I have never seen the Property Market so divided

By: Niro Thambipillay

November 18, 2024

I have never seen the Australian property market be as divided as it is right now. Some people who live in certain areas are reporting that properties are taking longer to sell and price growth is slowing. Prices are even falling in some areas. Others who live in other areas are saying the property market is as hot as ever.

Properties are selling more quickly. Prices are rising, so the question then is. Who do you believe? Well, today I’m going to do a deep dive into the data. I’m going to share what’s happening in the various segments of our property market so that you can have some clarity around what to expect for property prices.

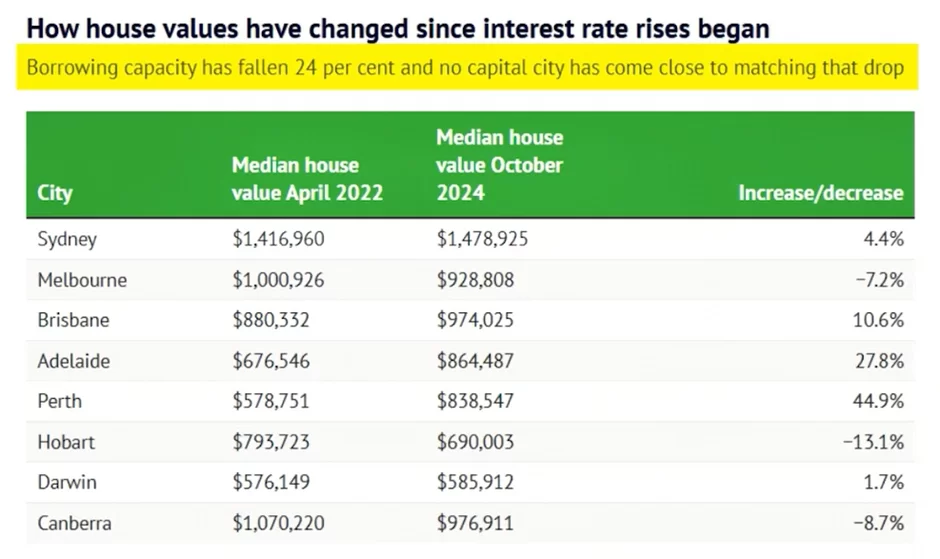

Going forwards, let’s dive in. Hello, it’s Niro here. Let’s begin by looking at how house values have changed since interest rate rises began. As per this table, the source of the data is CoreLogic and CanStar.

Now, the key takeaway point here is borrowing capacity has fallen 24% since interest rate rises began.

And yet no capital city has dropped anywhere near that much. In fact, many of our capital cities have actually risen. So, Sydney, for example the median house price has risen 4.4 % since April 2022. Melbourne, yes, prices have dropped, but they’ve dropped 7.2 % versus a 24% drop in borrowing capacity.

Brisbane prices are up 10.6%, Adelaide 27.8%, Perth a whopping 44.9%. Then we have Hobart, where prices have dropped since rates started rising, they’ve dropped 13.1%. Darwin, essentially a flat market, it’s only up 1.7 % since April 2022 and Canberra, prices have dropped 8.7% and this next chart really highlights why so many people are unclear about what’s happening in the property market.

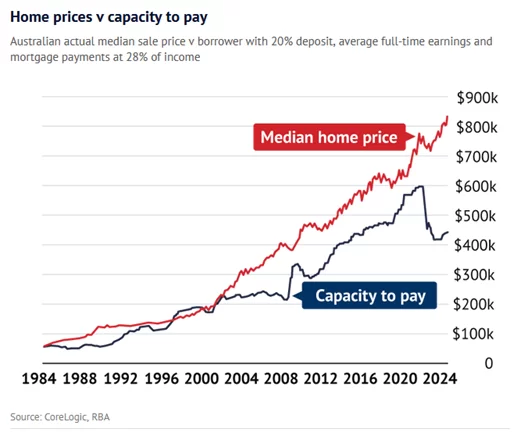

We’ve had the capacity to pay so people’s ability to pay for loans drop quite considerably since interest rates started to rise. And yet, the median house price in Australia has continued to increase. How is this possible? Even the Reserve Bank of Australia is quite taken back by what’s happened to property prices during this rate hiking cycle.

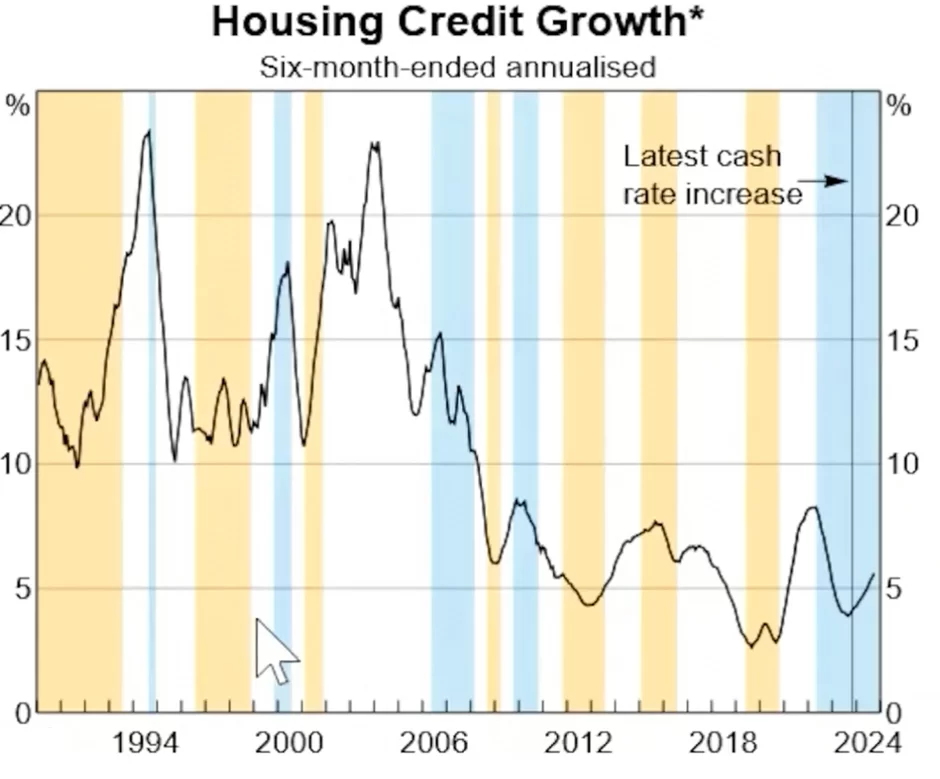

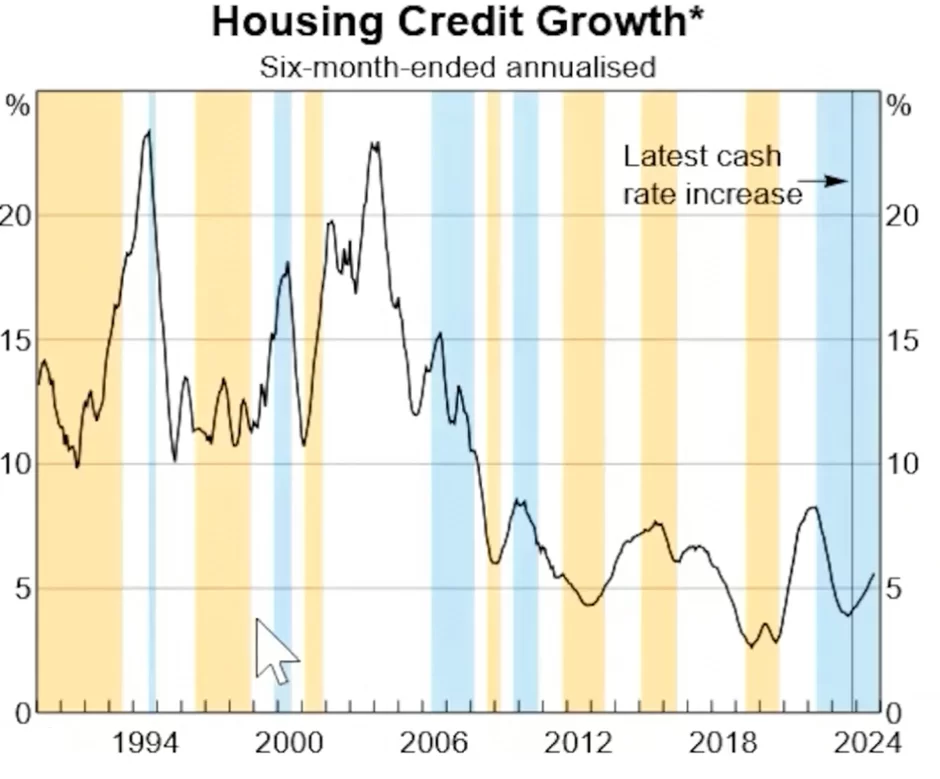

Here we have a chart showing housing credit growth versus interest rate movements. The yellow vertical bars represent time periods when interest rates were cut. Blue bars represent time periods when interest rates were increased.

Now, if we look at the blue bars, first of all, what we can see the first one here in round about 1994, then around about 2000, essentially, if we look at every blue bar, what you can see is that the black line falls.

What this means is that whenever interest rates have increased, growth in new loans has reduced, which makes sense because borrowing capacities have fallen. However, this last time period shows something very, very different. Here we can see this last rate hiking cycle.

Yes, interest rates rose. So that’s the blue section. And housing credit did fall slightly. But then has actually started to increase again. So how can the number of loans being taken out increase when people’s average borrowing capacities are being shredded? When so many people don’t have the ability to buy the kinds of properties that they want to in Australia?

Unfortunately, it comes down to the fact that we have a massive issue with demand over supply. We’re not building enough properties right now. Our number of properties being built is well below any sort of federal government target. And with our population growing so quickly and the fact that more and more home owners are living in their homes longer, meaning there are fewer properties available for sale, What it shows you is that even though the average person can’t afford properties in general, there are still more buyers than sellers, so that’s more demand than supply, forcing property prices higher.

But then what’s likely to happen When interest rates fall, when we look at each of the yellow bars here, what we can see is a very common theme. Either credit growth started to rise during the time period when interest rates are being cut, like this first yellow bar here, and if not, at least after the rate cutting cycle finished, you can see that credit growth increased every single time.

That means that more people took out loans as interest rates were being cut or shortly afterwards, which places more demand on properties. Why are people taking out more loans? Their borrowing capacity has increased. More people are able to afford property when interest rates are lower than when they are higher.

That’s a very obvious fact. But when you consider that and consider then where the property market is, it actually gives you some clarity as to what to expect will happen to property prices going forwards. You see, the median property price in Australia has risen for the 21st month in a row. Yep, 21 months of property price increases.

No market can ever increase every single month. Price growth will slow down for sure. However, that doesn’t necessarily mean that prices are going to reverse at least not on a national level because ask yourself what’s it going to take prices to fall? Well sellers need to sell that might seem really really obvious but only if we have more sellers selling property than available buyers only then will property prices start to fall.

And if that hasn’t happened with interest rates being the highest, they’ve been at for 12 years with inflation now falling, getting closer and closer to being in our target band and interest rates falling all around the world, it’s only a matter of time before interest rates fall in Australia. And as I showed you earlier on, whenever interest rates have fallen, more people have gone out and taken loans and that will happen again.

So, I believe that even though we are seeing the property market divide, certain areas are rising, certain areas are falling. I’ll talk a bit more about that shortly. I still expect the median property price in Australia to be higher at the end of next year than is right now to be higher in five years’ time than is right now and certainly higher in 10 years’ time than is right now.

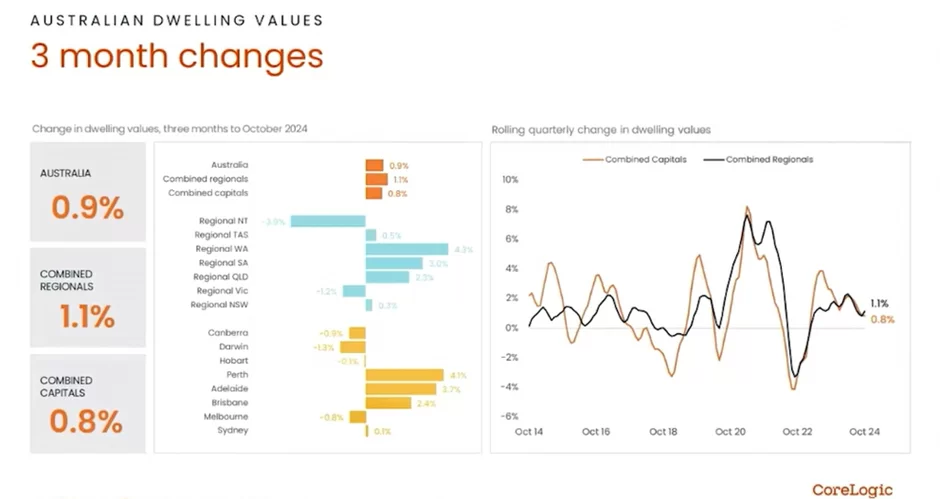

I really believe that if you do your due diligence, there’s a great opportunity to grab a deal right now, because the markets are actually dividing. Let me show you. If we look at this data from CoreLogic,

looking at the change in dwelling values in the three months to October 31, 2024, What we can see is that, yes, Australian median property prices are higher.

If we look at all of the regional markets, which doesn’t really make a lot of sense, but even if you do, prices are higher there. And all our capital cities, if you combine them, prices are higher there. But again, you don’t buy in all the capital cities. You don’t buy in all the regional markets. You buy in a particular city; you buy in a particular suburb.

So, you do need to drill down further. And when we look at the individual markets, as you can see here. Things look very, very different. We can see here the regional Northern Territory over the last three months, clearly our weakest market, but all the other regional markets have increased with the exception of regional Victoria.

If we then look at the capital cities over the last three months, we can see the Canberra and Darwin are struggling, Hobart relatively flat. Perth, Adelaide, Brisbane leading the way as has been the case now for quite some time. Then we have Melbourne still falling and Sydney, let’s say that’s a flat market 0.1 % growth over three months.

But if we break it down into different quartiles in terms of property market. We start to see something a little different. Sydney again, the areas that are falling the most are the most expensive 25% of property prices, mid-range properties and more affordable properties by Sydney standards are still rising in value.

Melbourne at the moment is falling across the board, although the cheapest end of town is starting to go flat. There are certain pockets. I know where demand is starting to really increase. Properties are selling very, very quickly. Brisbane prices are rising across the board. Again, though, the cheapest 25% of properties are doing the best.

Same for Adelaide and Perth. But then we have Hobart, where prices look like they might be finally starting to find some kind of a bottom. It’s still the most expensive end that’s falling. But the mid range and lower end of town are starting to show some new green shoots.

Unfortunately, poor Darwin and Canberra really struggling right now. So what this shows you is that different areas are performing very, very differently. You can’t just make a blanket decision saying, Oh, the property market is doing well. I’m going to buy anything and make money. At the same time, you can’t just say, Oh, the market in my local area isn’t doing well, so I’m not going to buy anywhere.

It’s clear the data shows that there are multiple areas doing very, very well. And although overall, I expect that the median property price in Australia will continue to rise and be higher in 12 month’s time than is right now, that will not apply everywhere. You do need to do your due diligence.

If you want help with that, check out the link in the description below. to get the audio version and digital version of my book here. Otherwise, I’ll see you next time.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.