Interest Rate Cuts Confirmed But There’s a Catch

By: Niro Thambipillay

January 30, 2025

Hello, it’s Niro here, and right now, almost everyone who’s seen the latest inflation data is really excited that interest rates are going to fall in February. Me? Well, as much as I don’t want to rain on everyone’s parade. I’m not so sure. That’s why today we need to look further into how the Reserve Bank of Australia actually is making its decisions around interest rates, what this could actually mean for interest rates and when they get cut, and number three, what this all means for you if you’re looking to either buy or sell property this year.

Before we get into all of that, if you’re new to my channel, hit that subscribe button, because I talk about all things related to the Australian property market and the economy.

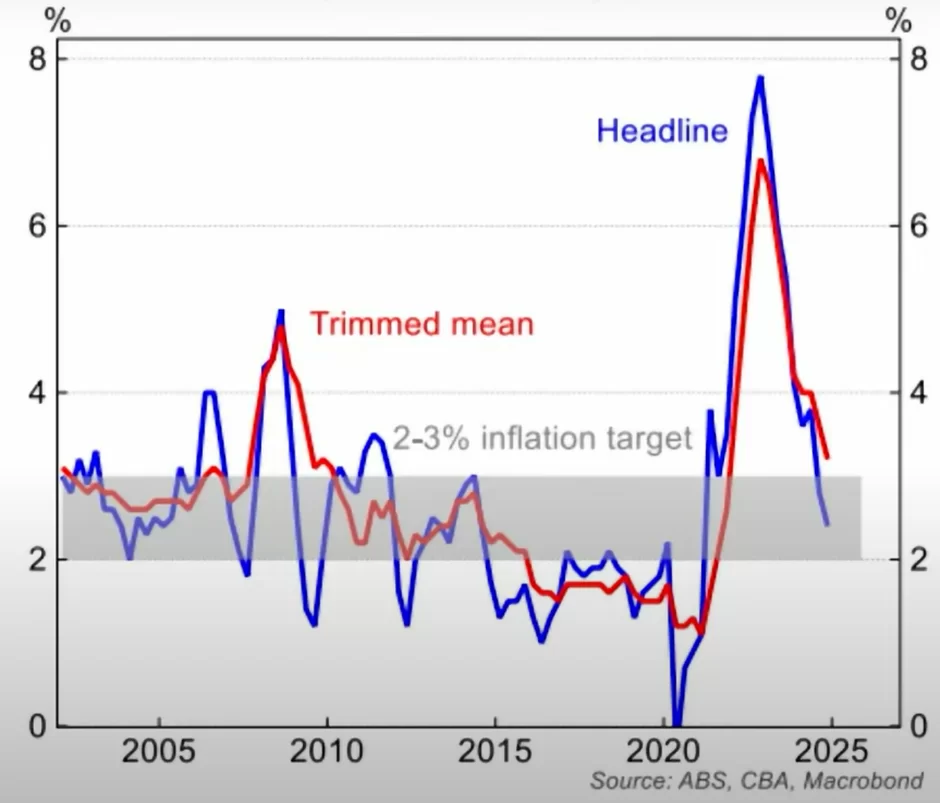

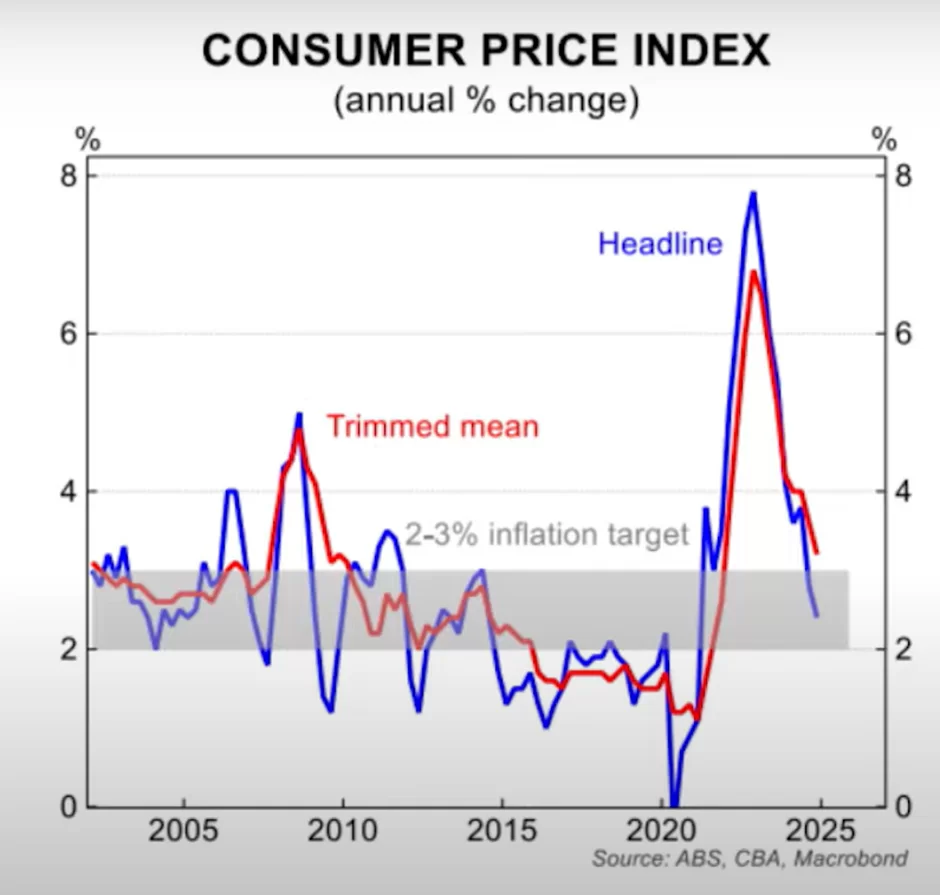

So, let’s begin by looking at why so many people are saying the RBA must cut rates. The latest inflation data came out and we’ve seen that annual headline inflation has fallen to 2.4%.

Now, why is that figure important? Because the Reserve Bank of Australia has said that its target for inflation is to keep it between 2 and 3%. So, 2.4% slap bang in the middle. As you can see from this chart –

Headline inflation is falling, and personally, I believe there’s a danger that if the Reserve Bank of Australia doesn’t cut soon, inflation could fall below 2%, which could also have a number of other negative consequences.

The Reserve Bank has also said that it’s concerned with wage growth, and it wants to see wage growth falling before it cuts interest rates. Well, when we look at this chart from the Commonwealth Bank of Australia, we can clearly see that wage growth is falling and falling rapidly. So that’s another tick.

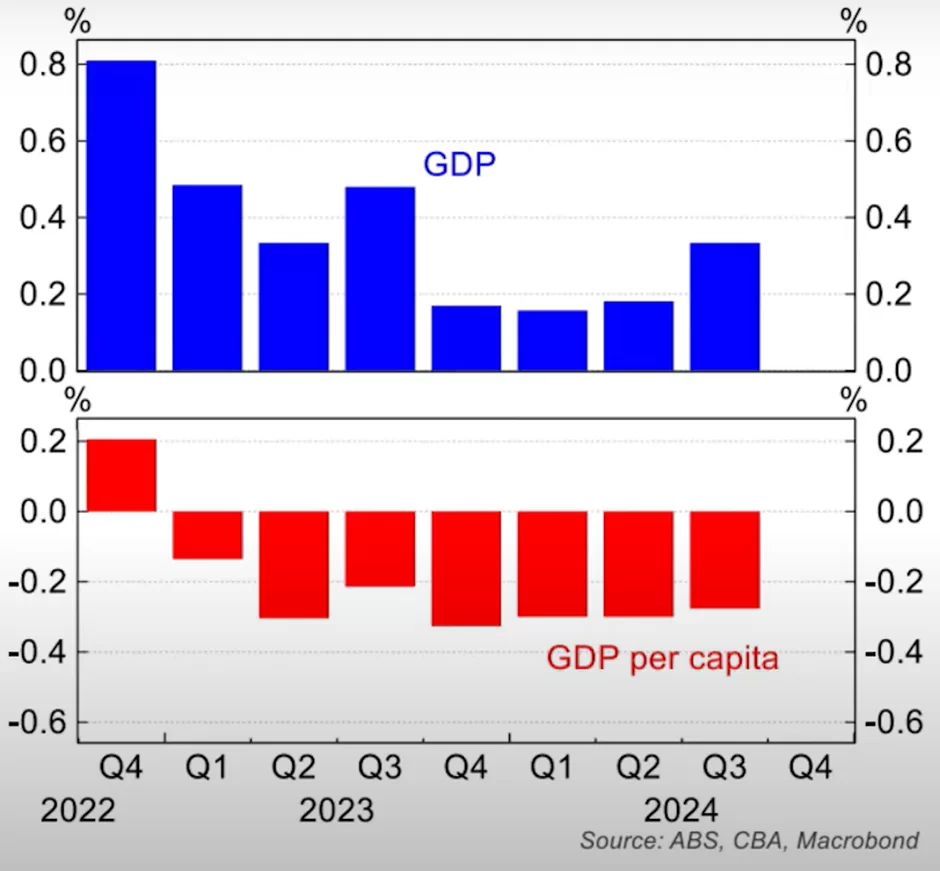

Then we have unemployment, which is rising and currently sitting at around 4%. Although the RBA seems to think that unemployment isn’t rising fast enough, whatever that means, the fact is that unemployment is rising. And then one of the biggest. factors that we look at is GDP growth. In other words, how fast is our economy growing? as you can see from this chart –

The rate of growth is slowing and has been slowing for quite some time. But worse, when we look at per capita GDP growth. So, what that means is we’re looking at how much the GDP is growing per individual who lives in Australia, we can see that has been negative for quite a while.

That’s why I said in my previous episode, and I went through this in a fair bit of detail, that the federal government has succeeded in making the average Australian a lot poorer, because we’re generating less economic output per person, which means each of us has less to spend. So, all of these factors point quite clearly towards why the RBA should drop interest rates in February.

However, why wouldn’t they when you see all of these factors? Well, many people will say, Oh, it’s the Australian dollar. Look how much the Australian dollar has fallen-

If the RBA was to cut rates, well, then that would make the Australian dollar fall. Well, there’s sort of two flaws with that argument. The first thing is that the Australian dollar has fallen in anticipation that the Reserve Bank of Australia will cut rates.

I would say that it’s already been priced in that Australia will cut interest rates, which is why our dollar is sitting where it is. But even if that’s not the case, the Reserve Bank of Australia has said that they won’t be considering the Australian dollar. At least not directly. However, indirectly, of course, it’s going to have an impact.

Why? Because when the Australian dollar falls, it means that things that we buy from overseas become more expensive, or the cost of imports becomes more expensive, and whenever things become more expensive, that of course, could add to inflation. So, it’ll be an indirect impact which the RBA will be monitoring.

But I don’t think that’s the reason why the RBA may not cut rates in February. Instead, the Reserve Bank of Australia has been saying that it’s not focusing on headline inflation, it’s focusing on something called the trimmed mean inflation rate. Now, what does that mean? Well, the trimmed mean inflation essentially cuts out the top 15% and bottom 15% of all the goods and services that the RBA is looking at.

It’s really taking out the most variable ones. What are some examples? Well, for example, there’s rent assistance happening right now across the country. And so, when there’s rent assistance, that means that the rental inflation is not as high because there’s government subsidies available, or we are all currently getting electricity subsidies. So that means that in terms of what we spend on electricity, obviously that’s not rising as much because the government is subsidizing that.

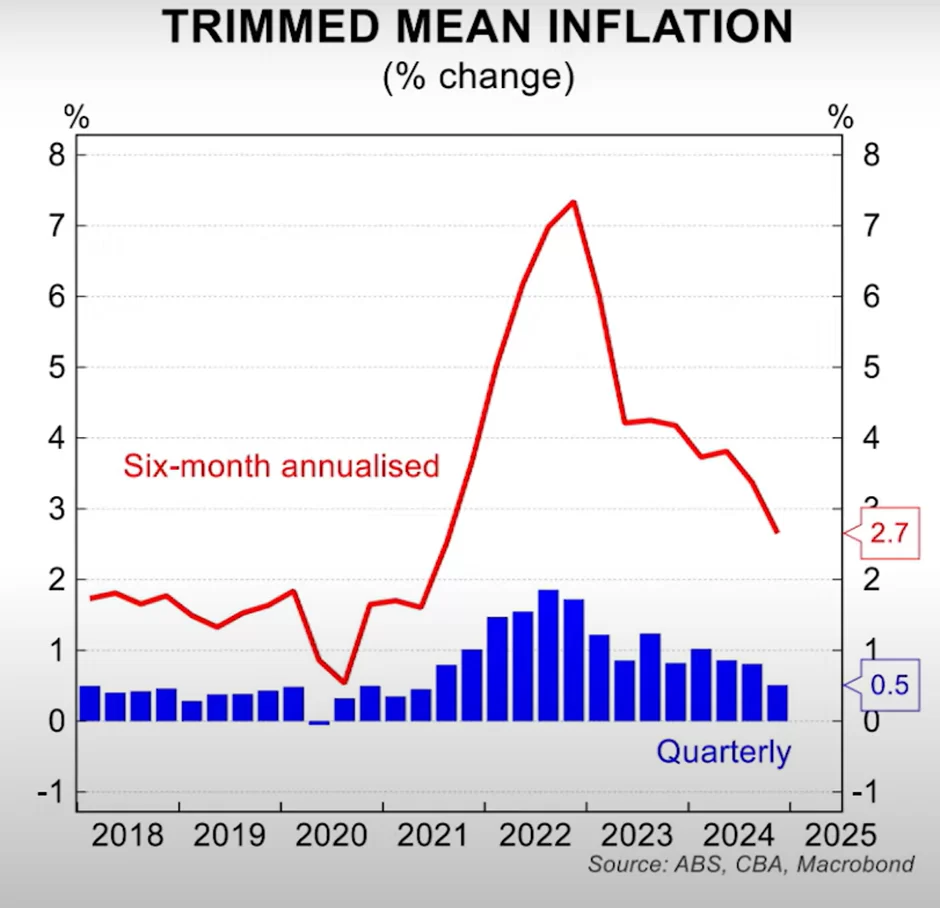

So because the government is providing these subsidies, inflation doesn’t look as high according to the Reserve Bank. That’s why they’re focusing on trimmed mean inflation and if you look at the rate of trimmed mean inflation,

You can see that, yes, it’s fallen, but it’s only fallen to 3.2%. That is actually above the Reserve Bank’s target of being between 2 and 3%. Now, if you look at the what’s actually happening to the trim mean inflation, and CBA have done a great job here,

what they’ve done is they’ve taken the last six months of trim mean inflation and annualized that, which means they’re saying If we just take what’s happened in the last six months and then project forwards, assuming that continues, then trimmed mean inflation is down to 2.7% it’s within the Reserve Bank’s target, therefore the Reserve Bank should cut interest rates in February.

Me? I’m not so sure that’s what the Reserve Bank will do. If the Reserve Bank continues to focus just on trimmed mean inflation, I don’t think they’ll cut in February. They’re more than likely going to cut in May at the earliest.

Why May? Well, the March quarter inflation data comes out at the end of April. After we have that data, the Reserve Bank meets in May. Now assuming that the trim mean inflation continues to fall like it has been and falls to something beginning with a 2, even if it’s 2.8 or 2.9%, then the Reserve Bank has no more excuses not to cut interest rates.

So, if they’re focused on trim mean inflation, I’m sorry, we may not see rate cuts in February. As much as I think the RBA should cut in February, we might be waiting until May. Regardless of when the reserve bank decides to cut interest rates. What does this mean for the property market?

Well, it’s clear that rates will be cut at some point this year. Now, when that happens, people’s borrowing capacities will improve. So, people who can’t afford property right now or just on the cusp, they will then be able to enter the property market. Number one, number two mortgage holders who are in some sort of financial distress right now and are just holding on.

We’ll get some relief. So, you’ll see fewer distressed. Sales and many economic experts are saying that once rate cuts begin, we could see up to four rate cuts in 2025. Now that’s going to really put a rocket under the property market because we already have a shortage of properties. Now when we have rate cuts coming into force that will have more people able to buy property.

So, me personally, I’m looking to buy property again, and in fact, I’m bringing forward my plans to buy, but again, you’re not going to see prices rise everywhere. They will be rising more in the undersupplied markets, where a certain oversupplied market, especially high rise, Units and certain other areas where there’s been lots of development, you’re not going to see property prices rise anywhere near as much in those areas.

So doing your due diligence is crucial. But ultimately though, the good news is rates are set to fall. All this uncertainty that you’re seeing in the mainstream media about all property prices are going to fall etc., that’s all going to go away very quickly. It’s a repeat of what we saw in 2023, when that year we started off with a lot of negativity about property prices, and yet prices took off.

I expect you’ll see the same this year, and that’s why if you can afford to buy property, this could be a really great opportunity for you to get in before prices take off, and if you want help to work out where’s the best place for you to buy, check out the link in the description below to get total for free the audio version and digital version of my book here. Otherwise, I’ll see you next time.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.