Experts Say: Do NOT Invest in Property in 2025

By: Niro Thambipillay

January 20, 2025

It’s happening again. So called experts coming out and saying, don’t invest in property in 2025, Australian property prices are tipped to fall in 2025, and house prices are expected to fall by a $100,000 in some of our property markets. Look, if you’ve seen these sorts of headlines and you’re put off by them or you find them really scary, then this episode is for you.

Today I’m going to do it deep dive into the data. I’m going to share some trends as to what’s been happening in the property market and then finally, I’m going to share with you what I expect to happen to property prices this year, based on my now 23 years of property investing experience. Even if I can just help a few people avoid making some property investing decisions that they will regret. Then this episode will have been worth it.

Let’s dive in. Hello, it’s Niro here, founder of the Investment Rise Buyers Agency. If you’re new to my channel, hit that subscribe button because I talk about all things related to the Australian property market and the economy. Yes, it’s true that property prices in some locations around the country have started to fall, but the price falls are so small that they are virtually irrelevant.

Have a look at this data. Here we have a table from core logic showing how far dwelling values have fallen since their peaks –

What you can see is that in Sydney, the peak was in September of 2024. And since then, Prices have dropped a grand total of 1.4%. Now, if you’re a property owner, you’re not even going to notice that price fall.

That’s how irrelevantly small these price falls are. But then if you look at how much property prices have risen in the last 10 years, it’s 70.4%. If we look at Melbourne, which has been one of our weakest markets in the country, prices are down 6.4% from their peak back in March of 2022. But over the last 10 years, prices are still up 49.3%.

Brisbane, Adelaide, Perth, these markets are all still rising at different rates. But over the last 10 years, you can see prices are up significantly, Brisbane 90.4%, Adelaide 93.3%, Perth 54.8%, Hobart our weakest capital city property market, prices are down 12.6% from their peak as of March of 2022.

But still up 87.3% over the last 10 years. It’s really only Darwin where prices are down 6.4% since their peak and down 3.4% in the last 10 years. Even Canberra which hasn’t been doing so well. Prices are down 6.8% since May of 2022, but they’re up a whopping 62.1% over the last 10 years.

And this is also the case when we look at regional markets. Regional New South Wales down 2.4% since its peak, but still up 98.8% over the last 10 years. If you look at regional Victoria, which is one of our weaker regional markets right now. Prices are down 8.6% since their peak, but still up 74.1%.

But then look at regional Queensland, regional South Australia, regional Western Australia. These are markets that are rising right now, and I expect they’ll continue to rise going forward. So, what this shows you is that the price falls are so minuscule compared to the long term. Growth that there really are nothing to worry about.

CoreLogic head of research Tim Lawless said values had been falling recently due to sustained higher interest rates that had limited borrowing capacity for buyers. That’s an important line that I’ll come back to in just a moment. In Melbourne, the market had also been affected by a weaker economy, the increase in land tax on investment properties, and better long-term pace of home building for its population.

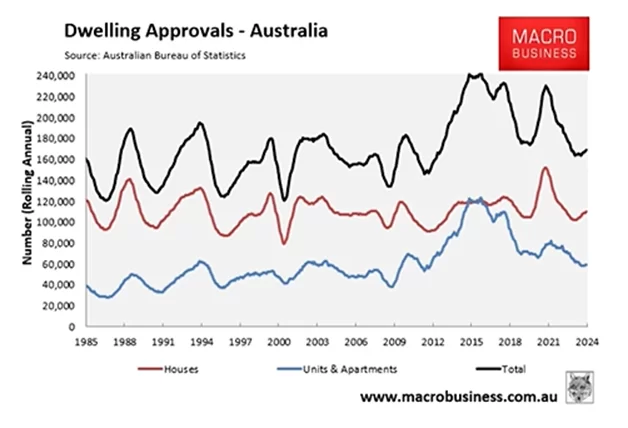

But Lawless said housing values generally increase over the long term due to an overall shortage of supply of homes compared with buyer demand. So, let’s have a look at the current housing shortage in Australia. Here’s some data from Macro Business

What we can see is that in the year to November 2024, 168,691 dwellings were approved for construction, which is around 71,300 or 30% below the Albanese government’s target to build 240,000 homes per year. Yep, we’re 30% below target. Now some people are saying those numbers are still not bad.

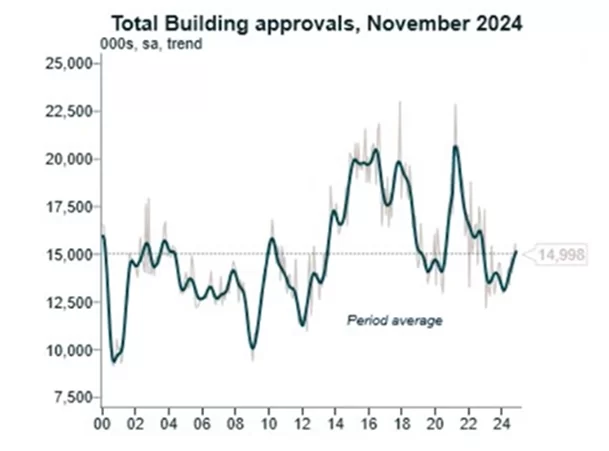

In fact, if you look at what Alex Joyner, Chief Economist at IFM Investors noted

He said that we’ll look at the total building approvals for November of 2024 for just the month. It was just shy of 15,000. It’s in line with the long-term average. Now that might be okay. However, it’s this next chart that completes the picture here.

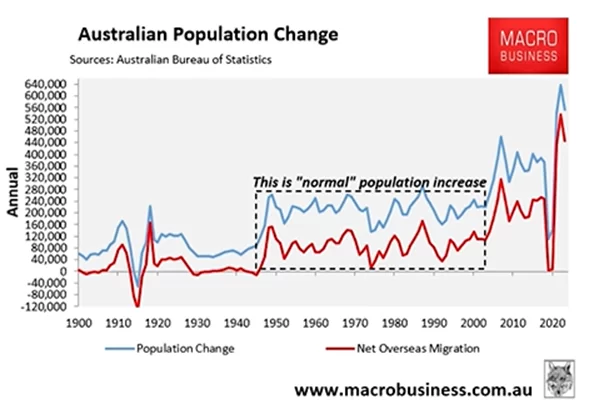

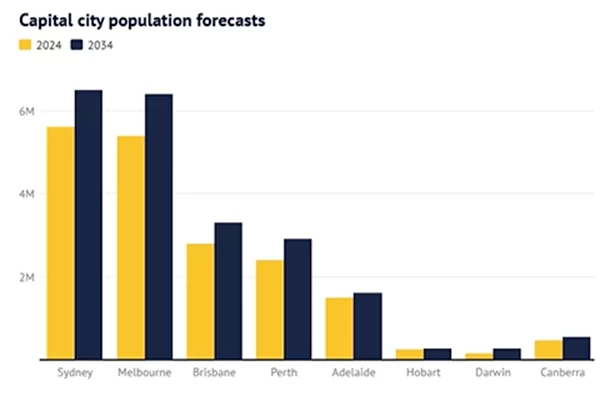

We can see how much our population has been increasing over the years. Sure, our rates of migration might have dropped from their peak say last year or maybe late 2022, but we’re still well above long term migration levels. That means we have more and more people coming into Australia at a time when we’re building fewer properties than we have in the past. And if we look at the population forecast on a capital city by capital city basis, we can see that in 2034, the population of every single one of our capital cities is expected to be higher.

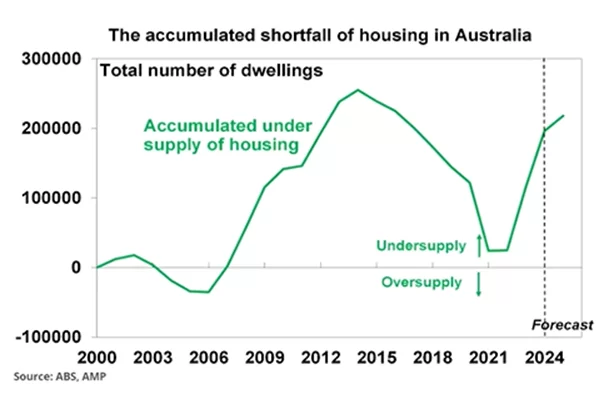

That is right now, especially in places like Sydney, Melbourne, Brisbane and Perth. And that’s why AMP are predicting the under supply of properties in Australia to increase. What that means is that the level of demand, the number of potential buyers that we have in Australia. Versus the number of properties available, that gap will increase. So, then you have demand being much higher than supply, which points towards more upwards pressure on property prices.

But then what about the fact that property prices are said to be falling? Well, like I showed you earlier, yes, property prices are falling in some areas, the biggest price falls we’re seeing are in Melbourne and Sydney, but many of our other markets are continuing to increase.

Perhaps the rate of growth might have decreased or slowed down, but it still means that property prices in those areas will be higher in the next few months than they are right now. But when we look at the key factor right now that’s slowing the rate of growth of property prices, it’s interest rates.

We know interest rates are at the highest they’ve been at for over a decade. The question then is what’s likely to happen to interest rates next? Well, based on where inflation levels are right now. We know that interest rates will be cut. The only question is when some people are saying February, some people are saying May, I’m going to say it’s going to happen sometime in the middle of 2025. when interest rates are cut, not if, but when they are cut, you will see people’s borrowing capacities.

Increase more people able to afford property and they can right now and that will force property prices higher in many areas around the country. So, for me, I believe many investors have a very unique opportunity. There is a temporary slowdown in multiple property markets before I believe prices take off and that’s why I’m personally looking to buy as much property as I possibly can in the first quarter of 2025.

Now, that doesn’t mean you can buy blindly. Not every area will rise in value. That almost never ever happens. You do need to know what you’re doing. So, if you want help to work out, well, where are the best places to buy? Check out the link in the description below to get total for free the audio version and digital version of my book here. Otherwise, I’ll see you next time.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.