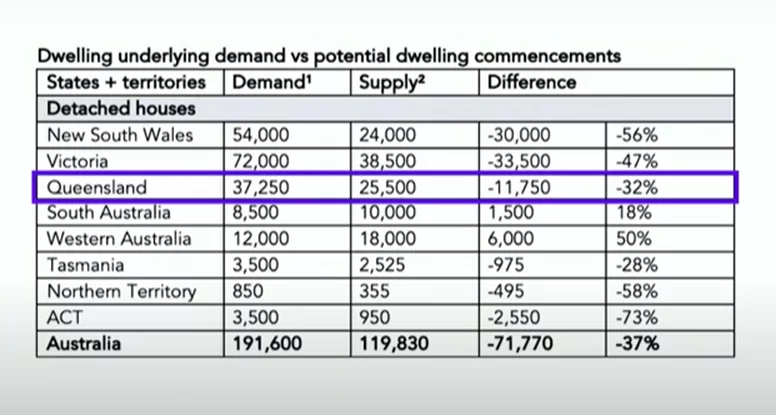

What that means is that the gap between the number of people who want and need properties to, to live versus the number of new properties being built, that gap is actually bigger than most of our other states and territories. And when we look at this next table produced by Michael Matusik,

what we can see is that when we look at Queensland at the moment, we need 37,250 Detached properties. They’re only building 25,500. So they’re undersupplied by 11,750 or a whopping 32%.

So that is quite significant. There is a massive undersupply of properties in Queensland. Now this is generally, I’m not looking at it on a city-by-city basis. I’m just talking about Queensland in, in general. So what that points to is that as long as that demand stays higher than Supply and all the data points that that’s going to happen the likelihood is that just based on this one criteria Property prices are likely to keep rising, but that’s just the first of the three criteria We look at when trying to see what’s likely to happen to property prices going forwards.

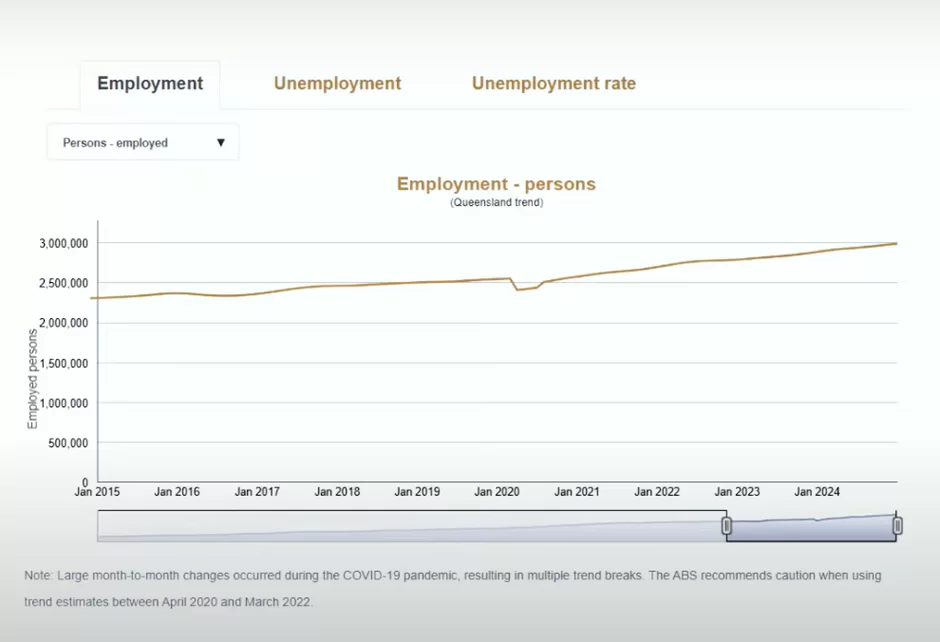

The second criteria we look at is jobs growth, fairly intuitive. If people aren’t gainfully employed, odds are they’re going to leave, or even if they stay, they’re not going to have enough money to pay for their mortgages, and that could have a detrimental impact on the property market. When we look at this next chart talking about employment, produced by the Queensland Government Statisticians Office.

What we can see is that the number of people being employed in Queensland has been rising quite steadily since January of 2015. Yes, there was a blip in January 2020, which is really the COVID pandemic, but apart from that, the number of people being employed has increased, which shows that jobs growth is good. The latest data in January said that trend employment in Queensland rose by 0.2% or 6,600 people.

When we look at the unemployment rate, we can see that since January 2021, unemployment has been falling. Obviously, there was a spike just before then, which is again the COVID pandemic. But what we can see here is that after falling towards the end of say 2022, there was a slight uptick, but now unemployment is starting to fall in Queensland, which goes against what’s happening on a national level because in Australia in general, unemployment is rising.

But in Queensland, in general, it’s actually falling, showing that jobs growth in Queensland on average is actually stronger than what’s happening on a national average.

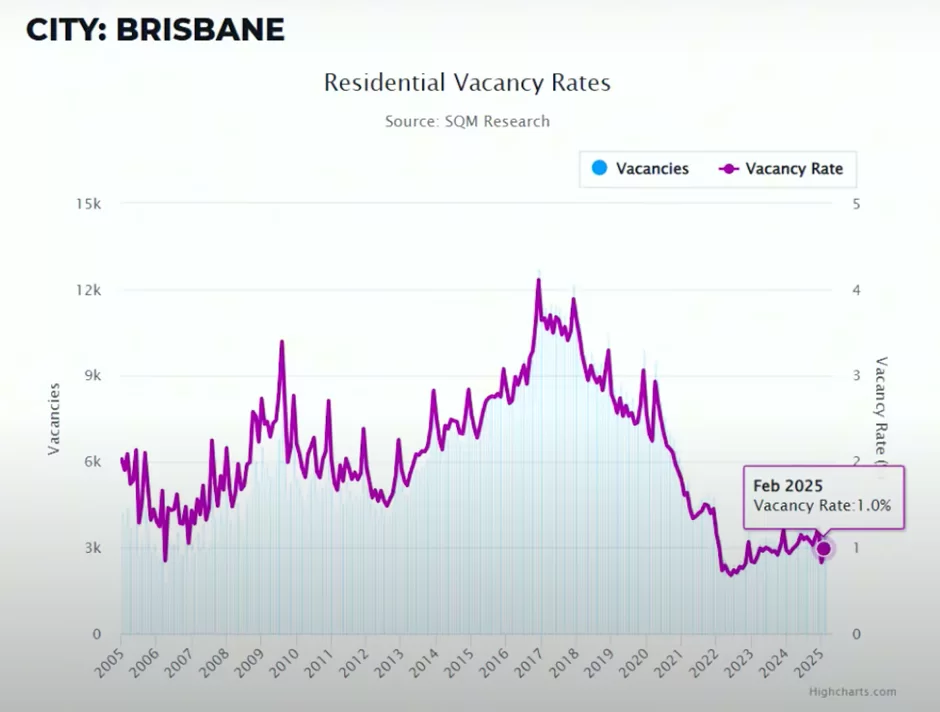

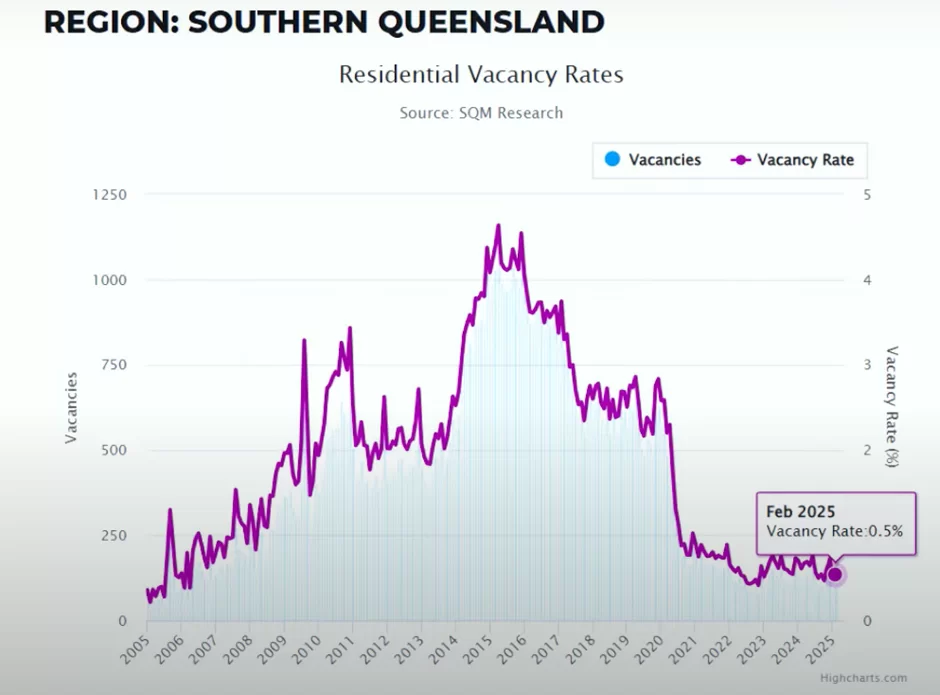

Then the third criteria we look at to determine how likely prices are to grow on a macro level is vacancy rates. Is there high demand from people wanting to rent properties relative to the number of properties available for rent?

When we look at this next chart from SQM Research,

what we can see is that for Brisbane as a whole, the vacancy rate has been dropping quite significantly since around about 2017 and 2018, and it’s still sitting at around about 1%. So, we’re looking at the purple line here. A vacancy rate of 1% is extremely low.

We would get concerned if the vacancy rate was sort of 3% or higher. But 1% is a very good result for us as investors. It also shows that there is a current rental crisis in Brisbane because there aren’t enough places to rent. And if I just look at one of the regions in Queensland, being southern Queensland,

we can see the vacancy rate here is even lower. It’s 0.5%, so it’s lower than Brisbane’s. And if I was to go through most regions around Queensland, what you will see is that the vacancy rates are really, really low, meaning there’s strong demand from tenants, which can give you a lot of confidence if you have an investment property there.

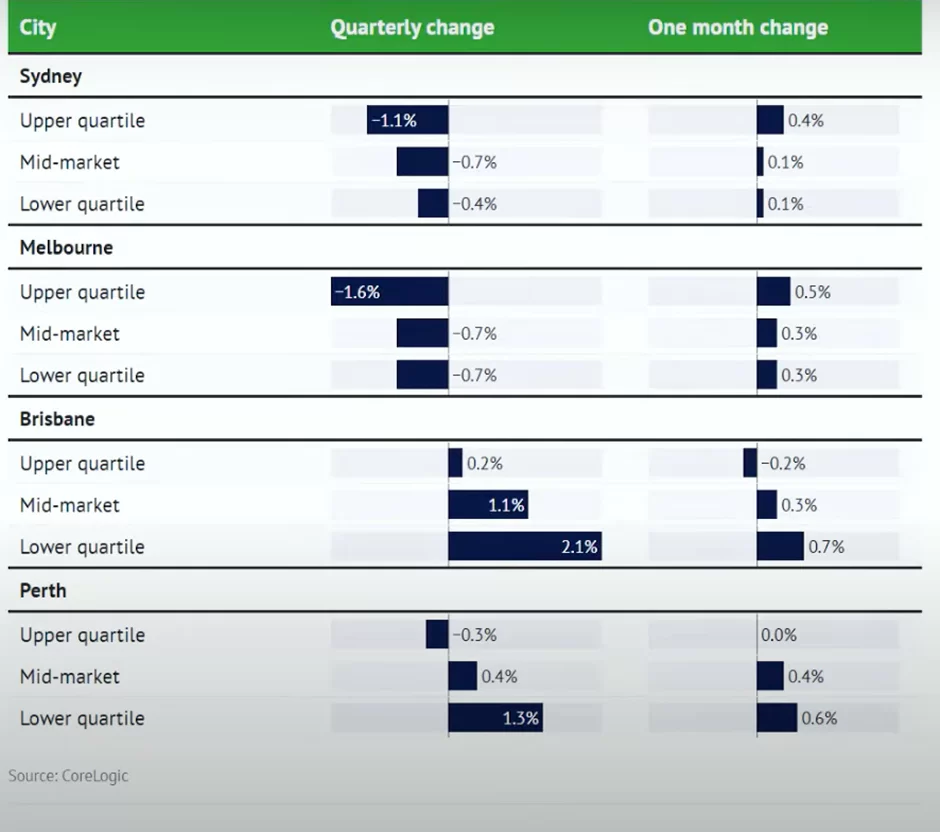

But now if we quickly go through the three criteria we looked at to determine future price growth, demand from owner occupiers versus supply, that gap is quite high at the moment. Jobs growth is strong, rental vacancies are very, very tight. So, all the key factors we look at from a macro level point towards Queensland’s property prices continuing to rise. But then, Why is Brisbane losing its mantle as one of the fastest growing markets? If we look at this next chart with data produced by CoreLogic,

what we can see is that when we look at the Brisbane market just last month, it was the upper quartile, the most expensive 25% of properties that fell 0.2%. But if we look at the middle of the market or the lower quartile, which is the cheapest 25% of properties, we can see that those markets are actually performing very, very well, especially the lower quartile. And I expect this is going to continue going forwards whereby you’re going to see a disconnect in the Brisbane market.

—-

Certain areas will struggle while other areas, especially those that are more affordable by current Brisbane standards. They are the areas that are likely to keep growing and continue to outperform many other areas in the country. So that’s why when you see that looks at macro level and saying that Brisbane property market may not be performing so well.

You’ve got to really understand that that’s talking about at a city-wide level. That’s the case with any city. You need to cut and dice the data and look at the individual pockets to see what’s happening. And clearly the data is showing that the more affordable areas in Brisbane are continuing to rise.

So, all of that might be great, but the question still remains, what about Cyclone Alfred? It’s one of the biggest weather events we’ve had in recent history. Is it going to upset the apple cart? Is it going to make Brisbane property prices fall? Here we have a chart put together by Propertyology, which looks at what’s happened to property prices in 20 year segments.

Here we can see in the 20 years to 1960, well, there was World War II. They had high inflation. They had all sorts of construction restraints. And yet property prices rose 3.6 times. That’s more than a tripling of the property price. Then in the 20 years to 1980, they had high inflation. They had the 1974 recession. There was 10% plus home loan interest rates. They had the oil crisis, the Vietnam War. And what happened? Medium property price rose six times. That’s a sixfold increase in property prices. What about the 20 years to the year 2000? Well, then we had the recession of 1982, again, 10% home loan interest rates, oil crisis, 10% unemployment, stock market crash, recession of 1991.

All of these things that many people would think would crush a property market. I mean, for example, home loan rates at 10% plus, and yet property prices rose 4.4 times over that 20-year period. What about in the 20 years to 2020? Well, during that time they had the oil crisis, we had the global financial crisis, commodity price crash, COVID 19, the recession of 2020, and what happened? Property prices rose. 3.7 times.

So, what this shows is that yes, over time, we have natural disasters. We have global economic events. We have interest rates fluctuating and yet property prices continue to rise, driven by some of the factors that I went through earlier on. But specifically, let’s have a look at what happened to Brisbane property prices after a major disaster.

So, in 2011, they had some major floods. 36 people died. 3,000 homes were destroyed. There was over $2.5 Billion worth of damage and yet, what happened to property prices? Well, from 2011, the median price in Brisbane was $430,000, By 2021, it was $780,000. Then in 2022, there was another major flooding event in Brisbane. What’s happened to property prices since then? Well, the median price has gone from, say, $780, 000 to now nearly a million dollars in Brisbane.

So, specifically, even when we look at Brisbane, these natural weather events, as disastrous as they are, they don’t stop property prices rising. If anything, they seem to spur on property prices because there’s more investment that comes in, because more money has to be spent to rebuild a lot of the damages, rents start to rise because you have more construction people coming in who need short term accommodation, tightening the rental vacancy, and overall, all that happens is that property prices continue to move upwards and that’s why with the massive undersupply of properties we currently have in Brisbane and Queensland in general, the massive amount of infrastructure that’s coming as a result of the 2032 Olympics, the strong jobs growth plus a whole host of other factors, I expect you’re going to see the Brisbane property market plus multiple areas around Queensland continue to be some of Australia’s best performing property markets.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.