A Very Rare Property Market Event is Here

By: Niro Thambipillay

October 21, 2024

There is a major new event happening in the Australian property market that I have personally never seen in my 22 year property investing journey. Today I’m going to outline what that event is, I’ll go through the data, to show And I’ll reveal why you do not want to be misled by some of the ridiculous headlines we’re seeing in the mainstream media.

Let’s dive in. Hello, it’s Niro here, founder of the Investment Rise Buyers Agency. If you’re new to my channel, hit that subscribe button, because I talk about all things related. To the Australian property market and the economy. Right now, the mainstream media is having a field day, putting the fear of God into you about the property market.

We’re seeing headlines about how property prices have slumped $288,000 in three months. Auction clearance rates are falling, and that the Australian property boom might be over. It’s enough to make you almost want to sell your house if you own property and run for the hills. If you’re thinking of buying property, no one would blame you if you felt like putting things off after seeing headlines like that.

So what does the data though actually say? First of all, consider this. The Australian residential real estate market is worth $11 trillion dollars. I’m not even sure how many zeros that is. But what’s even more interesting is that the total mortgage level is only $2.3 trillion dollars. So in other words, of the entire residential real estate market in Australia, the total loan amount, the total debt, is about 22% of total value of Australian real estate.

So, let’s do a breakdown of how each of our capital cities is performing. First of all, Sydney, for last month, property prices grew 0.2%, over the quarter 0.5%, and Over the last 12 months, 4.5% Sydney dwelling values are currently at a record high. And this data is from CoreLogic. Now, when you look at the graph,

you can see that the orange line is tracking annual change in property prices.

And yes, the line is dipping, but it’s still not below zero. So, although the rate of price growth in Sydney has reduced, property prices are still rising. Even though Sydney is our most expensive capital city market. And if you stay with me, I’ll actually show with you, which particular segments of the Sydney property market are doing better than others.

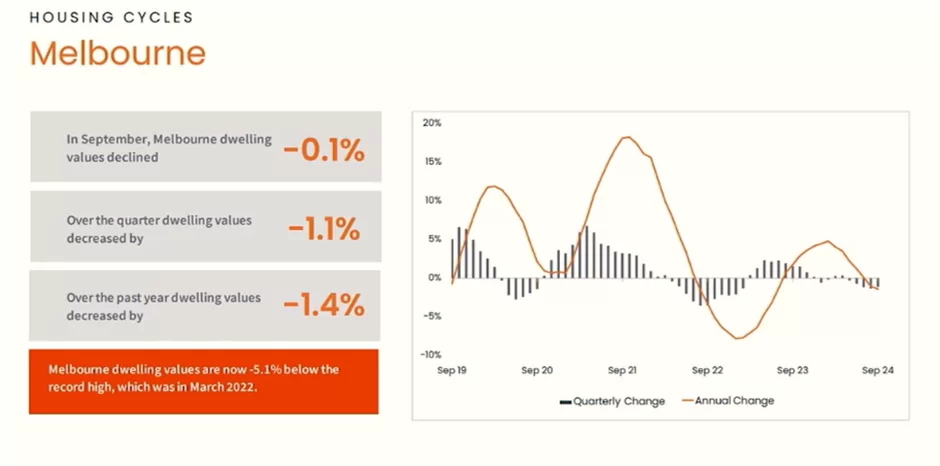

I’ll actually do this for all of our capital cities in just a moment. Then we look at Melbourne

Property market there is definitely weak, It’s not crashing. Last month property prices fell 0.1% over the last three months. They’re down 1.1% over the last year down 1.4%. You can see the orange line there is now slightly below the 0% mark.

Melbourne dwelling values though are 5.1% below the record high, which was in March 2022. So, it’s a market that is falling on a macro level, but there’s no massive cause for concern here. Then the Brisbane market

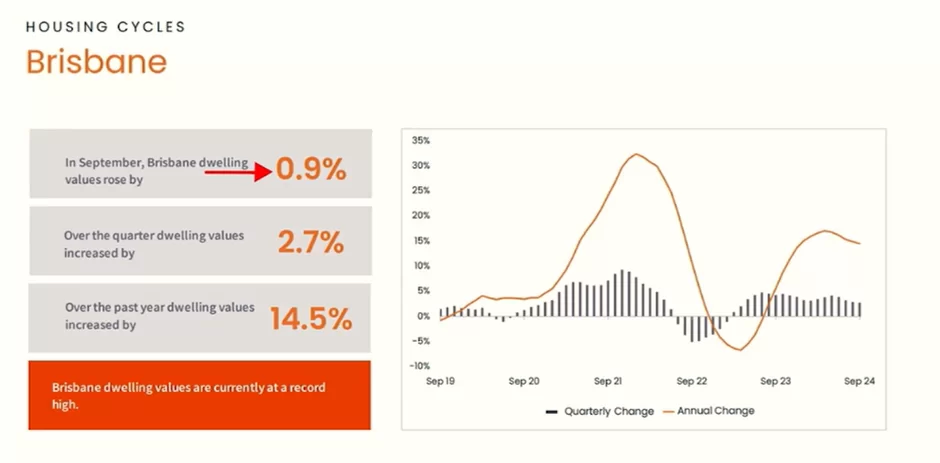

Last month, prices grew 0.9%. For the quarter, they’re up 2.7%. For the year to date, 14.5%.

Brisbane dwelling values are currently at a record high, and you can see that the orange line, which is tracking annual change in property prices, is well above zero. It is sitting at nearly 15%, so anyone who tells you, oh, the Brisbane market is finished, yes, prices have risen. We know that, But they’re still rising quite significantly, maybe at a slightly slower rate.

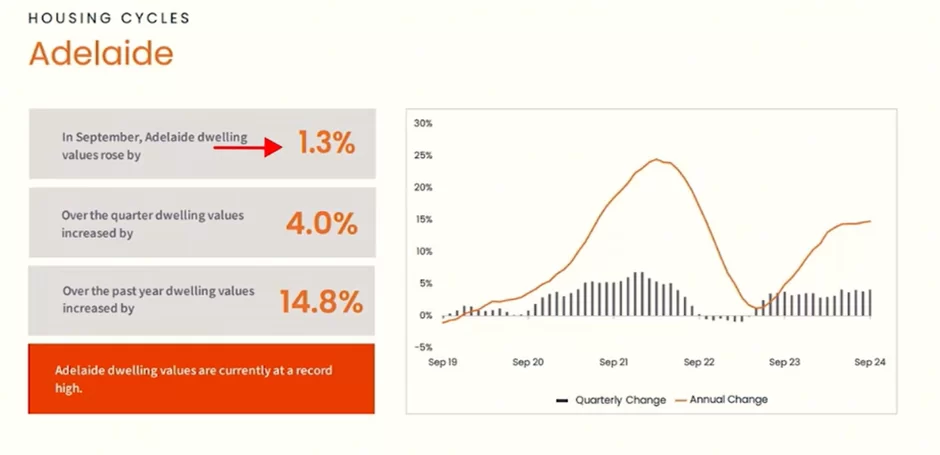

Adelaide. Now this is a surprise for so many. Last month, prices grew 1.3% over the last three months. They’re up 4.0% and for the last year up 14.8%.

Adelaide prices are at record highs but look at the orange line. It’s actually trending upwards. The rate of growth in prices on an annual basis is actually increasing here in Adelaide.

Then we come to Perth,

down for the last month, the last quarter, and the last year. Hobart dwelling values are now 12.5%. below their record high, which was in March 2022. There is no doubt that of our capital cities, Hobart is currently the weakest property market.

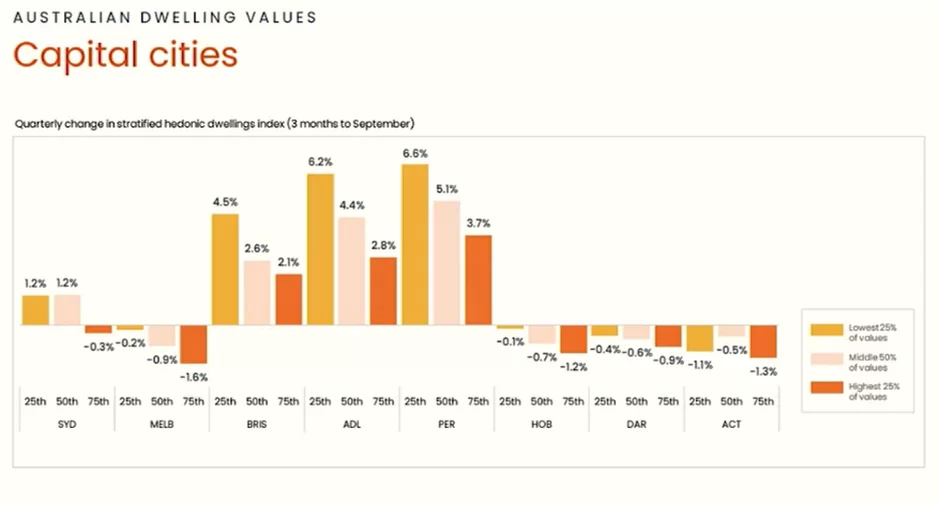

So that was just a quick synopsis of what’s going on in our major capital cities. But let’s go a bit deeper. Here we have property price performances for our capital cities broken down into the cheapest 25% of values, The middle 50% of values and the highest 25% of values. What you can see is that when you look at Sydney, it’s the highest 25% of values, the dark orange line that has dropped a grand total of 0.3% in three months.

the strongest performing capital city market, bar none. Last month prices grew 1.6% over the quarter. They’re up 4.7% for the last 12 months. They’re up an astonishing 24.1%. But again, look at the orange line the rate of price growth on an annual basis is staying relatively consistent.

What we are seeing in the Perth market, though, is that not all areas are performing as well as they have.

Then we have Hobart,

down for the last month, the last quarter, and the last year. Hobart dwelling values are now 12.5%. below their record high, which was in March 2022. There is no doubt that of our capital cities, Hobart is currently the weakest property market.

So that was just a quick synopsis of what’s going on in our major capital cities. But let’s go a bit deeper. Here we have property price performances for our capital cities broken down into the cheapest 25% of values, The middle 50% of values and the highest 25% of values. What you can see is that when you look at Sydney, it’s the highest 25% of values, the dark orange line that has dropped a grand total of 0.3% in three months.

So as you can see, this would make virtually zero difference to anyone who owns a property that falls in the top 25% of highest values in Sydney. That’s why when you see headlines that say prices have dropped $288,000. Okay, that might seem like a high number, but when you compare it as a percentage to the actual price of properties in these very expensive suburbs, it’s barely a blip on the radar.

Then if we look at Melbourne, we can see a similar story. The biggest price falls are in the most expensive areas. 25 %of property values, the lowest 25% of values in the middle 50% of values. They are falling, but nowhere near as much. In fact, the cheapest end is virtually flat right now.

And then if we look at Brisbane, Adelaide and Perth, they all follow a very similar format. All price points are rising in value, but there is no doubt that the lowest 25% of values is rising the most. Now, what’s it going to take for borrowing capacities to increase? Very simple, a reduction in interest rates.

We know that interest rates are likely to fall sooner rather than later. Yes, the Commonwealth bank, for example, has pushed back their predictions from November to December. And now they’re saying more likely February, which is what a lot of the other banks are saying. I personally think it. Interest rates will fall early in the new year because our inflation rate is already in the target band.

So, when interest rates fall, people’s borrowing capacities increase. They’re going to be jumping into the property market and that is going to cause a significant increase in demand. But then you might say, but yeah, but Niro, look at all these headlines about all the Increase in listings. Surely, that’s going to be an increase in supply.

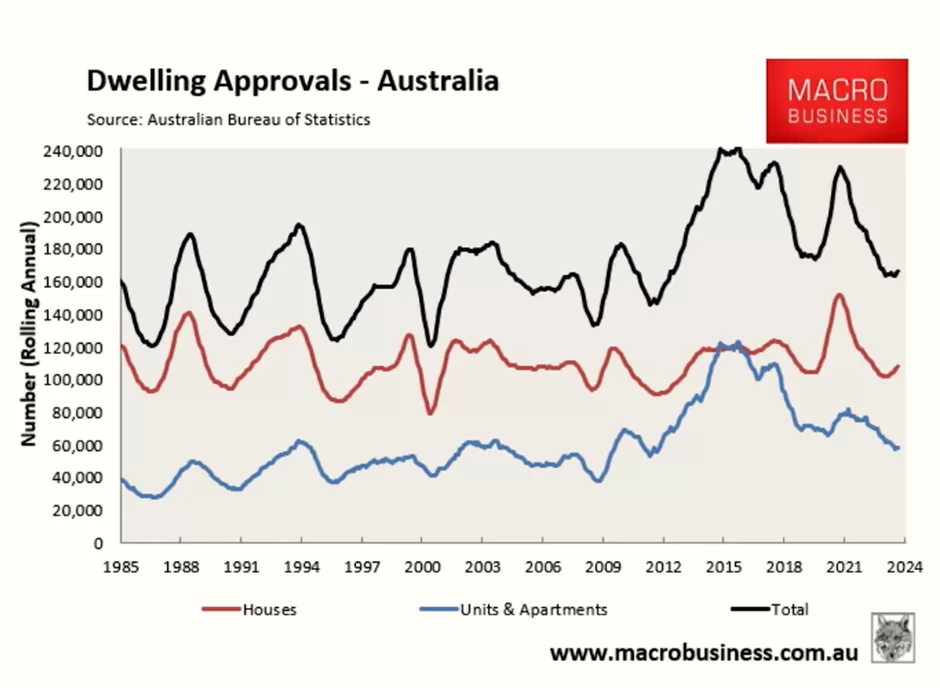

Yes, certain markets have swung slightly in favour of buyers, but when interest rates fall, you’re going to have more buyers jumping in, more competition. They will absorb those extra listings. So, then the question comes to, are we building enough properties? Sadly, that side of things is a disaster. If we look at dwelling commencements in Australia, the number of new properties being built, you can see that All lines are pointing downwards, we’re building fewer and fewer homes.

If we look at loans for the purchase or construction of new homes, you can see again that people are just not taking out loans for new properties. We’re at record low levels there as well. So with supply continuing to fall away, we’re nowhere near the prime minister’s target. With people’s borrowing capacity set to increase, we have a very unique opportunity right now to buy property before prices get way more expensive than they are right now.

I really believe that the next set of interest rate cuts will trigger a massive Super boom. That’s why so many savvy investors are trying to buy as soon as they possibly can. We know that because the number of loans being taken out by investors is increasing. We’re at 30% more than we were 12 months ago.

So, the takeaway message is simple. If you think property prices are expensive now, they’re only going to get more expensive over time. I expect we’ll see a major property price boom next year triggered by interest rate cuts. And so right now we have a very unique opportunity where even though supply is falling, the rate of property price growth is slowing, which might give you a great window of opportunity to buy before prices take off once again.

So due diligence is going to be even more important. You don’t just go and buy blindly because interest rates are expected to fall and the median house price in Australia will continue to keep rising. Do your due diligence. And if you want help with that, check out the link in the description below to get the audio version and digital version of my book here. It’s a full property investing blueprint based on my now 22 years of property investing experience.

Want Niro’s help to find an investment property? Find out more here 👇

https://www.investmentrise.com.au/property-buyers-agent-service/

Financial disclaimer: I am not your financial advisor and the opinions I share in this video are purely my opinions. This is not to be considered personal advice as it is general in nature.