A Warning about the Melbourne Property Market

The Melbourne property market has been one of the worst performing property markets in the country. So, is now the time to jump in or is the Melbourne market a falling knife you want to stay away from? Well, that’s exactly what we’ll cover in this video. Hello, it’s Niro here, and if you’re new to my channel, hit that subscribe button because I talk about all things related to the Australian property market and the economy.

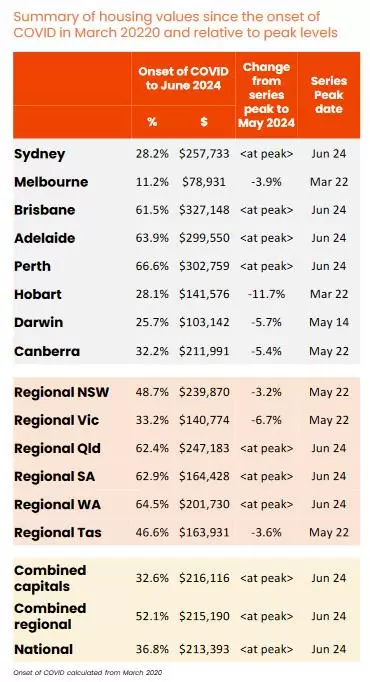

Here we have a summary of housing values provided by CoreLogic showing where property prices sit relative to their peak.

What you can see is that Melbourne property prices are still 3. 9% below their peak back in March, 2022. So over two years ago, whereas when you look at Sydney, Brisbane, Adelaide, and Perth, they’re all at their peak right now and prices are rising in those areas.

Yes, Melbourne, isn’t the worst performing market. You’ve still got Hobart prices, Darwin and Canberra all further below where they were since their peak, but still the Melbourne property market is quite weak. Then when we look at the regional markets, we can see that regional Victoria is 6.7% below its peak back in May of 2022.

Again, over two years ago, making it the worst performing regional market. But when we look at more recent performance,

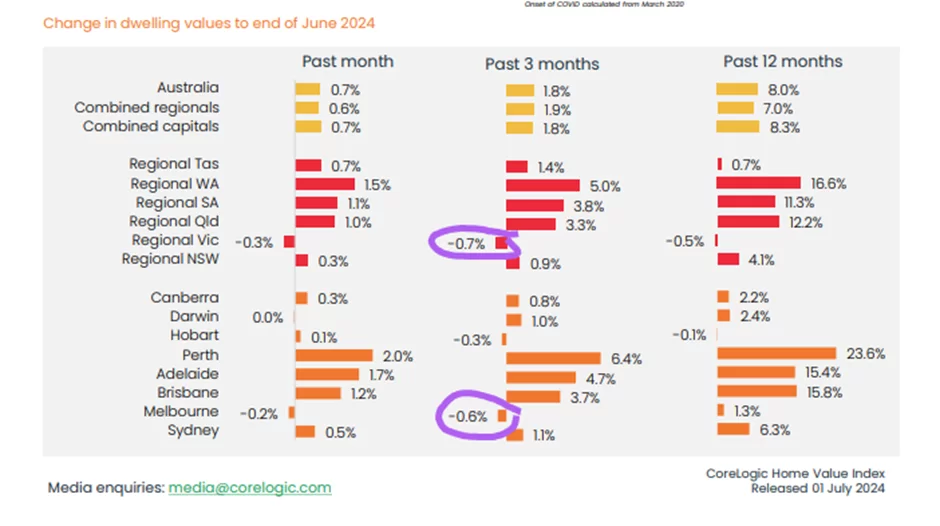

it shows that the Melbourne regional Victorian market is really struggling over the past three months. Regional Victorian property prices are down 0.7% and in Melbourne, property prices are down 0.6%. Over the last quarter. So they are clearly in a downwards trajectory and in a great chart produced by macro business,

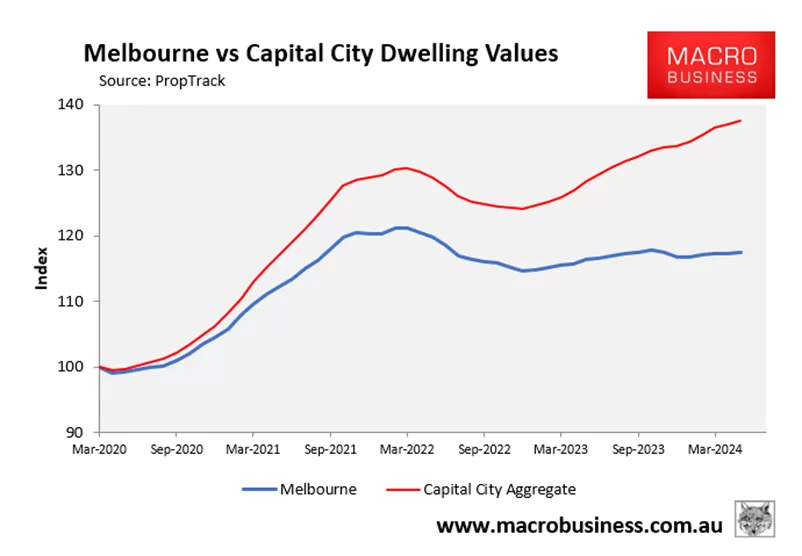

what we can see is that Melbourne property price growth since March of 2020 has been well below average. The blue line tracks Melbourne property price growth. The red line tracks the aggregate of capital cities. You can see that the aggregate is far above what Melbourne property prices have been, so if the Melbourne property market hasn’t been performing anywhere near as well as most of the other capital cities, is now the time to buy? Well, as an investor, there are two things you need to consider. First of all, the cash flow considerations, and then secondly, the capital growth potential.

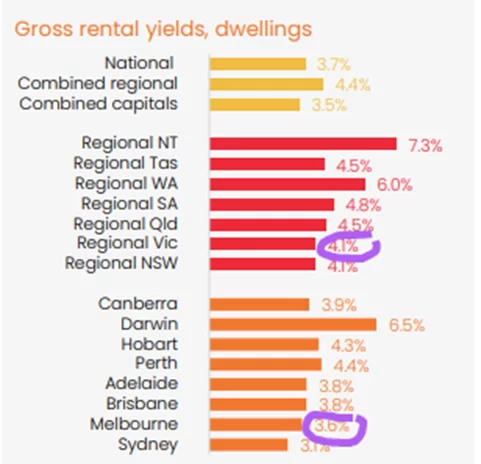

Let’s begin by looking at capital. Here’s a chart again from CoreLogic showing gross rental yields

What you can see is that Melbourne has the second lowest rental yields in the country. Only Sydney is lower, but Sydney property prices have been rising while Melbourne are falling. If you look at Brisbane rental yields, they are higher than Melbourne. Even though the median property price in Brisbane is now higher than Melbourne, then when we look at regional markets, you can see that regional Victoria also has the lowest rental returns in the country, equal with regional New South Wales. So, from a cash flow perspective, just looking at the rental side of things, it certainly seems like Melbourne, regional Victoria are one of the worst options in the country.

There are concerns that the Victorian state government will raise the minimum standards required for rental properties, squeezing the rental market and making it more unaffordable for investors. Victorian landlords could soon have to make significant changes to their properties under the state’s new minimal rental standards, raising concerns it will put further pressure on an already tight market.

The proposal includes prescribing standards on ceiling insulation, Draft proofing, hot water systems, cooling and heating. The Energy Minister Lily D’Ambrosio estimated it would cost landlords $5,000 if they were required to undertake all upgrades all at once. But many existing investors in Victoria are saying that these standards are going to be so onerous.

Why? Because the increased expenses as a result of schemes like this will make holding investment property in Victoria that much more unaffordable for most investors. That’s why so many investors are actually quitting the Melbourne property market and then you have all of Victoria’s property taxes, which make it very unattractive to invest there, especially if cashflow is any sort of concern for you.

Victoria’s Chief Real Estate Lobby Group believes the state is no longer as attracted to investors as other states, with property taxes slashing investor numbers by the thousands. Australian Bureau of Statistics data show 47,775 new investment loans issued in the states in the 12 months to April 2024.

A year prior, that number was 51,155. While going back another 12 months, It tops 60,000. Every other major Australian capital recorded an increase in investor loans over the past 12 months with only Tasmania and the ACT joining Victoria in decline. Senior Prop Track economist, Eleanor Cree said the reality was that would be landlords in Victoria were now looking elsewhere largely due to the state’s reputation for being overtaxed.

With relatively high property prices, high land tax and the nation’s highest stamp duty costs, Ms Kree said the incentive to invest in Victoria was less than it was in other areas. The state also built more homes than other states in recent years, limiting rental and sales price growth. The incentive to invest interstate is far greater at the moment, particularly given all of those other states have very tight rental markets with low vacancy rates, Ms. Cree said. It is largely due to the land tax changes. It’s probably one of the least attractive regions for investors at the moment. So, you’ve got lower rental yields, more costs associated with owning an investment property in Victoria versus almost anywhere else in the country, the worst land tax payments. If you’re not sure what I’m referring to there, the Victorian state government announced in its budget that in order to try and recover some of the debt that it’s incurred from its COVID spending, it’s really going to tax property investors heavily.

So essentially for any property investor looking to buy a house in Melbourne or even regional Victoria as an investment, you’re going to pay land tax and those land tax Bills can be quite expensive over time. On top of all of that, Victoria is one of the only states where the vacancy rate is increasing, which means that not only do you get lower rental yields, it’s actually harder for you to find a tenant in Victoria compared to many other states.

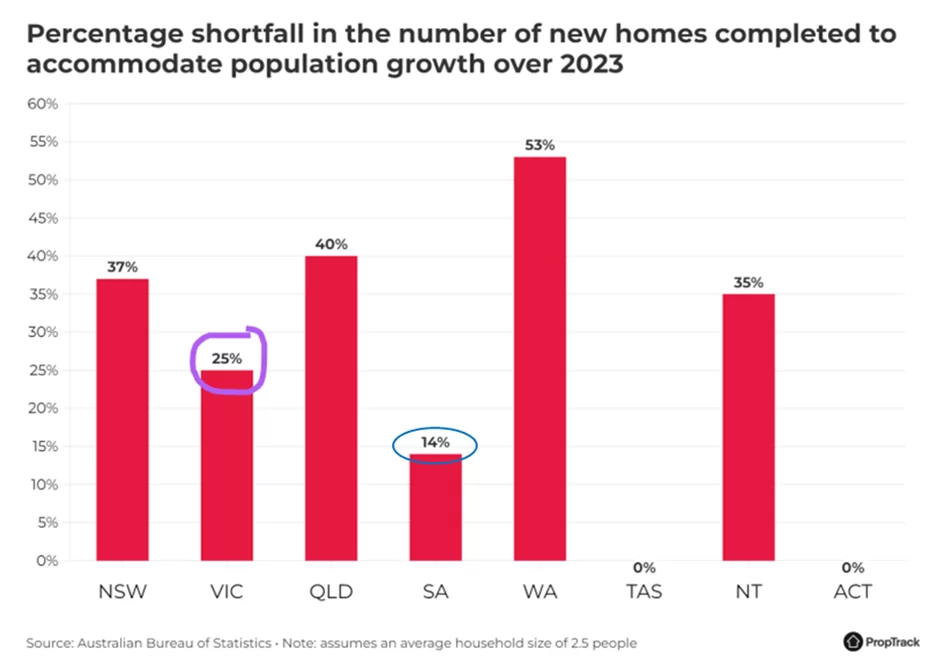

So, if you’re an investor who is in any way concerned about cash flow, Victoria right now is a market that I would personally avoid. Then what about capital growth? Because after all, that’s what almost every investor wants, right? And we know that despite the increase in the number of homes being built in Victoria, there’s still a shortfall of 25% in Victoria in order to accommodate the population growth from 2023.

Now, when you look at this chart,

you can see that the shortfall in Victoria is actually higher than say South Australia, but Melbourne’s property prices and regional Victorian property prices are falling in general while Adelaide and Regional South Australia are galloping along. We also know the Victorian state population is increasing rapidly.

Last year, over 180,000 people moved into Victoria with over 160,000 being from net overseas migration, and we’re starting to see articles in the mainstream media about people moving from Sydney to Melbourne in order to take advantage of the more affordable pricing. Melbourne, although expensive, is still far cheaper than Sydney property prices.

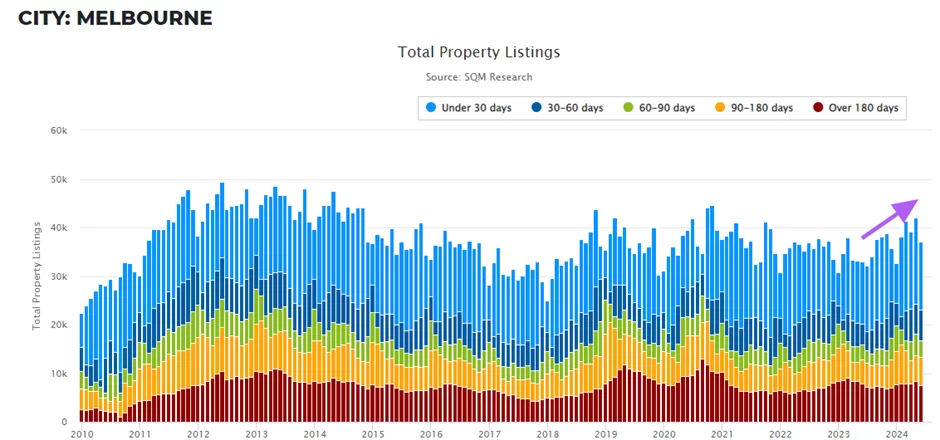

So then does that mean that Melbourne property prices are about to start rising? Well, have a look at this next chart,

which looks at listings. What you can see is that the number of listings, which is the number of properties available for sale, is actually increasing in Melbourne, whilst decreasing in many other capital cities.

It is clear Melbourne is a buyer’s market, with auction volumes 57% higher than the same period last year. The stock level overall is 30 percent higher than a year ago, and 16% above the 5-year average, so that’s also reflected in the clearance rate, which is tracking lower than average. Then you’ve got the fact that the Victorian state government is totally broke. It’s in the hole to the Tens of billions of dollars. So therefore, the government doesn’t have money to spend on infrastructure projects. It can’t do anything to improve infrastructure, to increase jobs, and that too will then compromise on the level of capital growth going forwards.

With a state government that’s essentially too broke to spend any money to invigorate the economy and create jobs with increasing supply. What do I think will happen to property prices? Well, there are many people who think that Melbourne property prices will rise simply because it’s our second biggest capital city. Prices haven’t risen for the last 24 months, so therefore it has to rise. To me, I’m not sure that’s a valid enough argument. Personally, if I’m a property investor who’s worried about Cashflow, who wants to buy in the area that’s safe, that’s rising already, I would be avoiding the Melbourne and regional Victoria property markets.

If, however, you have a bundle of money, you really believe in the Melbourne or regional Victorian markets, and you’re not worried about cashflow, then you might choose to take a punt. But from a risk perspective, I think the risks far outweigh the rewards. Just because property prices have dropped for the last two years, that’s no reason they need to rise. If you think that, let me leave you with a word of caution.

Here we have a table looking at our various property markets, and all of them have had a 10-year span where property prices have risen by less than inflation. All of them that is, except Melbourne. You can see that Melbourne’s worst 10-year period was from 2005 to 2015, yet prices still grew by 42%. Compare that to say, Perth, which from 2010 to 2020 only grew by 1%.

Therefore, what if Melbourne is now two years into its worst ever 10-year period where property prices don’t rise more than inflation? Sure, they may not crash. But if they don’t rise more than inflation, then wouldn’t it be better putting your money into other areas that are rising right now with greater capital growth potential and greater rental returns?

For most investors, in my opinion, I would say yes. If you want to know how to find these areas with strongest capital growth potential, get the audio version and digital version of my book here. It’s a full property investing blueprint based on my now 22 years of property investing experience.

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.

Want Help Finding Investment Property?

It all begins with a 15 minute call with a member of our team