Australia in a Per Capita Recession. What that means for property prices will shock you.

By: Niro Thambipillay

September 21, 2023

@investwithniro Australia is in a Per Capita recession. What that means for property prices is startling #propertyinvestingaustralia #australianproperty #australianrealestate #realestateaustralia #australianpropertymarket #economics101 ♬ original sound - Niro Thambipillay

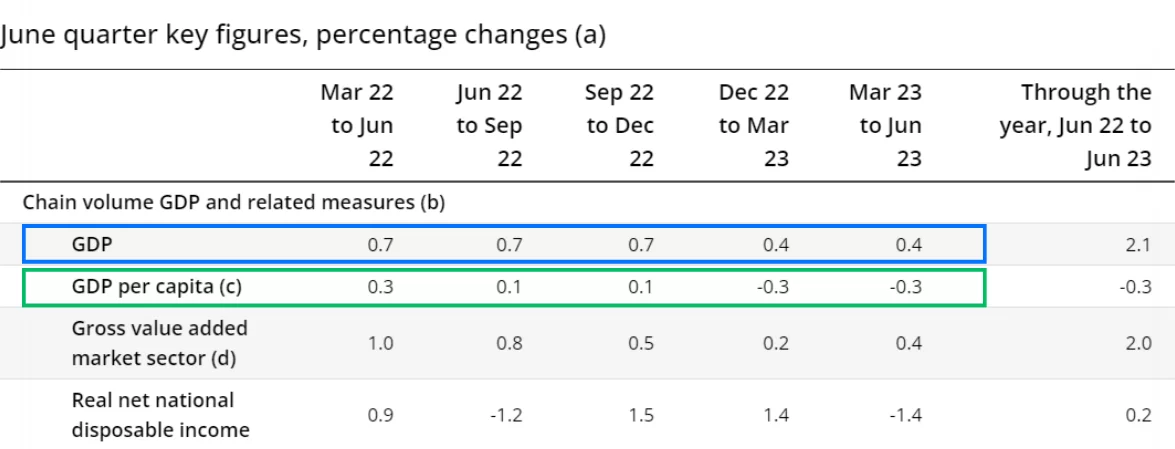

Here we have the national accounts figures from the Australian Bureau of Statistics.

What you can see here from this table is that our GDP is still growing (the blue box), albeit at a slower and slower rate. But GDP per capita is actually negative (the green box), and it’s been negative now for two quarters. That’s what it means to be in a per capita recession.

But what does that actually mean?

It means that essentially, we’re spending less per person.

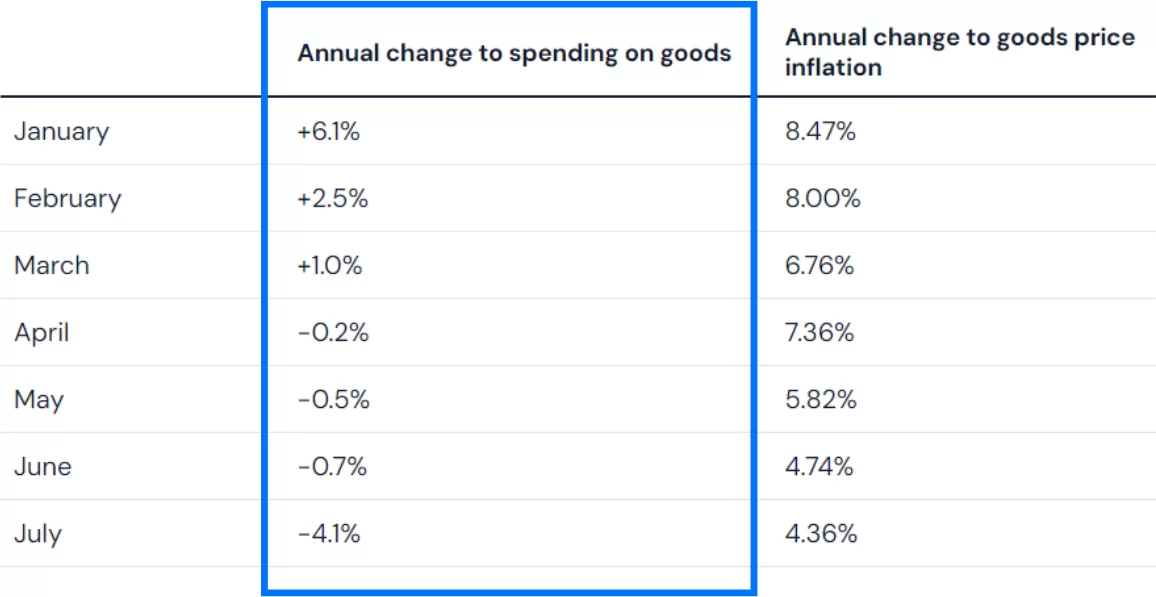

The RBA’s interest rate hikes are actually working. And you can see that here in this chart when we see the annual change to spending on goods.

In January, annual change was increasing by over 6%. But then you can see it started to reduce every month.

In April it went negative, and in July it’s negative 4.1%, which means that we’re spending less on goods than we were at this time twelve months ago by 4.1%.

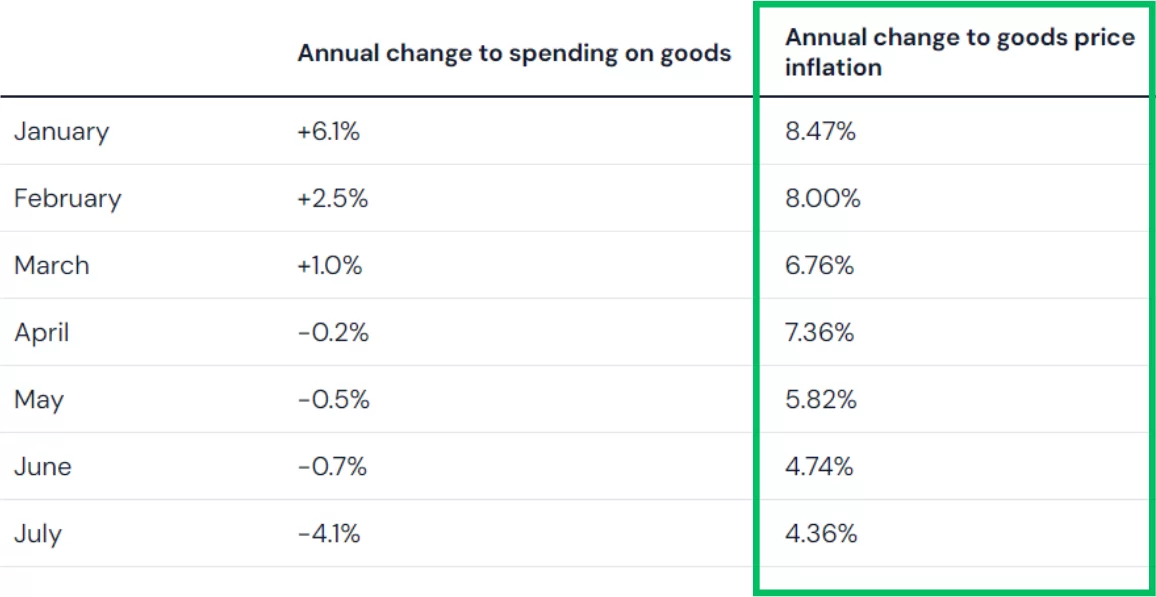

But now, look at the 2nd column, which then completes the picture. The second column refers to the annual change to goods price inflation.

What you can see is in January it was at 8.47%. It’s been reducing every month. And in July it was down to 4.36%. So, you can see that inflation is coming down.

Sure, it’s not yet in the RBA’s target band of 2 to 3%, but it’s dropped from over 8% to just over 4%. That’s actually a reduction in inflation by 50%. That’s actually too fast.

What the RBA wants is for inflation to fall, yes, but for it not to fall so quickly that it crashes through the ground and goes into negative territory, then you have deflation.

That has all sorts of ramifications for the economy. Instead, they want to create a soft landing. Expect to see that term quite often.

Think about it like a plane trying to land on the tarmac. It keeps descending and descending. But if it keeps descending without slowing up, it’s going to go right through the ground. Instead, the plane wants to descend and get down to the Tarmac safely.

That’s what the RBA is trying to engineer. And if inflation is falling too quickly right now, what will they do?

Well, they only have one tool at their disposal. They’re likely to drop interest rates.

Here’s what the four major lenders have to say about that.

CBA expects rates to fall in March and there to be four rate cuts in 2024.

CBA, Australia’s biggest bank, believes the cash rate has peaked and is now expecting cuts from March next year (previously February). It believes there will be four interest rate cuts next year, bringing the cash rate down to 3.10 per cent by the end of 2024.

Westpac expects rates to start falling from September 2024, and there’ll be six rate cuts, according to them, into 2025.

ANZ thinks there’ll only be one rate cut in 2024.

Westpac and ANZ also believe the cash rate has peaked. Westpac expects the cash rate will start falling from September 2024, with a total of six cuts across 2024 and 2025 to bring the cash rate to 2.60 per cent in late 2025.

ANZ, who’s forecast remains unchanged, predicts there will be one 0.25 per cent cut in late 2024.

Westpac and ANZ also believe the cash rate has peaked. Westpac expects the cash rate will start falling from September 2024, with a total of six cuts across 2024 and 2025 to bring the cash rate to 2.60 per cent in late 2025.

ANZ, who’s forecast remains unchanged, predicts there will be one 0.25 per cent cut in late 2024.

NAB is the only major bank expecting one more hike later this year. The bank believes there will be a 0.25 per cent hike in November, bringing the cash rate to a peak of 4.35 per cent. It then thinks there will be five cuts in 2024 and 2025 to make the cash rate 3.10 per cent by early 2025.

So, it’s clear that the per capital recession we’re in will force the RBA to drop interest rates. It’s only a matter of when.

But what will that mean for property prices?

Well, consider this. In 2023, interest rates have been the highest they’ve ever been in for over a decade.

And yet what have property prices done?

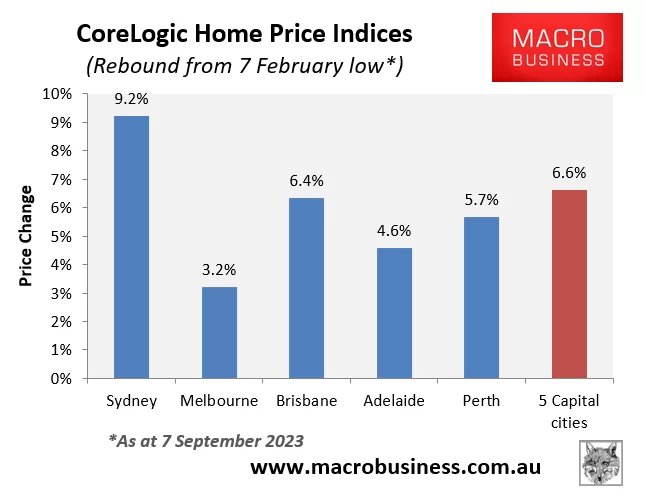

Well, in Sydney, they’ve risen by nearly 10%.

Brisbane isn’t far behind, followed by Perth and Adelaide. And many regional markets have done even better.

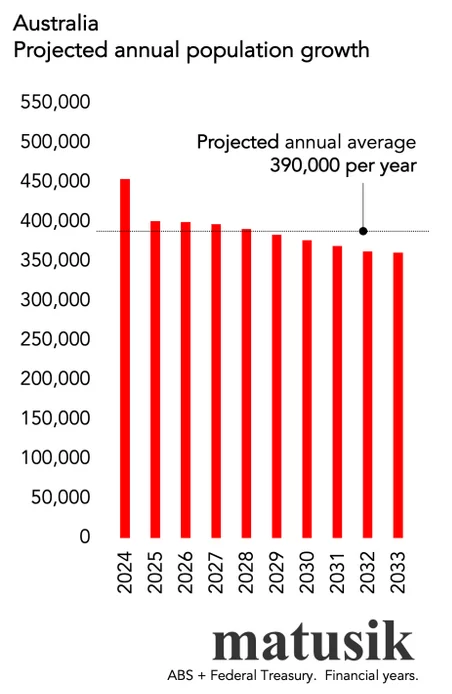

Now, consider what would happen when interest rates fall. Combined with the fact that we have massive immigration coming into the country and we are not building enough properties.

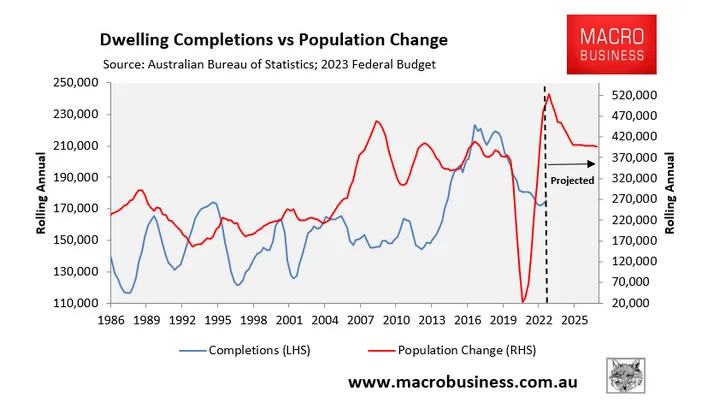

In fact, when you look at this next chart, the blue line being blue line being dwelling completions, you can see it’s actually falling.

But then the red line, which is population change, that’s increasing and set to settle at record highs. That means that we’re building fewer homes at a time when our population is actually increasing.

Combine that with the fact that interest rates are set to fall next year.

Property prices have already risen in 2023 and it certainly seems like the per capita recession could trigger the next property price boom.