Who Else Wants to Buy an Investment Property That Makes You Money In the Coming 3 Years?

By: Niro Thambipillay

September 5, 2017

Who Else Wants to Buy an Investment Property That

Makes You Money In the Coming 3 Years?

How Some Investors Are Getting Great Growth Without Renovating, Buying in Regional Towns or Investing in Overpriced Apartments

Are you looking to buy an investment property, but do Sydney’s ridiculously high prices, low rental returns and predictions of prices dropping scare you right now?

Well, what if I told you that you were right to question whether now is the time to invest in Sydney…

But what if I told that you that there was ONE INVESTING STRATEGY…

Just ONE that could help you…

Make some amazing capital growth in the coming few years, catch up if you missed the Sydney boom and give you incredible certainty about your financial future.

Oh, and it’s got nothing to do with renovating, negotiating a discount or giving up your Saturdays attending Open Homes

Let me explain.

The One Strategy that Identifies the Next Markets to Grow

Hi, I’m Niro Thambipillay and I’ve had the privilege of helping property investors purchase over $61.8 Million worth of property in just the last 6 years.

Personally I have been investing in property for over 15 years and it is because of property that my family and I have incredible certainty about our financial future.

But it wasn’t always like that.

In fact, when I first got started investing, I could barely afford the Sydney market.

Prices had risen dramatically…

And the government was talking about changing the rules and taxing investors.

I Was Afraid The Sydney Market Would

Fall In The Coming Few Years.

And it turned out I was right, with apartment prices dropping 20% just after I had planned on buying…

Yes, I dodged a bullet!

Had I bought in Sydney at the time, I would have ended up buying at the wrong time,

Not getting any growth for a number of years and

Been saddled with a massive mortgage where the rent didn’t cover the interest payments.

Essentially, I would just be up to my eyeballs in debt, while interest rates rose.

Oh sure, if I’d been able to hold on for long enough, I would have been ok…

But at what financial cost?

Rates fluctuated considerably and there is no guarantee I would have been able to afford to hold the property until the next boom… that started only in 2012.

So, thankfully, I didn’t buy in Sydney at the time.

However, rather than just do nothing and keep my money in the bank…

Or blindly follow the crowd and keep investing in Sydney, when all the data clearly showed the Sydney boom cycle was coming to an end, I asked myself a key question:

“Where else could property prices grow?”

And more importantly,

Can You Anticipate the Markets That Will Grow NEXT?

Well, the more I studied property, the more I came to the conclusion that you could… at least in theory.

But I had to prove it to myself.

So I started by investing interstate… when most people called me crazy!

And I doubled my money in 12 months!

In fact, since I worked out that it was possible to anticipate the next property boom, I have bought and sold millions of dollars of investment property…

I bought in Sydney in 2011 – when almost nobody else was talking about a Sydney price boom…

I have helped my parents build a significant property portfolio and prepare them for retirement

And I now have the freedom to spend time with my two young boys and be the dad I’ve always wanted to be.

So you’re probably thinking right now – ok Niro…

How Do You Anticipate The Next Property Boom?

Well let me tell you…

After all, you have every right to be sceptical

But imagine how much more certainty you would have about your financial future if you could correctly anticipate the next market to rise.

And you started investing in suburbs before others found out about them allowing you to make the maximum gain possible

While you then sat back and smiled quietly knowing almost everyone else was being misled by the popular press, or well-meaning but misinformed friends and family.

Wouldn’t that be a great position to be in…

Well, let me show you how to get there

The 4 Components You Need to Analyse…

So you can anticipate the next Property markets to grow.

Let me point them out first and then I’ll explain how they all connect.

- The relationship between interest rates and property price movements in different markets…

When you understand this, you’re going to be stunned at how blindingly obvious this is.

It took me years to get it

(I’ve never been the smartest tool in the shed!)

… and if I’d learned it earlier I would have made even more money through property!

Oh well… my problem. Your Gain!

- Affordability – a key characteristic that so many people forget!

- Supply and demand

- Job creating infrastructure

Alright – so now let’s break down each of these criteria separately.

Firstly…

What is the Link Between Interest Rates

And Property Prices?

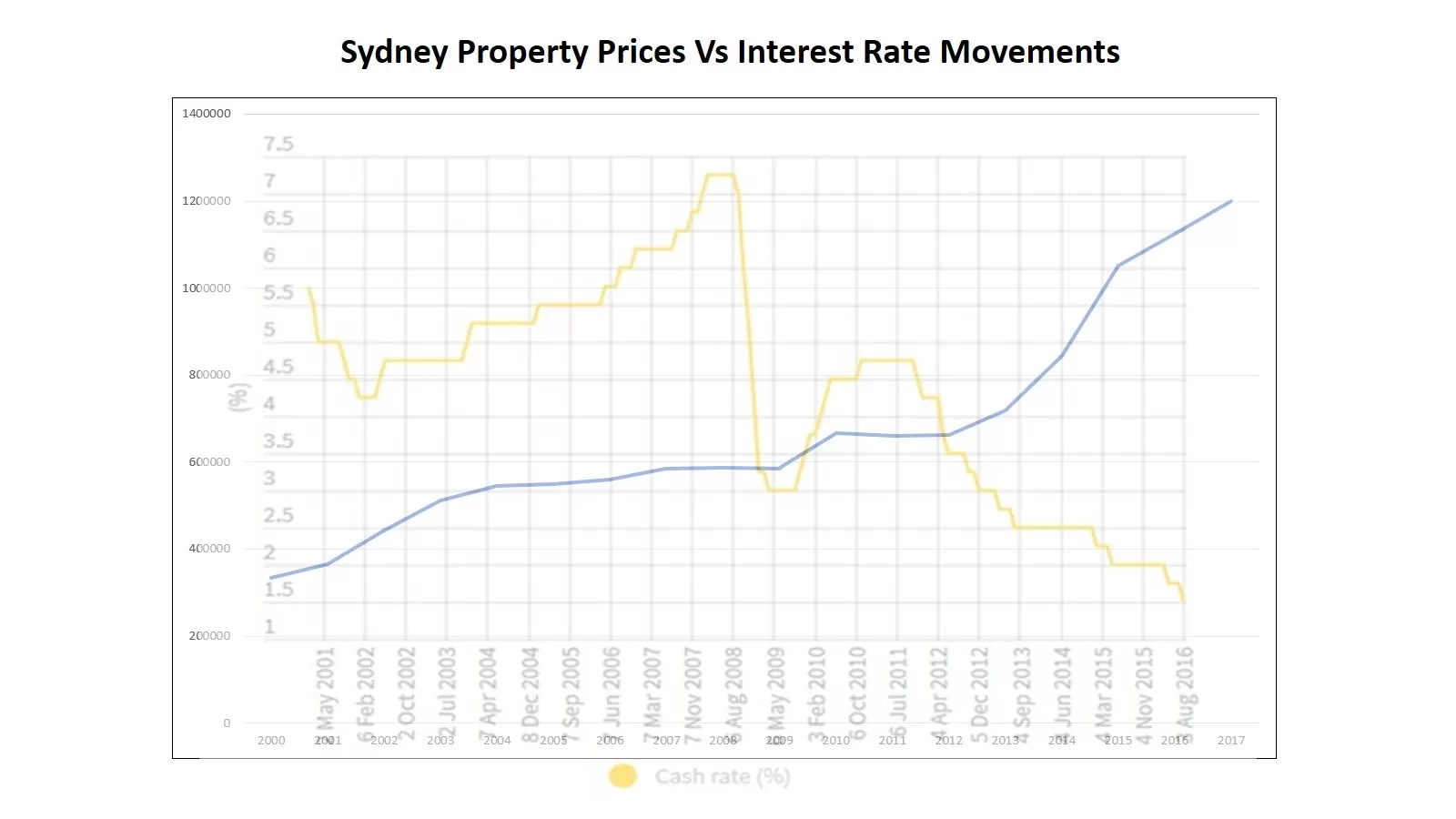

Simply put, when interest rates drop, Sydney and Melbourne prices rise.

But when interest rates rise, price growth in these two markets stops… and in some suburbs, prices even go backwards.

Let me show you…

As you can see, when rates drop or remain low, Sydney prices rise!

But when rates rise, Sydney prices go flat.

And Melbourne follows a very similar pattern.

You see, our two biggest cities will always be our most expensive markets.

So when rates drop, people’s wages stretch further because loan repayments are less, allowing you to afford a higher price.

For example, you might be able to afford the loan repayments on a mortgage of $650,000 today but when rates drop, you may be able to afford the loan repayments on a higher mortgage of say $700,000

And the more interest rates drop, the higher the prices of property you can afford, while on a similar salary or income.

But when rates rise, these two markets go flat and some suburbs even fall.

I’ll tell you why this happens in just a moment but…

What’s Been Happening to Rates Since December, 2016?

Well, banks have been raising rates even without the Reserve Bank of Australia (RBA) doing anything.

And the RBA has also said that it’s next rate movement will also be upwards.

So you can expect the slowing growth rate in Sydney… to come to a grinding halt shortly!

But when rates start to rise, other markets like Brisbane and Perth often start to rise(as long as they meet some of the other components I’m about to share)

Why?

Well, this brings us to the second component needed to anticipate the next market to grow, which is…

Affordability.

You see, whenever the Sydney and Melbourne markets boom, their property prices rise at a much faster rate than wage growth…

Which is exactly what has happened over the last few years.

So people have to stretch their budget even more to afford the higher prices

But when rates rise, they can’t stretch the budget as much because the interest payments are higher.

Let me highlight this by using the reverse example of what I just showed you…

If you can, for example, afford the loan repayments on a mortgage of $700,000 , when rates rise, you may only be able to afford the loan repayments on $650,000 because the interest rates are higher.

So far less people can afford higher prices, bringing capital growth to a grinding halt for a few years at least!

In Sydney’s case, capital growth often stops for 7 to 9 years, as it takes that long for wages to catch up and prices to be affordable again.

However, markets which are much cheaper are affected differently, when rates rise.

And that’s why…

Now Is A Very Exciting Time To Invest If You’re Looking To Get Capital Growth In The Coming Few Years.

You see, when our expensive cities become more “out of reach” for people after a price boom…

And as rates start to rise…

People start looking to move to areas where property is more affordable.

And traditionally Brisbane is the market that grows straight after a Sydney and Melbourne boom.

And why is Brisbane more affordable right now?

Well, according to the Australian Bureau of Statistics (ABS)…

From 2008 – 2015, Brisbane Property Prices Rose Only 23.6%.

However, Incomes Rose 31%.

Yes, wage growth in Brisbane actually outstripped property price growth.

And as at the end of June 2017, Sydney property prices were on average 70% higher than Brisbane prices but Sydney incomes were on average only 14% higher than Brisbane’s.

Oh and by the way, the long term average difference between Sydney and Brisbane property prices is only about 25%

So this gap must close…

And it will only close by Brisbane prices rising

But I’m getting ahead of myself.

Let me come back to affordability.

With the growth in wages having been higher than the growth in property prices in Brisbane, you can see why affordability is not an issue there.

But just because property is cheap is no guarantee that prices will rise in the coming years.

This brings us to the next criteria, which is…

Demand Must Be Greater Than Supply

If prices are already affordable, and demand starts to exceed supply, then prices will naturally start rising.

And demand will only increase if the population starts to increase.

According to the Australian Bureau of Statistics (ABS), in the 12 months to June 2017, QLD had its highest rate of population growth in 10 years.

This was driven primarily by interstate migration from Sydney and Melbourne residents, who went searching for cheaper prices.

The ABS also reported Sydney’s net population growth has been the slowest over the same time period.

The fact that QLD’s population is growing faster than in many years, while Sydney’s population growth is slowing down at the same time is no co-incidence.

You see Brisbane is not the only affordable capital city in Australia.

You’ve also got places like Adelaide and Hobart.

But I don’t know anyone who gets excited about moving to…

Adelaide or Hobart!

These two cities just don’t have the sustainable population growth for prices to rise long term.

You see…

A Common Error People Make When Investing Is…

They see affordable markets where prices start to rise and immediately jump in…

Thinking there is an opportunity to make a quick buck!

But…

I always look to see why the growth is happening.

Is it happening primarily because of interstate investors, like in Adelaide and Hobart?

If so, the growth will be short lived because vacancy rates will soonstart to rise due to the influx of investors.

You see, when there are too many investors in an area (and not enough tenants)

Then, eventually many investors will look to sell

Because they can’t handle the rents dropping or long periods of not having a tenant

And with everyone selling, and not enough buyers, prices go back down again.

So buying properties in heavily investor dominated areas is a very speculative (and risky) strategy that can backfire painfully.

I’ve made that mistake myself – and it hurts!

So you want to make sure you are investing in areas where the price growth is being driven by population growth.

In other words, it is the fact that more people want to live in an area that creating excess demand and driving prices upwards.

And for this population growth to be sustained, we come to component number 4, which is:

Jobs Growth

Ask yourself, is there large-scale investment in job creating infrastructure?

This is the final question to ask, when you’re trying to anticipate the next market to grow

And this is why I see so much danger in investing in regional towns.

Because, where is the growth in jobs?

You see, according to the ABS, currently 2/3 of Australians live in capital cities. That figure will rise in the coming years to be ¾ of all Australians.

So less people will be looking to live in regional towns in the coming few years.

And so, not only will demand for properties in regional towns decrease (which was criteria #3)

But there just isn’t the investment in jobs to even attract people to move to regional towns on a long term basis.

So how can you then get long term capital growth in regional towns?

That’s why I recommend sticking to capital cities…

For example, according to the QLD State Government Infrastructure plan, in South East QLD, there is currently $134 Billion worth of infrastructure plans in various stages of completion, primarily around Brisbane.

Well, that’s it!

You now know the 4 criteria you need to analyse to anticipate where the future capital growth will be.

Remember, just because a market has boomed in the past few years is no guarantee it will boom in the next few years.

In fact, a market that has boomed previously often goes flat, as the wind goes out of the market because people just can’t afford the higher prices anymore, especially as rates start to rise.

But if you find a market that has been flat or just starting to rise, that meets all 4 criteria, now you have the best chances of capital growth in the coming few years

And that is what you want to take advantage of.

So, when you look at all 4 criteria, I think I’ve made it pretty clear where I’m anticipating the next property boom to be…

Brisbane!

And the evidence is already here…

The Housing Industry Association of Australia (HIA) reported that Brisbane had more detached home sales than any other market in the country, far outstripping even Sydney

It is clear that Brisbane has finally woken up from its 8 year slumber… and is now the next Growth market in Australia but…

There’s a Problem…

Two actually!

First of all, these 4 criteria need to not only be applied to a particular city like Brisbane, but they also need to be applied to each suburb.

For instance, some suburbs have a much higher rate of population growth due to people moving there.

These suburbs are more owner occupied, which is where you want to invest for capital growth.

And it’s easy to get your property rented

Oh, and these areas are not flood prone either.

However, some suburbs are more investor dominated, like the inner-city unit market or even the Brisbane to Gold Coast corridor.

You want to avoid these types of areas because you’ll struggle to get your property rented

So you need to do your research – and apply these 4 criteria in great detail.

You can’t just paint all of Brisbane with the same brush and think that all areas will perform the same.

It just doesn’t work that way

And this brings us to the second problem.

All of this research involves … time

And I’m guessing, time is the one thing you’re lacking right now.

Hey, I bet even reading this was a bit of a stretch.

Soif time is an issue for you and you’d like some help getting an investment property in markets that on track to grow by potentially 10% or more in the coming few years

Here’s Some Great News.

I’ve set aside some time to personally review your current financial situation, your goals and what you want to achieve by investing in property.

And then create a full customised, property investing plan for you… FREE

This is a genuinely free offer, and there are no strings attached.

In fact, it’s even better than you realize.

Not only do we designa personalised investing plan for you, we actually show you exactly where you ought to be investing… so you can kick start your financial goals immediately.

If that sounds interesting to you …

Here’s What To Do Next.

I’ve posted a short description of how this works, and my hidden motivation here.

Go here to read it.

Assuming you’re OK with my “hidden motives”, you’ll want to proceed to the next step.

That’s simply a short video that shows you exactly what will happen during your session and what you can expect to get out of it.

Now This Is NOT What You Might Be Thinking.

If you’re skeptical and are wondering if this is some kind of “Sales Pitch in Disguise”, that’s understandable.

The good news is, it’s NOT.

In fact – it’s quite the opposite.

As you’ll see here, I’m willing to pay YOU money in the event you feel this free service was a waste of your time.

No strings attached.

It’s all spelled out in black and white here.

The “Catch” You’ve Been Looking For.

There are two.

First, we’re unable to extend this offer to just anybody.

There are some qualifications you’ll need to meet – the “biggest” being that you’re looking to actually invest in property (and not buy your own home).

The second is this is very time sensitive …for a reason.

We’re a small company (by design) and can only offer a handful of these free consults each month.

In fact, I do them all personally and I only have a certain amount of time.

So if you found this article helpful, and would like help getting the perfect investment property for you that grows in value in the coming few years, go here.

We’ve set aside some time to design a fully personalised investing plan for you …using the exact methods I described in this article.

…And we’ll do it for free.

If that sounds like something that could help you, go here before all spots are taken.